News

Norton Is Bundling Cryptomining Software With Its Antivirus

While the feature is turned off by default and can be enabled only on computers that meet certain hardware requirements, it’s not exactly easy to remove it entirely.

Many users install an antivirus to protect themselves from cryptomining malware, such as KryptoCibule, which silently hijacks system resources and uses them to mine various cryptocurrencies.

The users of Norton 360 don’t have to wait for cryptominers to infect their computers because the company behind the popular antivirus software has generously included one with the application.

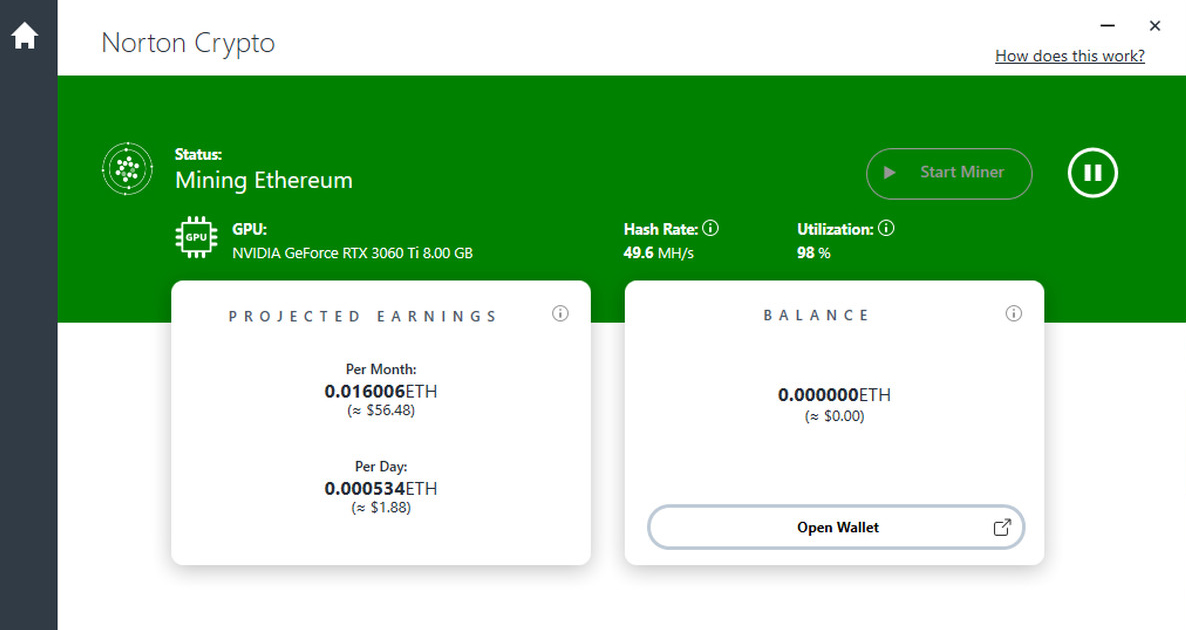

Called Norton Crypto, the cryptomining tool has been available in Norton 360 since June 2021, allowing users to painlessly mine Ether, the native cryptocurrency of Ethereum.

“As the crypto economy continues to become a more important part of our customer’s lives, we want to empower them to mine cryptocurrency with Norton, a brand they trust” explained Vincent Pilette, CEO of NortonLifeLock, the company that owns the Norton product line. “Norton Crypto is yet another innovative example of how we are expanding our Cyber Safety platform to protect our customer’s ever-evolving digital lives”.

However, not all users of Norton 360 welcome this innovation, and some have already canceled their subscriptions to put some weight behind their disapproval of the new feature. One common complaint users have is that the presence of a cryptominer could make them juicy targets in the eyes of cybercriminals, who have been actively going after cryptocurrency owners ever since Bitcoin became a well-known name.

Also Read: Young Arabs Are Embracing The Fintech Revolution

While the feature is turned off by default and can be enabled only on computers that meet certain hardware requirements (the presence of a capable NVIDIA graphics card is one of them), it’s not exactly easy to remove it entirely. To do that, it’s necessary to temporarily disable the tamper protection feature Norton 360 uses to prevent malware from disabling it.

What’s more, Norton Crypto is a blatant cash grab because it charges a fee of 15% in addition to the cost of Ethereum’s transaction fees. To put the number into perspective, most other Ethereum mining pools, which anyone can join without much effort, charge just 1 or 2%.

Clearly, someone at NortonLifeLock has decided to pursue what they must believe is a terrific opportunity to join the cryptomining mania, and they’re willing to see how their user base will react.

News

Checkout.com Set To Launch Card Issuing In The UAE

The payment service provider’s expansion is a first-of-its-kind investment and could reshape digital transactions across the region.

Checkout.com is laying the groundwork to become the first global payments platform to introduce card issuing in the United Arab Emirates — a move that could reshape how businesses in the region manage financial transactions.

The company plans to roll out its domestic card issuance offering in the UAE by 2026, subject to regulatory approval. The launch would give businesses the tools to issue both physical and virtual branded cards. This, in turn, opens up new ways to reward customers, streamline expense processes, and handle B2B payouts efficiently.

Checkout.com’s CEO and Founder, Guillaume Pousaz, revealed the plans during Thrive Abu Dhabi, the firm’s debut conference in the Emirates. Joined on stage by Remo Giovanni Abbondandolo, General Manager for MENA, Pousaz presented to an audience of over 150 partners and merchants at Saadiyat Island. Also in attendance was H.E. Omar Sultan Al Olama, the UAE’s Minister of State for Artificial Intelligence, Digital Economy, and Remote Work Applications.

Abbondandolo highlighted the strategic importance of the announcement: “As a global business, we focus on bringing products to markets that our customers want and need. Today’s announcement is proof of our commitment to the MENA region and its rising influence in the digital economy. The appetite for innovation here is real, and we’re proud to be building the infrastructure that powers it”.

One early adopter of Checkout.com’s UAE acquiring services is Headout, a travel experiences marketplace, which recently named the payment provider as its main partner in Europe. The company has already begun card issuing there and is keen to expand that offering into MENA once approval is granted.

The expansion of services in the UAE and beyond builds on Checkout.com’s track record in the region. It was the first global payments firm to secure a Retail Payment Services license from the UAE’s Central Bank and was instrumental in rolling out Mada and Apple Pay in both the UAE and Saudi Arabia.

Also Read: Protecting Your WhatsApp Account From Hackers: Kaspersky Expert Tips

The firm has also been rolling out new products: One of the latest is Flow Remember Me, currently in beta testing. It allows shoppers to store their card information once and access it across Checkout.com’s entire network, potentially cutting checkout times by up to 70%.

Earlier this year, Checkout.com also introduced Visa Direct’s Push-to-Card solution in the UAE, enabling both domestic and international payouts. Its collaboration with Mastercard has grown as well, making it easier for businesses to send funds directly to third-party cards securely and quickly.

With regional tech ambitions on the rise — spurred by initiatives like Saudi Arabia’s Vision 2030 and the UAE’s 2031 Agenda — Checkout.com sees its role as one of a key enabler. “Our mission is to help ambitious businesses navigate the complexity of payments, so they can move faster, go further, and make the most of every opportunity,” said Abbondandolo. “In MENA, performance is personal. It’s local. It’s built on trust. And when payments perform, businesses thrive”.