News

WeRide Granted First Self-Driving Vehicle License In UAE

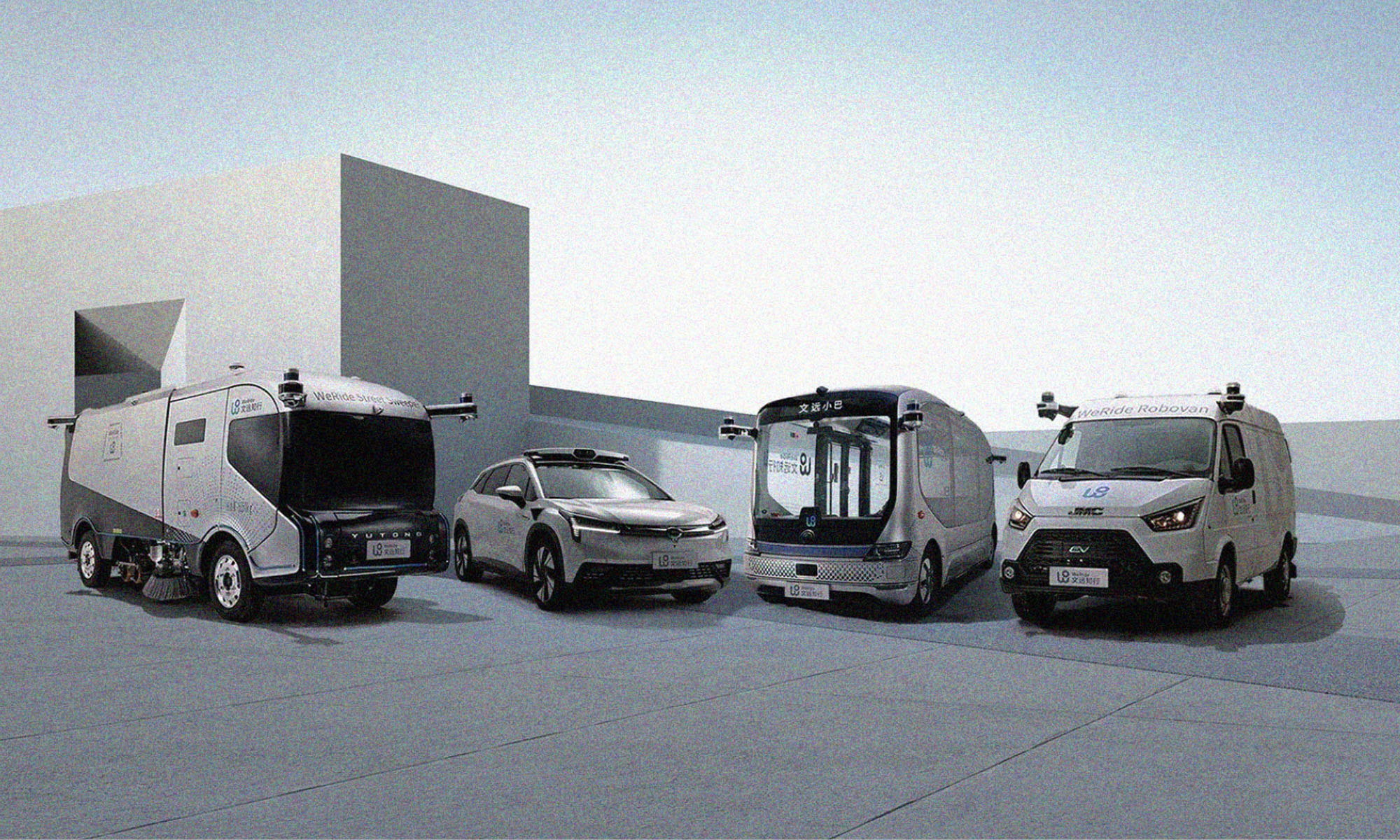

The Chinese autonomous driving company may soon deploy robotaxis and robobusses across the Emirates and beyond.

Chinese autonomous driving startup WeRide was the first company in the world to hold driverless permits for testing in both China and the USA. Now, the autonomous technologies experts have secured a license to deploy self-driving vehicles in the UAE, having already completed public testing on some routes within the Emirate.

Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, announced the news on Twitter: “We approved the first national license for self-driving vehicles on the country’s roads, which was granted to a specialized WeRide company”.

Dubai aims to make 25% of its transportation completely autonomous by 2030, so the permit comes at an ideal time. Last month, as part of the Eid al-Adha holiday services, the Integrated Transport Centre (ITC) of Abu Dhabi announced that visitors to Saadiyat and Yas Islands could experience free autonomous driving car rides, including a vehicle called “TXAI”, which was launched by WeRide in partnership with a local company Bayanat.

Also Read: UAE’s du Teams With Huawei For Net-Zero Telecom Services

WeRide has developed its state-of-the-art technologies through WeRide One, which the company describes as a “one-for-all and all-for-one platform for urban autonomous driving applications. Designed with high flexibility on both the software and hardware levels”. The platform uses self-evolving deep learning systems to prioritize safety, plus AI algorithms and a fusion of camera, LiDAR, and radar to replace human operators.

In a recent press release WeRide said, “In the future, WeRide will continue to deepen its presence in the Middle East region and bring high-quality autonomous driving technology, products, and services to more customers and consumers”.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant