Guides

Top 10 Best Freelance Platforms In The Middle East

Looking to launch or upgrade your freelance career in the MENA region? Discover the top 10 online marketplaces where freelancers can find gigs.

Looking for the ideal place to flex your freelance muscles in the Middle East? Our curated list of the top 10 freelance platforms in the region has you covered. Whether you’re a seasoned pro or a newbie stepping into the gig economy, this guide will help you navigate the best spots to find work.

Quick Summary Of The Top 10 Best Freelance Platforms In The Middle East:

| Platform: | Withdrawal Methods: | Service Fees: | Special Features: |

| Upwork | Bank Transfer, PayPal, Payoneer, M-Pesa | 10% | The world’s largest freelance platform |

| Fiverr | PayPal, Fiverr Card, Bank Transfer, Payoneer | 20% | Unique mini-store format, Fiverr Pro for established freelancers |

| Freelancer.com | PayPal, Bank Transfer, Skrill, Payoneer, Express Withdrawal | 10% | Lower service fee with membership, competitive pricing |

| Ureed | Wire Transfer, PayPal, Payoneer | 20% | MENA-focused, wide range of specialties |

| Tasmeem ME | N/A | N/A | Creative-focused, job board, external payment handling |

| Mosawer.net | Direct Payment (Client) | 20% | Photography-focused, simple booking process |

| Elharefa | Cash, Bank Transfer | 20% | Transparent payment handling, short and long-term projects |

| Bawabba | Direct Payment (Client) | 20% | Wide range of services, direct client contact |

| Inploy | N/A | No Fees | Free Contact Exchange, payment facilitation in testing |

| Bayt | N/A | N/A | Comprehensive job site with freelance opportunities |

The Middle East Is Embracing Gig Work

If you’re interested in the best freelance marketplaces in the Middle East because you want to kick off your freelance journey or elevate your existing gig game, then you’re not alone.

The Middle East, a region once synonymous with oil, has been fast morphing into a hotbed of freelance activity. Tectonic shifts in economic landscapes, spurred by youthful vigor and digital dexterity, are making the gig economy not just an alternative, but a preferred mode of work.

In a sweeping survey of over 4,000 professionals from the MENA region, a whopping nearly 9 out of 10 stated that freelancing is their current or future plan, particularly when it comes to online marketing, graphic design, and content writing.

For those who are interested in trading regular work schedules for a more flexible freelance lifestyle, the appeal is clear: the autonomy to choose projects that resonate with your skills and interests, the freedom to set your own hours, and the ability to work from anywhere are powerful draws. And when you couple the perks of freelancing with the appeal of cities like Dubai, Bahrain, and Abu Dhabi, which have thriving startup ecosystems (particularly in sectors like fintech, edtech, and digital media), the proposition becomes all the more enticing.

That’s why there’s no shortage of websites where MENA freelancers can find gigs that align with their expertise and aspirations. On one hand, we have global marketplaces like Upwork, Fiverr, and Freelancer. On the other hand, regional alternatives such as Ureed, Tasmeem, and Mosawer.net are equally excellent, helping freelancers and employers within the region collaborate with ease. Let’s take a closer look at them.

#1- Upwork

🏦 Withdrawal Methods: Bank Transfer, PayPal, Payoneer, M-Pesa

💵 Service Fees: 10% of the earnings made on the platform

As the most popular freelance platform in the world, Upwork stands as a colossal figure even in the MENA region, offering a platform where freelancers can connect with clients in need of services ranging from graphic design to web development and much more.

Thanks to its size, there’s no shortage of work opportunities on Upwork, posted by anyone from solo entrepreneurs to large brands. That’s why the platform is equally ripe with potential for newbies looking to snag your first gig and seasoned professionals eyeing big-ticket projects.

However, Upwork can be a bit competitive for newcomers due to its vast pool of established freelancers and the fact that it costs money to let clients know that you’re interested in their project because freelancers receive only a limited number of free Connects every month.

#2- Fiverr

🏦 Withdrawal Methods: PayPal, Fiverr Card, Bank Transfer, Direct Deposit, Payoneer

💵 Service Fees: 20% of the earnings made on the platform

Fiverr flips the traditional freelance model on its head. Instead of bidding on projects, freelancers set up digital mini-stores, showcasing their services to clients who come shopping. This unique system takes the pressure off bidding and allows freelancers to shine in their own creative space.

As freelancers complete projects and rack up positive reviews, they ascend the ranks, possibly earning the coveted Top Rated Seller badge, which amps up their visibility on the platform. For those with a solid freelance reputation elsewhere, there’s Fiverr Pro. An application to this exclusive club can open doors to high-value projects and premium clients.

However, the path isn’t rosy for everyone. Newbies may find it tough to gain traction amidst a sea of established freelancers. And the steep service fee of 20% can be a deterrent for some, especially considering that Fiverr’s customer support notoriously sides only with clients.

#3- Freelancer.com

🏦 Withdrawal Methods: PayPal, Bank Transfer, Skrill, Payoneer, Express Withdrawal

💵 Service Fees: 10% of the earnings made on the platform, which can be reduced with a paid monthly membership

Rounding up the trio of global online marketplaces for freelancers is Freelancer.com. Founded in 2009 with its headquarters nestled in Sydney, Australia, this platform has grown into a popular space for freelancers and clients to connect.

This platform attracts with a fairly low service fee of 10%, which can be lessened with a paid monthly membership, making it even more palatable for those who plan on using the platform extensively. The variety of withdrawal methods adds to the platform’s appeal, catering to freelancers worldwide, including those in the Middle East.

Just know that Freelancer.com does have its share of challenges. One notable concern is the race to the bottom competition often seen from freelancers from Pakistan and India, who sometimes offer extremely low rates for their services. This can make it harder for freelancers in other regions to compete on price.

#4- Ureed

🏦 Withdrawal Methods: Wire Transfer, PayPal, Payoneer

💵 Service Fees: 20% of the earnings made on the platform

Formerly known as Nabbesh, Ureed has rebranded and evolved into a bustling marketplace for freelancers in the MENA region. Unlike Upwork, Fiverr, and Freelancer.com, this freelance services marketplace has its deep roots in the Middle East, with all of its founders being from the region.

Since its inception in 2017, the platform has witnessed robust growth, doubling in size and extending its reach beyond borders. Now, it boasts over 5,000 employees working remotely across 10 countries, and is home to freelancers spanning 500+ different specialties, 55% of which are women.

To get started on Ureed, you just need to sign up, create an attractive profile to showcase your expertise and experience, test your knowledge to get a blue check, and start pitching for projects. It’s a simple system that should be instantly familiar to those who have used other platforms and should take no time at all to get used to for those with little to no experience.

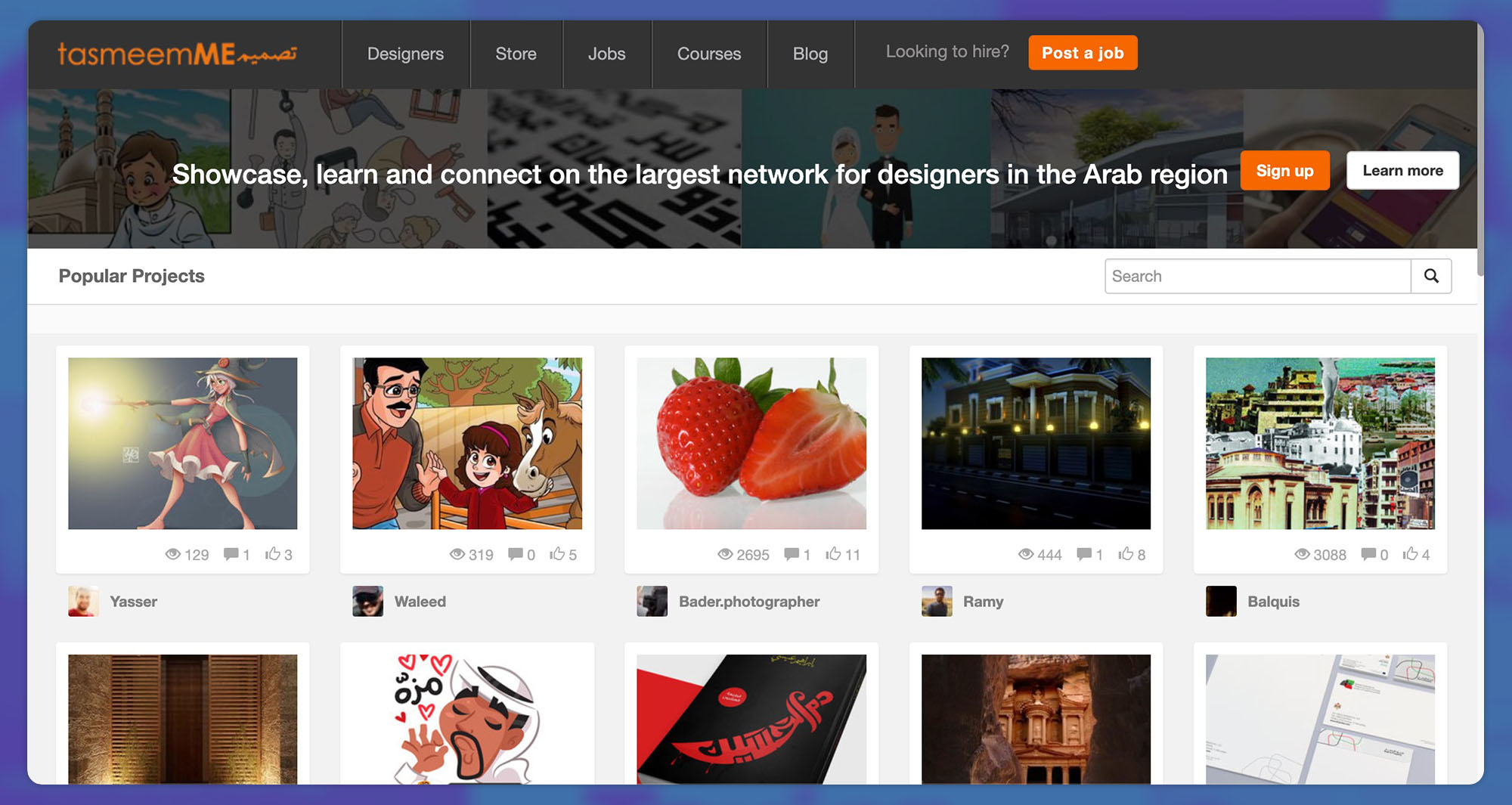

#5- Tasmeem ME

🏦 Withdrawal Methods: Not Applicable

💵 Service Fees: Not Applicable

Tasmeem ME, translating to “my design” in Arabic, is a haven for creatives in the Middle East, particularly those who spend their days creating logos, illustrations, 3D models, motion graphics, websites, and so on.

Launched in 2009 as a part-time endeavor, it morphed into a full-fledged platform by 2014. Today, Tasmeem ME is known mainly for its job board, where freelancers can browse through a variety of creative projects. Besides connecting freelancers with clients, Tasmeem ME is also a place where designers can showcase their work and a hub for learning and professional development, offering a range of courses that go well beyond design.

It’s worth pointing out that Tasmeem ME, unlike some other freelance platforms, doesn’t handle payments. It purely serves as a bridge between freelancers and clients, leaving the financial transactions and agreements to be managed externally.

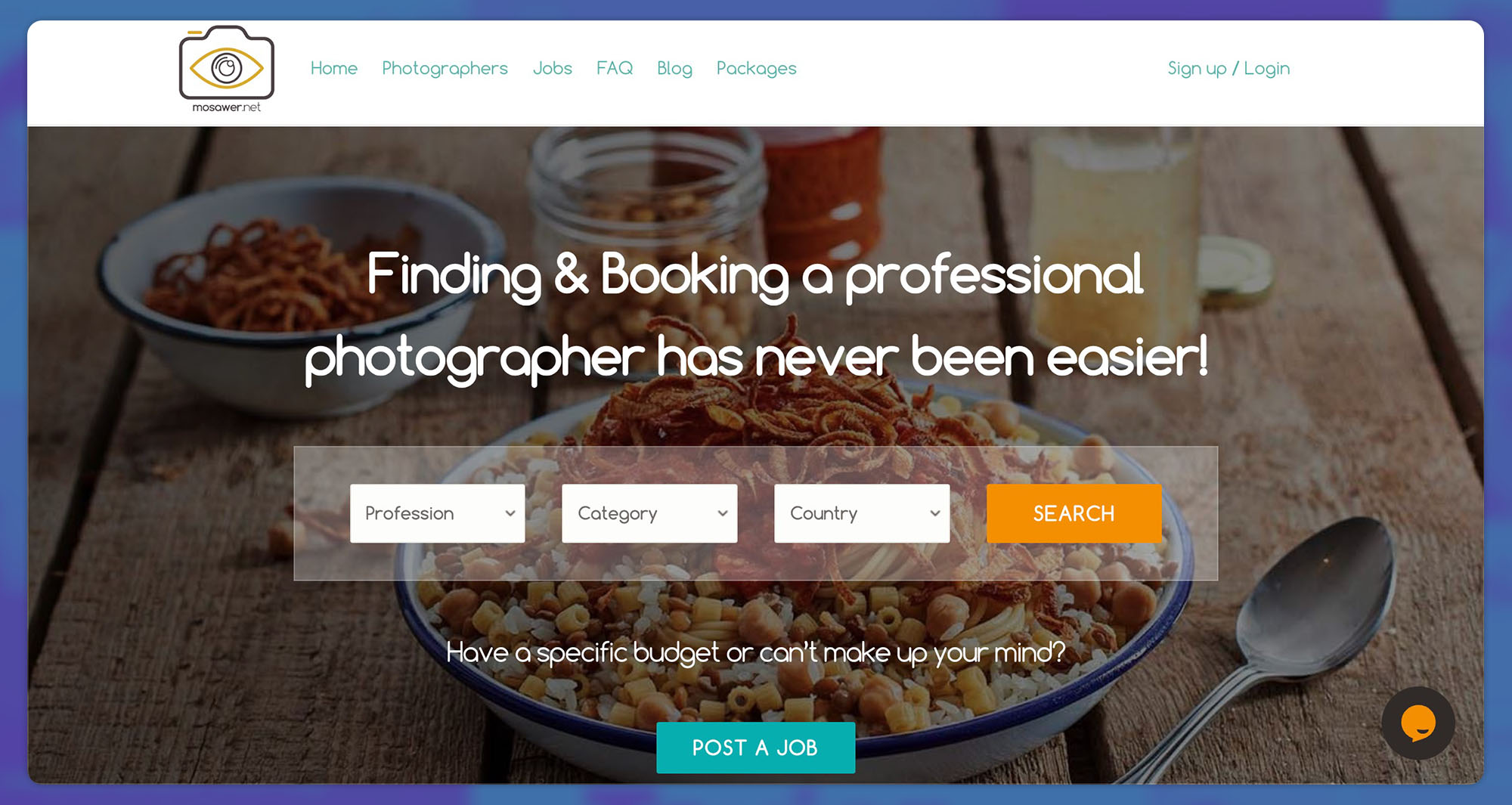

#6- Mosawer.net

🏦 Withdrawal Methods: Handled directly with clients (payment processing options to be released soon)

💵 Service Fees: 20% commission on bookings (to be introduced later this year)

Mosawer.net shines a spotlight on freelance photographers in the Middle East, offering a platform where they can showcase their portfolio and attract customers. As a freelancer, you get to create a profile, display your work, and be discovered by clients in search of photography services. The platform has a simple yet effective process: clients can search, filter, and shortlist photographers, request quotes, and then confirm bookings through a chat.

If you’re keen on a particular project, clients can also post public jobs, allowing you to privately send in your application. Although it’s completely free to sign up and create your portfolio, Mosawer.net plans to introduce a 20% commission fee on bookings later this year.

The current model requires freelancer photographers to handle payment processes directly with your client, but there’s a promise of several payment options being introduced soon. While this is a point of friction, the platform makes up for it by offering exclusive benefits and discounts from their partners, just by sharing your Mosawer.net profile link with them.

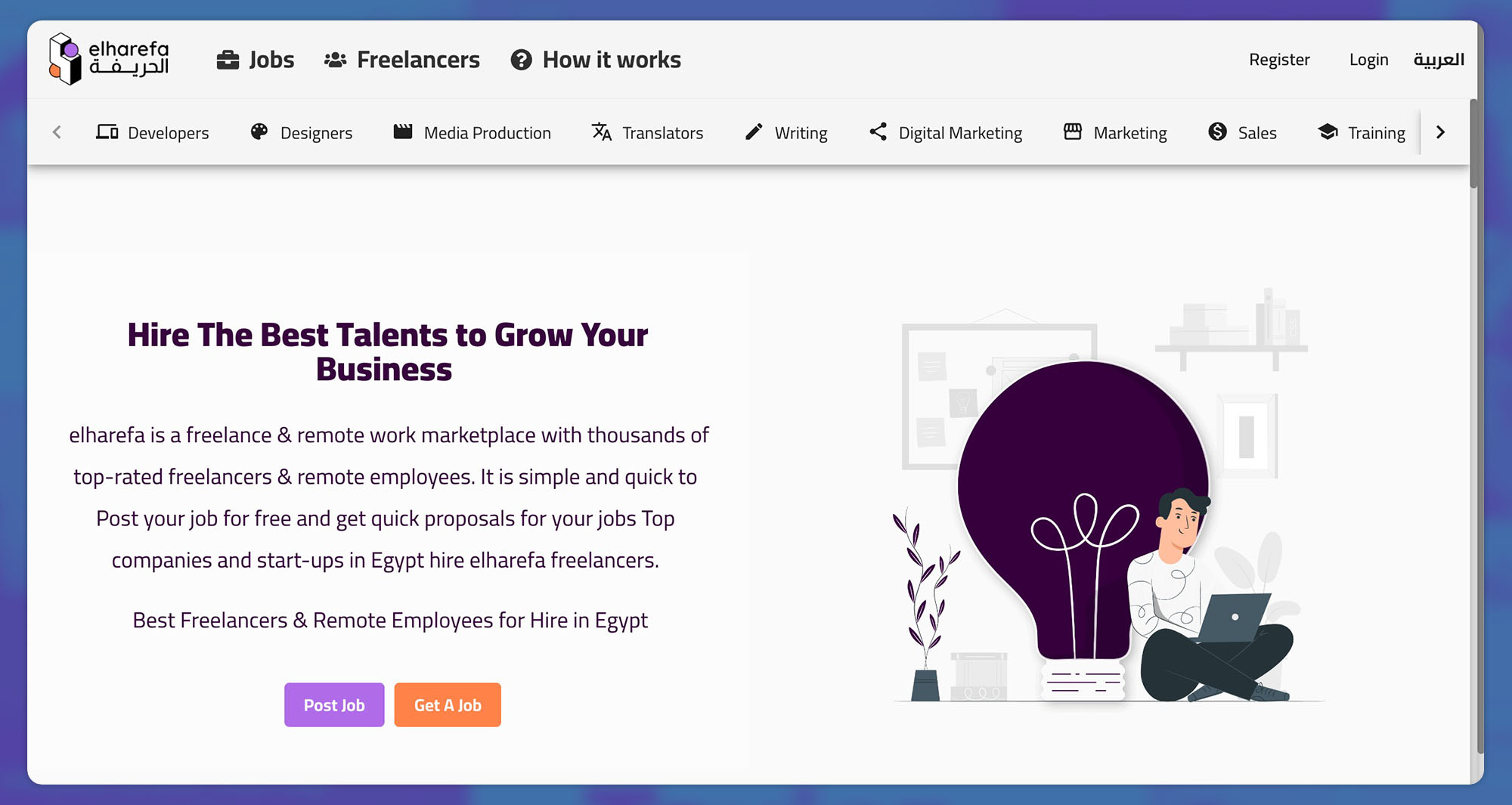

#7- Elharefa

🏦 Withdrawal Methods: Cash, Bank Transfer, Vodafone Cash, Orange Cash, Etisalat Cash, Aman Payments, Masary’s Shops (Egypt)

💵 Service Fees: 20% of the total project value

Dubbed as a hub for the talented and diligent, Elharefa is Egypt’s most popular website for freelancers. Getting started is straightforward: browse through the available jobs, create a free account, fill out your profile, and once verified, you’re set to draft and send proposals to jobs that catch your eye.

The monetary aspect is handled with transparency. Once a client picks you for a job, they pay the project budget to Elharefa, who takes a 20% cut, and you get started on your project. Payments are released post project completion and client approval, and transferred within 5 working days.

Elharefa supports both short-term projects or long-term gigs with milestone-based payments, so whether you’re looking for a quick gig or a longer, more involved project, this platform has got you covered.

#8- Bawabba

🏦 Withdrawal Methods: Direct payment from clients

💵 Service Fees: 20% commission for the lead if the deal closes successfully

Focusing primarily on the UAE, Bawabba is a platform where freelancers can offer over 160 different types of services, such as photography, music, arts and crafts, writing, graphic design, consulting, legal, architecture, programming, maintenance, and entertainment. One of the notable features of Bawabba is the absence of a sign-up requirement to contact freelancers, making the process less cumbersome for potential clients.

The payment structure on Bawabba is quite direct; freelancers are paid per project, per hour, or per word, depending on the nature of the job, with payments made directly by the clients. Although Bawabba charges a 20% commission for leads if a deal closes successfully, it holds no accountability for disputes between the user and the customer.

This lack of mediation in payment disputes could be a downside as the onus of payment retrieval falls solely on the freelancer, which could be challenging especially in cases of disagreements.

#9- Inploy

🏦 Withdrawal Methods: Not Applicable

💵 Service Fees: No Fees

Breaking into the MENA freelancing scene in 2019, Inploy has quickly become the go-to platform for Egyptian freelancers and small business owners looking to connect with clients locally and beyond. Pitching itself as an online marketplace for premium talent, Inploy hosts a vast directory of service providers across over 30 categories.

The platform stands out with its Free Contact Exchange feature, breaking down communication barriers between clients and freelancers by enabling them to connect directly at no extra charge. This is a breath of fresh air in an industry where platforms often act as a middleman at every stage.

Right now, Inploy is testing payment facilitation features, whose purpose is to ensure safe and secure transactions between clients and freelancers. It’s likely that these features will be monetized in the future.

#10- Bayt

🏦 Withdrawal Methods: Not Applicable

💵 Service Fees: Not Applicable

Dubbed as the MENA’s version of Indeed, Bayt isn’t your typical freelancing platform like Upwork or Fiverr. Instead, it positions itself as a comprehensive job site, connecting job seekers with employers across the Middle East since its inception in 2000.

Despite not being a traditional freelancing website, it holds a treasure trove of opportunities for freelancers. A simple filter using the “freelance” keyword unlocks a world of freelance gigs among the 55,000+ active job listings on the platform. Navigating through Bayt is a breeze, especially with its well-designed mobile app that makes job hunting on the go quite convenient.

Conclusion

Embarking on a freelance journey in the Middle East is an exhilarating venture waiting to unfold, especially with the surge of online platforms bridging the gap between freelancers and potential clients. We hope that our introduction of the top 10 best freelance platforms in the MENA region has helped you choose the right platform to kickstart or elevate your freelance career. Good luck!

Guides

The Most AI-Proof Career Opportunities In The Middle East

Concerned about AI’s impact on your career? Discover the most AI-proof job opportunities thriving in the Middle East and beyond.

The rise of artificial intelligence (AI) is sending shockwaves through the global workforce, transforming industries and displacing jobs at an unprecedented pace. Writers, graphic designers, web developers, transcriptionists, translators, and many others have seen their roles dramatically impacted in just the past two years (since the release of ChatGPT).

Given these rapid developments, it’s no surprise that people across the Middle East and other regions are increasingly looking for AI-proof their future. If you count yourself among them, you’ve come to the right place. In this article, we’ve thoroughly researched and compiled a list of career opportunities (presented in no particular order) that are likely to thrive in the Middle East despite the ongoing AI revolution.

Summary Of AI-Proof Career Opportunities:

| Career | Average Base Annual Salary (AED) |

| Artificial Intelligence Specialists | 171,000 |

| Maintenance Technicians | 48,000 |

| Doctors | 252,000 |

| Registered Nurses | 84,000 |

| Social Workers | 85,000 |

| Elementary And High School Teachers | 83,000 – 85,000 |

| Emergency Responders | 100,000 |

| Skilled Tradespeople | 60,000 |

Artificial Intelligence Specialists

💵 Average Base Annual Salary (Source): AED 171,000

It’s probably no surprise that one of the most career opportunities in the Middle East lies in the heart of the AI industry itself. The AI boom has naturally led to a surge in demand for professionals who have a deep understanding of the technology and can develop, implement, and troubleshoot AI systems.

In the United Arab Emirates, the number of AI workers quadrupled to 120,000 from 2021 to 2023, according to Al Olama, the UAE’s AI Minister, as the country pushes forward with its ambitious goal of becoming a global AI hub by 2031. The UAE is investing heavily in AI education and research, establishing dedicated AI universities and research centers to nurture local talent and attract international experts.

To become an AI specialist, you need to have a strong foundation in computer science, mathematics, and statistics. That’s why most AI specialists hold at least a bachelor’s degree in one of these fields, although many also pursue advanced degrees such as a master’s or Ph.D. to deepen their expertise and stay at the forefront of the rapidly evolving AI landscape.

Maintenance Technicians

💵 Average Base Annual Salary (Source): AED 48,000

The impact of AI extends far beyond the digital realm, as advanced robotics and intelligent machines are poised to revolutionize the physical world. Multiple companies, including Boston Dynamics, Tesla, and Figure AI, are working on developing general-purpose humanoid robots capable of performing a wide range of tasks guided by advanced AI reasoning.

As these sophisticated machines become more prevalent, they are expected to take over an increasing number of jobs in warehouses, factories, and hazardous environments. While this may lead to the displacement of some human workers, it also creates a growing demand for skilled maintenance technicians who can keep these complex systems running smoothly.

To succeed in this field, aspiring maintenance technicians should consider pursuing vocational training or a degree in mechatronics, robotics, or a related field. Hands-on experience through internships, apprenticeships, or industry collaborations can also be invaluable in developing the practical skills needed to excel in this role.

Doctors

💵 Average Base Annual Salary (Source): AED 252,000

In the Middle East, countries like Saudi Arabia, Qatar, and the UAE have shown a particularly strong willingness to embrace AI in healthcare, with two-thirds of their populations open to the idea of replacing doctors with robots, compared to just 55% across Europe, the Middle East, and Africa as a whole, according to a PwC study (PDF).

However, despite the rapid advancements in AI technology, doctors are unlikely to be made obsolete anytime soon. Instead, AI will become an invaluable tool that complements and enhances the expertise of medical professionals, enabling them to provide better care to their patients.

AI is already being used in various healthcare applications, from accelerating the development of new cures, enhancing disease detection, and improving patient outcomes. These developments have not gone unnoticed by UAE leaders, with the country’s National Artificial Intelligence Strategy 2031 placing significant emphasis on the healthcare field and the Ministry of Health and Prevention (MoHAP) launching the UAE health sector’s first Centre of Excellence (COE) for AI in October 2023.

Registered Nurses

💵 Average Base Annual Salary (Source): AED 84,000

Just like doctors, registered nurses are unlikely to be replaced by AI anytime soon, despite the development of robot nurses. The human touch, care, and empathy provided by nurses are invaluable, especially during times of sickness and vulnerability.

In fact, the demand for registered nurses in the Middle East is growing rapidly due to the region’s expanding population and the increasing healthcare needs of an aging demographic.

A recent report on the impact of AI on the Middle Eastern healthcare landscape predicts that the UAE will require an additional 15,000 nurses and allied health professionals in Abu Dhabi and 11,000 nurses in Dubai by 2030 to keep pace with the country’s healthcare needs. As a result, registered nurses can expect ample job opportunities in the Middle East, with AI serving as a tool to enhance their work rather than replace them.

Social Workers

💵 Average Base Annual Salary (Source): AED 85,000

The role of social workers is expected to remain essential and largely unaffected by automation. Social workers provide crucial support, guidance, and advocacy for individuals, families, and communities facing challenging circumstances, and the demand for their services is growing in the Middle East.

According to a recent statistic, the revenue of the human health and social work activities industry in the UAE is projected to reach approximately 5.9 billion U.S. dollars by 2024. This growth indicates a promising future for social workers in the region, as their skills and expertise will be increasingly sought after to address the diverse needs of the population.

For example, social workers have career opportunities in special needs centers, schools, geriatric and psychiatric hospitals, and other social service organizations. Depending on the specific role, such as social therapist, school counselor, or special needs teacher, obtaining a license may be required.

Elementary And High School Teachers

💵 Average Base Annual Salary (Source): AED 83,000 – 85,000

While AI is set to play a significant role in the education sector, it’s extremely unlikely to replace teachers entirely. Instead, AI will augment and support the work of educators.

According to the World Economic Forum, AI can assist teachers by automating administrative tasks, such as grading and record-keeping, allowing them to focus more on personalized interactions with students and enhancing the overall quality of education. Another exciting application of AI in education is the personalization of learning content and experiences. AI-powered systems can adapt to individual students’ needs, learning styles, and abilities, providing tailored support and resources to optimize their learning outcomes.

This creates new opportunities for tech-savvy teachers and those willing to embrace AI in their teaching methods. A teacher who understands modern AI tools and knows how to incorporate them effectively into their lesson plans will be highly sought after.

Emergency Responders

💵 Average Base Annual Salary (Source): AED 100,000

The jobs of emergency responders, including firefighters, paramedics, and police officers, are very safe from AI automation. The critical, hands-on nature of their work, which often requires split-second decision-making, empathy, and adaptability in unpredictable situations, guarantees that human responders will remain essential even in the future.

However, AI has the potential to revolutionize emergency response by assisting responders in various ways. Companies like Omdena are pioneering AI solutions to improve emergency response management, preparedness, and response.

For example, Omdena’s AI models analyze historical data, weather patterns, and other factors to predict the likelihood of emergencies such as floods, wildfires, and earthquakes. They also help optimize resource allocation and coordinate the response of different agencies to improve the efficiency and effectiveness of disaster relief operations.

Skilled Tradespeople

💵 Average Base Annual Salary (Source): AED 60,000

In the short term, skilled tradespeople can rest easy knowing that AI won’t be fixing leaky toilets, unclogging drains, or rewiring electrical panels anytime soon. The complex problem-solving skills and dexterity required for these tasks are still beyond the capabilities of current AI systems.

However, the medium and long-term outlook for trades in the Middle East is more complicated. As AI disrupts various industries, many people are considering transitioning to trades as a safer career option. This influx of new workers could potentially increase competition and put downward pressure on wages, especially for entry-level positions.

Moreover, in wealthier parts of the Middle East, the demand for skilled tradespeople is often met by workers from South Asia who are willing to accept lower wages. Despite these challenges, established tradespeople with a strong reputation and a loyal customer base can still thrive in the AI era by providing high-quality work and excellent customer service.

Conclusion

Even though the AI revolution is expected to disrupt the entire job market and make many traditional career paths obsolete, there are still plenty of work opportunities in the Middle East remain resilient against automation. Generally, the most AI-proof career opportunities are those that either directly contribute to the development and implementation of AI technologies or require uniquely human skills such as empathy, creativity, and critical thinking.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News3 weeks ago

News3 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant