News

Areeba To Bring Biometric Payment Authentication To MENA

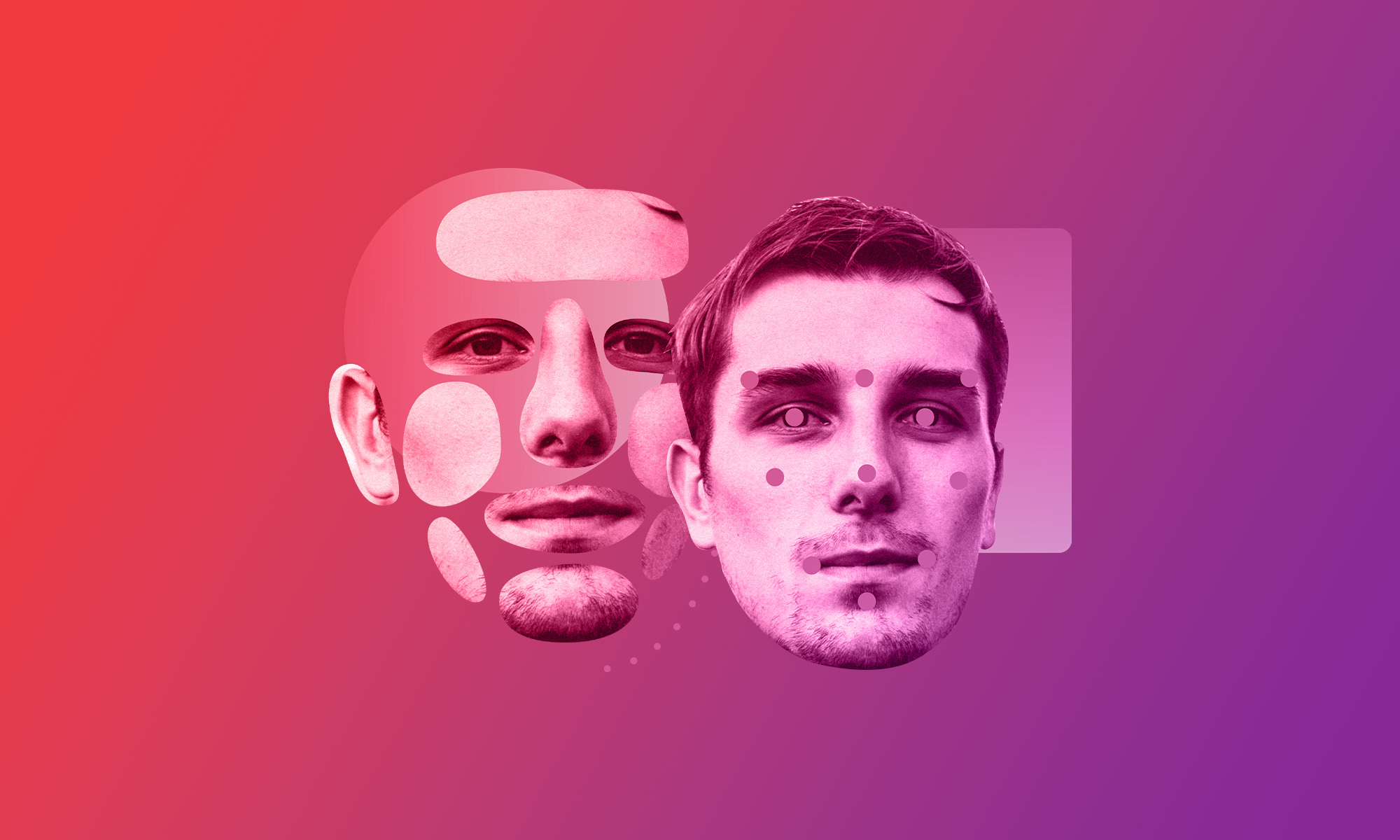

The service will let shoppers authenticate transactions using Face ID or fingerprints.

Areeba, the Middle East’s leading payment processing service provider, has introduced Out-of-Band authentication (OOB) in partnership with Swiss payment experts, Netcetera. The biometric and fingerprint-reading technology represents the most convenient method for cardholders to make secure and flawless e-commerce transactions.

Instead of entering a password or receiving confirmation via text message, cardholders can use fingerprints or facial recognition to authenticate payments, thus reducing fraud and enabling a smooth purchasing experience more aligned with modern shopping habits and lifestyles.

“Areeba is always an early adopter of cutting-edge technologies to provide its customers with the highest level of fraud protection. We are pleased to launch the OOB with Netcetera, a company that combines quality, reliability, service, and innovation,” says Maher Mikati, CEO of Areeba.

Also Read: Gen Z Spearheading Payment Innovation In The Middle East

According to Statista, in 2022, the biometric and digital identity sector was valued at 28 billion USD, and forecasted to exceed 70 billion USD by 2027.

The MENA region is a particularly strong market for the type of technology provided by Areeba, and with Netcetera’s expertise and technology, the new service is full of potential. According to Netcetera, their platform “provides continuous upgrades and updates to support all new trends and client requirements in the payment industry”, offering the best solutions to clients for improving conversion and helping to grow their fintech businesses.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.