News

Signal Now Supports In-App MobileCoin Cryptocurrency Payments

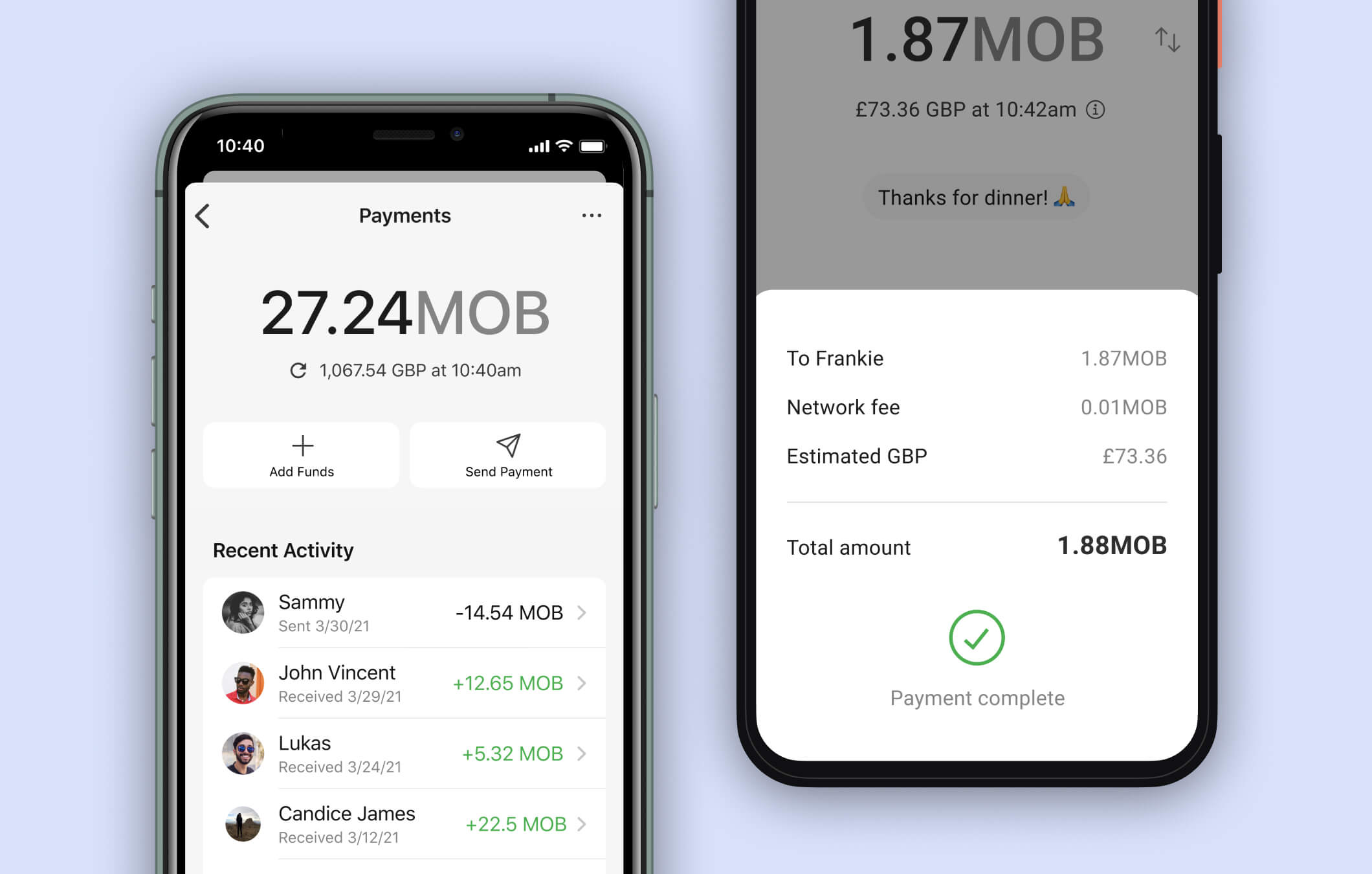

Signal’s latest beta version has introduced a new payment feature, called Signal Payments, allowing users to send and receive cryptocurrency from within the app.

The latest beta version of the privacy-oriented instant messaging platform Signal has introduced a new cryptocurrency payment feature, called Signal Payments, allowing its users to send and receive MobileCoin tokens directly from the Signal app.

Initially, the cryptocurrency payment feature will be available only to Signal users living in the United Kingdom, but support for more regions is planned for the future.

Signal

“Signal Payments makes it easy to link a MobileCoin wallet to Signal so you can start sending funds to friends and family, receive funds from them, keep track of your balance, and review your transaction history with a simple interface,” explains Signal in the official announcement. “As always, our goal is to keep your data in your hands rather than ours; MobileCoin’s design means Signal does not have access to your balance, full transaction history, or funds.”

Following the launch of the beta integration of MobileCoin, the value of a single MOB token jumped from $7 to over $60.

It’s no coincidence that MobileCoin was picked as the first cryptocurrency supported by the messaging app. The platform’s founder, Moxie Marlinspike, is listed as MobileCoin’s technical adviser, and some keen observers have pointed out that his involvement could be much deeper than both he and MobileCoin admit.

According to an early version of the MobileCoin whitepaper, Marlinspike was the project’s original CTO. If this information is true, then the decision to integrate MobileCoin should raise some serious questions among users, questions some members of the crypto community have already voiced their opinions.

Also Read: What Will Happen If You Don’t Accept WhatsApp’s New Privacy Changes?

“Signal sold out their user base by creating and marketing a cryptocurrency based solely on their ability to sell the future tokens to a captive audience,” said Bitcoin Core developer Matt Corallo, who also used to be a contributor.

MobileCoin CEO Joshua Goldbard disputed the authenticity of the whitepaper, claiming that it wasn’t written by anyone at MobileCoin even though the project’s current whitepaper is almost identical to it. Marlinspike refused to say anything about his professional relationship with MobileCoin.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant