Web3

Non-Fungible Tokens: A Beginner’s Guide To Getting Started With NFTs

What does a relatively obscure digital artist named “Beeple” have in common with Twitter CEO and founder Jack Dorsey? “Non-Fungible Tokens”, or NFTs for short.

Still confused?

In March 2021, artist Mike Winkelmann (aka “Beeple”) entered the history books when one of his projects sold for over $69 million at famous auction house Chrisite’s. Meanwhile, Twitter CEO Jack Dorsey was auctioning off a part of his own digital legacy: His first ever Tweet from 2006, which eventually sold for an astounding $2.9 million!

The technology that allowed these sales to take place is known as an NFT, or Non-Fungible Token. Put simply, NFTs are cryptographic tokens that use blockchain technology to allow users to define the uniqueness of an individual asset.

If that description still sounds a little mystifying, and you’re having trouble getting your head around Non-Fungible Tokens, NFT art, or any other aspect of this burgeoning technological trend, don’t worry, we’ve put together this easy to understand guide to help get you started.

Non-Fungible Tokens: A Very Simple Definition

If you were lucky enough to be in the market for an original Picasso painting or perhaps the studio master of your favorite Beetles album, how would go about verifying that they were the real deal?

In the case of those two examples, the enormous costs involved would mean that the items would come with certificates of authenticity, and a mound of paperwork from industry experts that verified their “provenance”.

However, when it comes to digital-only items like Beeple’s artwork, how would you ever know that your JPEG file was the original? It could easily have been duplicated thousands of times before you ever got your hands on it!

This in a nutshell, is the purpose of an NFT. It allows someone to create a “digital tag” for an item, using blockchain technology to assign a unique identifier that guarantees authenticity.

NFTs can be used to prove the originality of digital art and even music tracks, but in the future they might also be used to track real-world assets too, such as a house, a car, or even a prize-winning racehorse!

What Does The Non-Fungible Part Mean?

Cryptographic tokens like Bitcoin are designed to replicate money: You could exchange your Bitcoin for a friend’s Bitcoin, as they both have equal value. Likewise, you could also split a Bitcoin between a group of people, much like a $20 bill. This makes Bitcoins “Fungible”.

On the other hand, although a “Non-Fungible” token is sort of like a Bitcoin in the way its technology works, it can’t be divided or distributed, and it can’t be exchanged on a like-for-like basis.

These properties make NFTs ideal for representing individual assets, as they can’t be modified or split. You can’t buy half a painting for example, and although you might be able to swap the painting for something similar, it must always exist as a unique item of its own accord.

How Does The Technology Work?

The technology behind NFTs is very complex, but if you can get your head around how “blockchain” works, you’ll easily understand the basic concept:

A blockchain is a bit like a database. It stores blocks of data in a linked chain. However, unlike a typical database that would be stored on a central server, blockchain is completely decentralized. Every node of the chain is spread around the entire world, and each part holds a full record of the data that’s been stored there since its creation.

The order of the data on the blockchain is important, but each block itself is useless on its own, and tampering with any of the nodes would render the entire chain invalid. Combine that with decentralization, and you have a very solid and secure method for storing data.

Because NFT items are transferred and traded within the infrastructure of the blockchain, ownership is provable and guaranteed, with a complete ledger of transaction history embedded within.

How To Make Money With NFTs

OK, so that’s the technical part explained. Now here’s the part that most readers are probably holding out for: How do you go about buying and selling NFTs, and how difficult is it to create NFT artwork for yourself?

Let’s dive right in:

How To Buy & Sell NFTs

First up, if you’re keen to start buying and selling NFT items, you’ll need to get yourself a digital wallet.

A digital wallet is, as the name suggests, a secure place where you store all of your cryptocurrencies. There are lots of different online exchanges available where you can go to swap your regular (Fiat) money for Cryptocurrencies, and these sites will also come with a digital wallet where you can store your digital currency.

Coinbase is probably the best known of these exchanges, and it’s super easy to join the site via iOS, Android or your web browser.

Choose Your Currency

At this point, the only consideration you’ll need to make is which of the various marketplaces you’ll be using to buy and sell your NFT items.

Not all NFT marketplaces use the same currency (or blockchain) for buying, selling or creating NFTs. As a beginner, you’re probably best sticking to a Coinbase wallet and using Ethereum, as this is the currency that’s used by some of the largest NFT marketplaces (more on those in a moment).

If you’d like to dive in at the deep end with some of the more obscure marketplaces, we’d suggest starting out with something called Metamask.

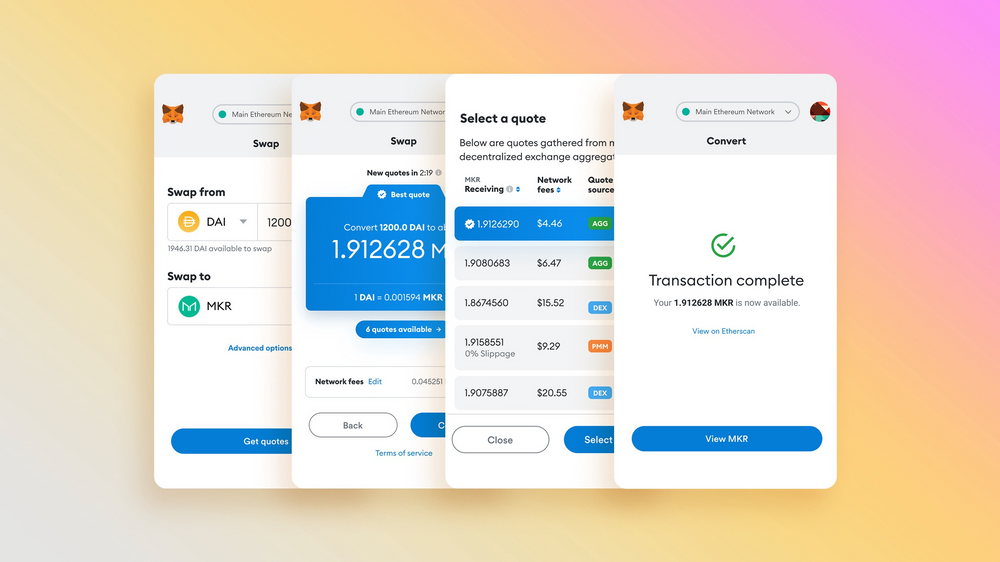

MetaMask Wallet

Metamask is a more flexible option than Coinbase, and comes with a browser extension and mobile app, giving you a secure wallet and a token exchange to manage a broader range of digital assets.

Different NFT Marketplaces

Once you have some digital currency loaded up, you can begin to browse the various NFT marketplaces. Once you’ve joined one, you can make as many purchases (or sales) as you’d like.

At the time of writing, we managed to find dozens of different platforms where you can buy and sell NFTs.

Here are the most popular:

- OpenSea

- Rarible

- SuperRare

- Mintable

- BakerySwap

- Foundation

- AtomicMarket

- KnownOrigin

- Enjin Marketplace

- Async Art

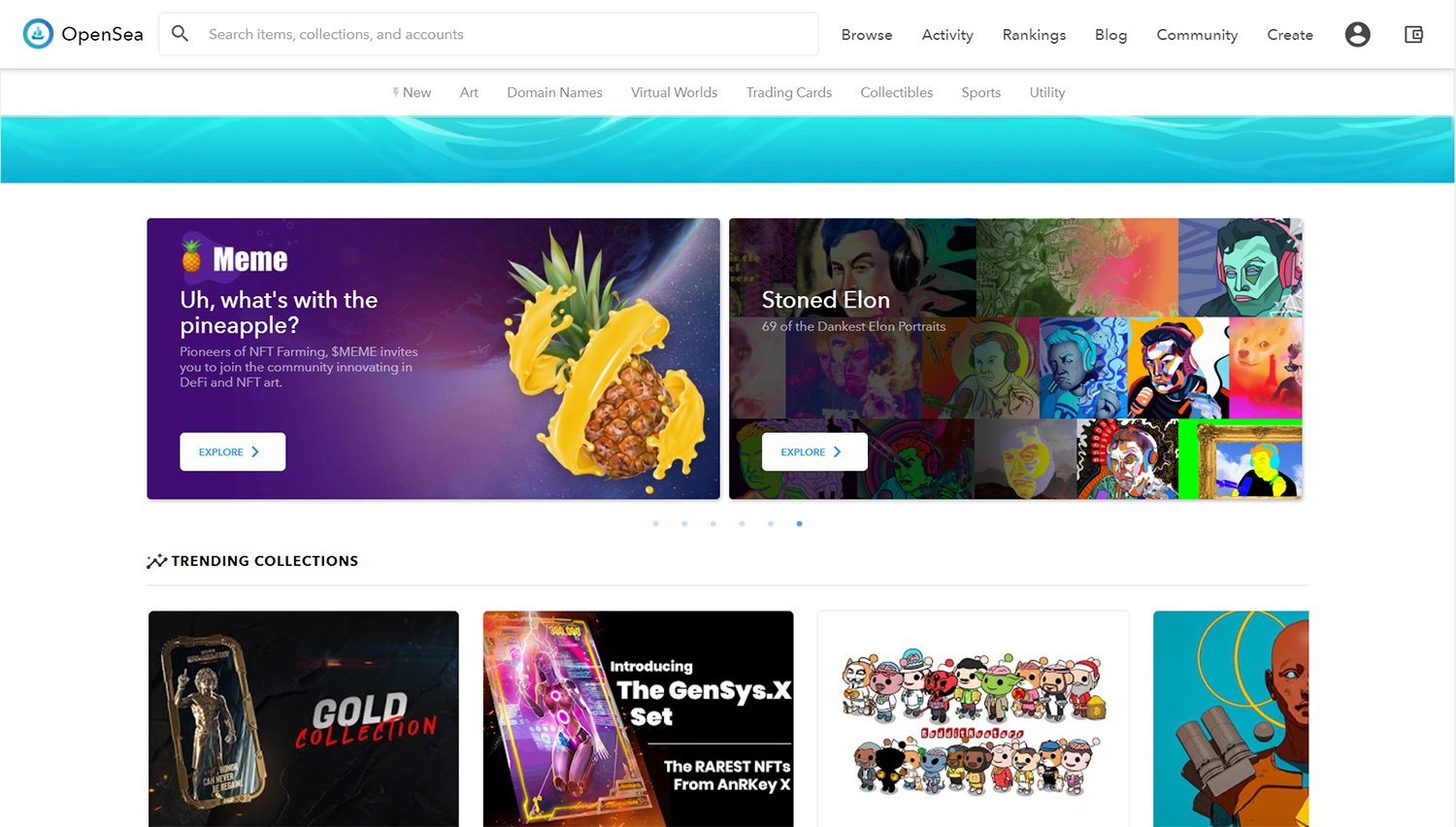

Out of that list, the top four entries make up the lion’s share of the current market, with OpenSea being by far the largest.

OpenSea Homepage

If you’ve made it this far, you’ll have no trouble buying and selling NFTs on a site like OpenSea. It’s as easy as making a bid on eBay!

So What Kind Of Items Are For Sale?

For the most part we’re talking digital art, but there’s a thriving economy for all sorts of digital assets. Here’s a non-exhaustive list:

- Trading cards like CryptoKitties (think Pokemon Go).

- Digital sports memorabilia, from NBA to F1.

- Censorship-resistant domain names.

- Virtual worlds and collectable Minecraft-style builds.

- Virtual clothing and wearables for avatars.

- Rare in-game items such as weapons and armor.

At this point, it’s important for us to make a bit of a disclaimer: Whilst the sites we’ve mentioned are completely legit, we’re not offering any investment or financial advice here. If you decide to start trading in digital artwork or collectables, you’re certainly not guaranteed to make money!

How To Create Your Own NFT Artwork

Buying and selling other people’s NFTs is one thing, but how do you go about making your own NFT art and publishing it on one of the marketplaces?

Surprisingly, it’s actually a pretty easy process and requires almost zero technical knowhow: If you’re signed up to one of the big marketplaces like Opensea or Rarible, all you need to do is make sure you have a crypto wallet attached to your account, then head over to the “Create” section of the site.

A few clicks later, you’ll be the proud owner of your very first piece of NFT art!

Is It Really That Simple?

Yes! Once you’ve uploaded your artwork and filled out some details (your name, description of the file, that kind of thing..), you’ll then go ahead and pay a small fee to “Mint” your creation (more on that below).

“Minting” is the process of adding a block onto the Ethereum blockchain, where your artwork’s unique identifier will live forever.

What Will Your Art Be Worth?

Your guess is as good as ours!

We’d wager that you probably won’t be breaking Beeple’s $69.3 million record anytime soon, but if you’re a talented artist, sites like OpenSea and Rarible could eventually help you to launch a full time career.

Bring Gas Money With You

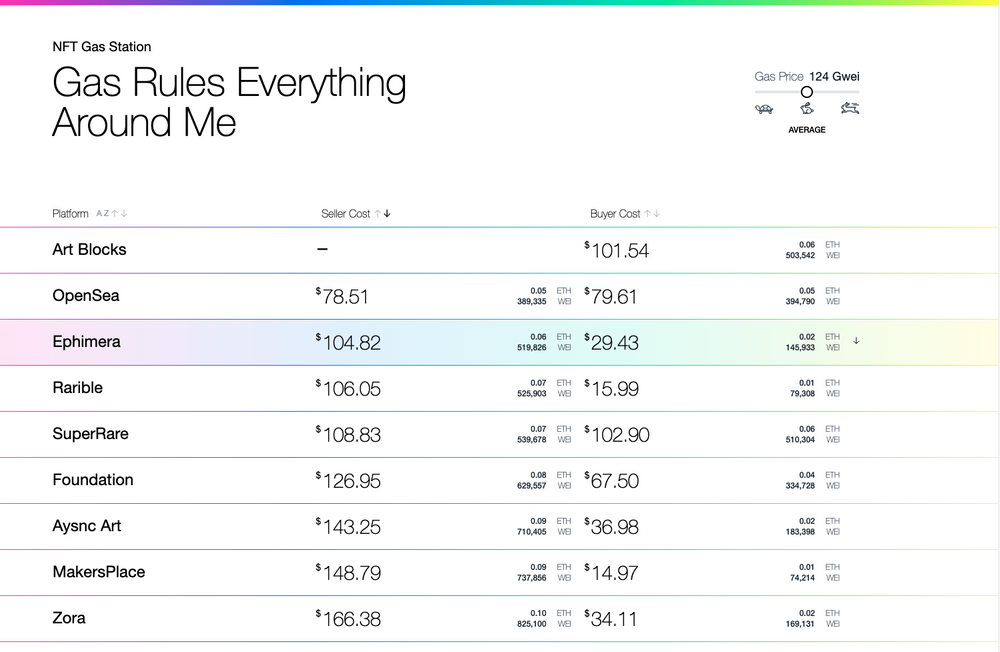

NFT Gas Station

Minting your own NFT requires the creation of a unique new entry on the blockchain, which ultimately requires a significant amount of processing power to get done. As Ethereum is the most commonly used network used to mint NFTs, this comes with what is known as a “gas fee” for the effort and energy used in computation. Optimist provides a helpful tool called NFT Gas Station which gives you an estimate of the gas fees on all major NFT marketplaces.

Some Real World Applications

So at this point, you probably fall into one of two camps: You’re either a digital creator trying to figure out how NFTs could help get your passion off of the ground, or you’re someone with an entrepreneurial spirit looking to make their fortune.

So the big question then: Are NFTs just hype, or do they have tangible uses in the future?

It’s still too early to tell, but we’re already seeing some interesting applications:

Digital Artists & Photographers: NFTs are fantastic news for anyone who makes a living with digital art. The NFT marketplaces allow you to show off your work to the entire world, and then trade it digitally without fear of it being copied.

The nature of blockchain also means that every time your piece gets traded online, you’ll get a fair commission from each and every sale, without having to employ a middleman like an agent or a gallery.

Musicians: Kings of Leon look set to be the first band to release an album using NFT technology. The release will be a little bit like a limited edition vinyl, with special perks like unique album art and access to front row concert seats.

NFTs are a natural fit for modern musicians, as they enable artists to release tracks or albums digitally in limited numbers, without the fear of piracy or duplication. NFTs enable an artist to retain the copyright for a track, but sell it on the open market as either a limited edition, or a one-off studio master.

Physical Items: It’s important to note that NFTs aren’t in any way restricted to digital items. The great thing about blockchain technology is that it not only keeps a paper-trail of every transaction the item has ever gone through, but it can also hold encrypted information or history.

- NFTs could prove the authenticity of art and antiques.

- Classic car owners could use NFTs to trace a vehicles history and originality.

- Real estate sales could be managed and tracked using NFT tokens.

Licensing & Record Keeping: In the future, it’s highly likely that a form of NFT technology will be used for sensitive information, such as medical records and even passports, whilst NFTs could also prove valuable for issuing patents and licenses for all manner of activities.

Summing Up

NFT technology and marketplaces like OpenSea are still very much in their infancy. However, the technology behind this new trend is sound, and could easily signal the start of a revolution for digital artists, musicians and other online creators, as well as offering practical solutions for offline applications as well.

Exciting times lie ahead that’s for sure, and there are certainly fortunes to be made for early adopters that do their research.

Web3

5 Gaming Cryptos That Will Explode In 2024

Because the gaming metaverse is still in its infancy, gaming cryptos are emerging at a rapid rate, and these 5 promising projects could play important roles in it.

If there’s one segment of the cryptocurrency market that has been doing exceptionally well this year, it’s gaming cryptos. Platforms such as Decentraland (MANA) don’t need an introduction anymore because they’ve already attracted plenty of attention from seasoned crypto investors and regular fans of video games alike.

Even large video game publishers, such as Electronic Arts and Ubisoft Entertainment, believe that the most popular games in the future will be backed by blockchain technology, allowing their players to prove ownership of virtual assets and trade them as non-fungible tokens (NFTs).

Because the gaming metaverse is still in its infancy, gaming cryptos are emerging at a rapid rate, and the most promising projects could play important roles in it. By betting on them early, you can see a huge return on your investment down the road.

Disclaimer: This article is for informational purposes only, and it does not include any financial advice. Please remember to always do your own research before investing into any gaming cryptos. If you’re new to the crypto world, and would like to start your trading journey, we highly recommend you consider using a trusted exchange platform like Coinbase or Binance.

#1 – UFO Gaming (UFO)

Despite its recent slump, UFO Gaming has experienced an enviable growth this year, making the earliest investors extremely happy.

UFO Gaming is building something called a dark metaverse, which it describes as a closed-loop ever-expanding ecosystem consisting of play-to-earn games, breedable in-game NFTs, earning virtual land, and other aspects.

Right now, UFO Gaming has a single game, Super Galactic, but more games are coming in the near future. Thanks to the unique rating system, more active players can earn bigger rewards and access more challenging game content.

Recently, UFO Gaming branched off into the eSports territory by launching its own Apex Legends Tournament hosted by Twitch streamers Apryze and Nokokopuffs. The prize pool worth a whopping $10,000 immediately attracted plenty of attention, and that’s exactly what this gaming crypto needs to succeed.

#2 – Vulcan Forged (PYR)

Vulcan Forged is like an incubator for blockchain games. This community-based project supports developers by providing the resources, infrastructure, and money needed to create world-class blockchain games.

The platform has its own thriving NFT marketplace and a tool that allows for instant dApp and NFT creation, and they’re both powered by the PYR settlement, staking, and utility token.

What’s really interesting about Vulcan Forged is the fact that 10 percent of the entire PYR supply goes into the LAVA pool. Players can then earn LAVA tokens by simply playing and engaging with any Vulcan Forged-made or hosted game. Best of all, the more LAVA tokens a player has, the more PYR airdrops they can receive each month.

#3 – Merit Circle (MC)

Merit Circle isn’t your typical crypto game. Instead, it’s an innovative project whose goal is to maximize value accrual across different games in the metaverse.

To be more precise, Merit Circle is a branching decentralized autonomous organization (DAO) whose members work together to participate in play-to-earn games and precious NFTs so they can collectively earn money.

The project has partnered with many leaders in the play-to-earn industry, giving its members access to exclusive rewards and emerging games. If you would like to increase your earning potential, then you can join Merit Circle as a scholar by applying for a scholarship on the official Discord server.

Understandably, Merit Circle focuses on the largest games out there, such as Axie Infinity, which are often prohibitively expensive for new players to get into on their own. However, Merit Circle members can create subDAOs, each representing a specific play-to-earn game. All subDAOs then contribute to the mainDAO.

#4 – RMRK (Pronounced “Remark”)

It can be difficult to understand everything RMRK is trying to do because the scope of the project is pretty large.

What you should know is that it’s built on the Kusama blockchain, Polkadot’s canary network, and designed to enable NFT creators to put together and build a system of arbitrary complexity by combining the so-called NFT legos.

These NFT legos can own other NFTs and change their output media by equipping them with additional building blocks. For example, imagine that you own two NFTs: a virtual dog and a fancy dog collar. RMRK’s NFT legos make it possible to put the collar on the virtual dog to create what’s essentially an upgraded version of the original dog NFT, increasing its value.

If you would like to learn more about RMRK, you can join the RMRKable Hacktoberfest. Besides learning a lot of useful information, you can also earn $50,000 in prizes. Registration ends on November 30, 2021, so you better hurry up to secure your virtual seat.

#5 – Aavegotchi (GHST)

As the name of this gaming crypto suggests, the project is inspired by the wildly popular Japanese digital pet handheld game, Tamagotchi. Just like Tamagotchi, Aavegotchi lets you take care of a virtual pet, but there’s a lot more to it than that.

Each Aavegotchi virtual pet is an ERC-721 non-fungible token that has a cryptocurrency stake inside. This stake comes from tokens staked through the Aave DeFi lending protocol. Players earn interest depending on which token is staked inside their Aavegotchies.

Of course, Aavegotchies also have a certain rarity value, which reflects everything from the uniqueness of their names to their traits to equipped wearables within the Aavegotchi universe.

Aavegotchi has recently partnered with Blackpool, a quantitative hedge fund for the NFT, so the future is looking bright, indeed.

Wrapping Things Up

By looking at the top 5 gaming cryptos currently available, we feel that 2024 will be a huge year for blockchain gaming. Developers from around the world are working on extremely promising projects that implement many features cryptocurrency enthusiasts and gamers have been dreaming about for years, and major corporations see the growing demand and want to be part of this exciting space.

You can be part of it too. All you need to do is recognize the opportunity and join the right project early on.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News3 weeks ago

News3 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant