News

BlackBerry Movie Tells The Story Of The Famous Keyboard Phone

It’s time to take a break from the Steve Jobs movies and give some appreciation to Mike Lazaridis and Jim Balsillie.

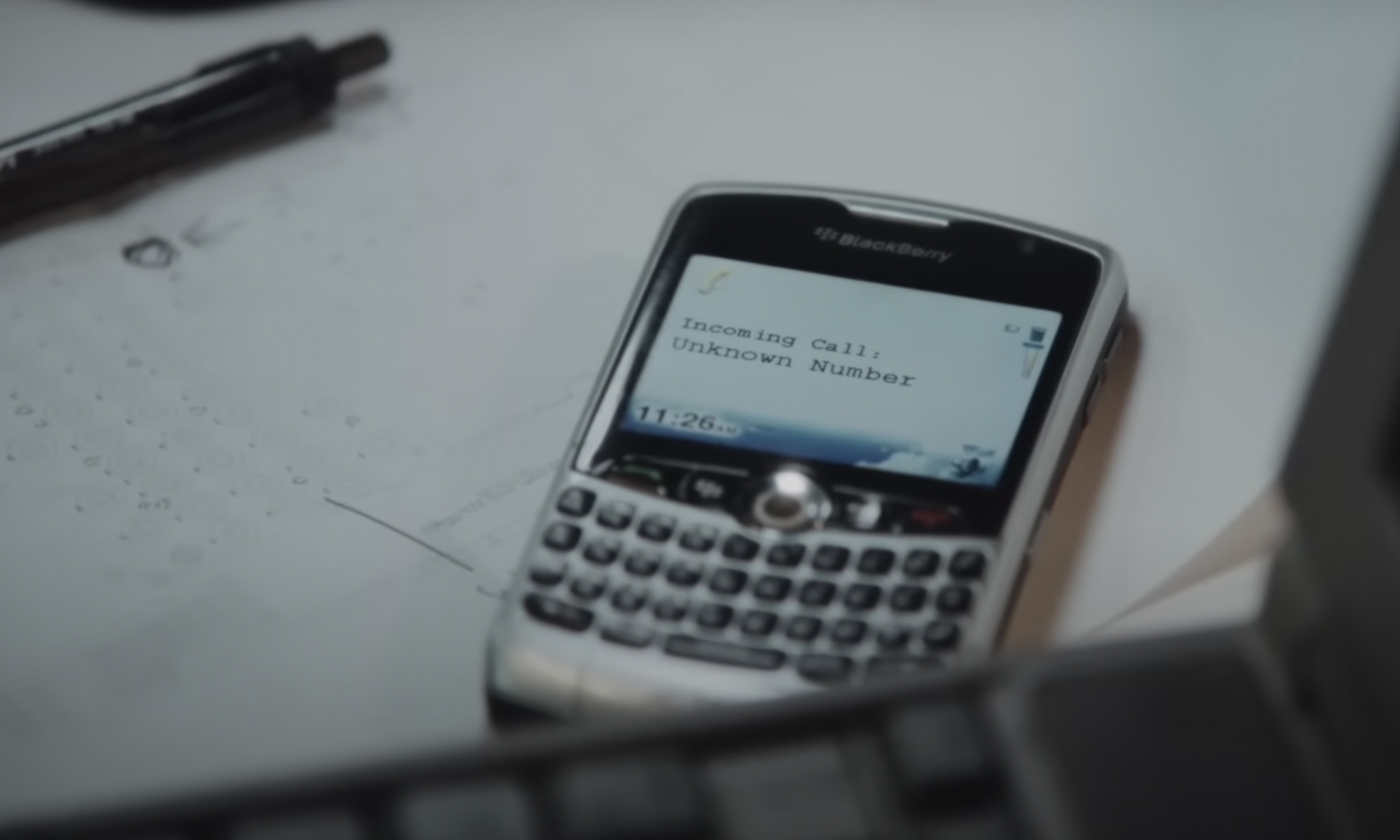

Are you a BBM and email enthusiast who misses phones with physical keyboards? In that case, you might be interested in the upcoming Blackberry movie, featuring the creation journey of the famous handset.

The film stars Jay Baruchel (How To Train Your Dragon), Glenn Howerton (It’s Always Sunny in Philadelphia), and Matt Johnson, also the movie’s director.

BlackBerry is released in theaters on May 12th and covers how the once-famous phone became the premier business communicator, but ended up losing out to the smartphone. In the trailer, we see Johnson’s Doug and Baruchel’s Mike Lazaridis watching the infamous Steve Jobs announcement of the new iPhone, and the stress and excitement as the company pushes to launch its first product.

Also Read: Top 10 Best Video Games Set In The Middle East

If you’re interested in learning more about Blackberry’s rise to fine, or want a preview of the movie before it hits the screen, check out the book Losing the Signal: The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry. The text forms the basis of the movie’s script and is a fantastic read for anyone with fond memories of rocking a Blackberry in the past, as well as a cautionary tale of a business ultimately going bust.

News

PayPal & TerraPay Join Forces For Cross-Border MENA Payments

The collaboration will be especially helpful in regions where traditional banking infrastructure is limited or inconsistent.

PayPal has teamed up with TerraPay to improve cross-border payments across the Middle East and Africa. The move is designed to make it easier and faster for users to send and receive money internationally, especially in regions where traditional banking infrastructure can be limited or inconsistent.

The partnership connects PayPal’s digital payments ecosystem with TerraPay’s global money transfer network. The goal is to streamline real-time transfers between banks, mobile wallets, and financial institutions, significantly improving access for millions of users looking to move money securely and efficiently.

Through the partnership, users will be able to link their PayPal accounts to local banks and mobile wallets using TerraPay’s platform. This means faster transactions and fewer barriers for individuals and businesses across the region.

“The Middle East and Africa are at the forefront of the digital transformation, yet financial barriers still limit growth for many,” said Otto Williams, Senior Vice President, Regional Head and General Manager, Middle East and Africa at PayPal. “At PayPal, we’re committed to changing that […] Together, we’re helping unlock economic opportunity and build a more connected, inclusive financial future”.

For TerraPay, the deal is a chance to scale its reach while reinforcing its mission of frictionless digital transactions.

“Our mission at TerraPay is to create a world where digital transactions are effortless, secure, and accessible to all,” said Ani Sane, Co-Founder and Chief Business Officer at TerraPay. He added that the partnership is a major milestone for enhancing financial access in the Middle East and Africa, helping businesses grow and users move funds with fewer limitations.

Also Read: A Guide To Digital Payment Methods In The Middle East

The integration also aims to support financial inclusion in a region where access to global banking tools is still uneven. With interoperability at the core, TerraPay can bridge the gap between different financial systems — whether that’s a mobile wallet or a traditional bank — making it easier to send money, pay for services, or grow a business across borders.

As the demand for cross-border payment options continues to rise, both PayPal and TerraPay are doubling down on their commitment to provide reliable, secure, and forward-looking financial tools for the region.