News

OnwardMobility Partners With Foxconn To Release 5G BlackBerry Smartphone

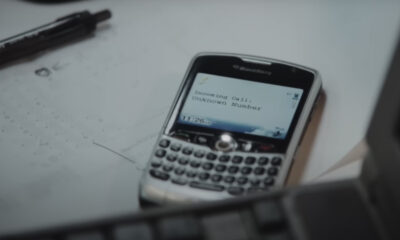

OnwardMobility, a US-based startup founded in 2019 by serial entrepreneur Peter Franklin, who worked for Microsoft and online game company Zynga, has announced its plan to release a new 5G BlackBerry Android smartphone with a physical keyboard.

The startup has already made agreements with BlackBerry, which has agreed to license its brand, and FIH Mobile Limited, a subsidiary of Foxconn Technology Group, which will provide its world-class design and manufacturing expertise.

“This is an incredible opportunity for OnwardMobility to bring next-generation 5G devices to market with the backing of BlackBerry and FIH Mobile,” said Peter Franklin, CEO of OnwardMobility. “Enterprise professionals are eager for secure 5G devices that enable productivity, without sacrificing the user experience.”

Indeed, the coronavirus pandemic has highlighted the global need for better information security, and smartphones play an essential role in the personal and work lives of most people. During the pre-iPhone era, BlackBerry devices were the go-to choice of productivity-oriented professionals, but the rise of modern smartphones with touchscreens forced BlackBerry to stop selling them in 2016.

To revive the brand’s former glory, something several other companies have unsuccessfully attempted before, OnwardMobility will have to do a lot more than just slap a physical keyboard on a run-of-the-mill Android smartphone. The startup knows that it faces an uphill battle, which is why it’s betting on the combination of security and productivity.

Also Read: Sightec Completes First Drone Delivery Without GPS

“We are excited that customers will experience the enterprise and government level security and mobile productivity the new BlackBerry 5G smartphone will offer,” commented John Chen, Executive Chairman and CEO, BlackBerry.

The new BlackBerry device will first launch in North America and Europe. No release date has yet been announced, but all involved parties hope to release it within this year. Currently, OnwardMobility is speaking to customers and mobile carriers on a global scale to develop its distribution plan. Understanding the critical importance of the Asian market, the goal is to enter it as soon as possible.

News

Qatar Airways Debuts World’s First Boeing 777 Starlink Flight

The airline has ambitious plans to roll out the high-speed, low-latency service across its entire Boeing 777 fleet within a year.

Qatar Airways has taken a significant step ahead of the competition by being the first operator to offer Starlink internet on a Boeing 777 aircraft traveling from Doha to London.

As the largest and first airline in the MENA region to offer Starlink’s ultra-high-speed, low-latency internet, Qatar Airways continues to raise the bar for in-flight services after winning the coveted Skytrax “World’s Best Airline” for 2024 award.

Initially, the carrier planned to outfit three Boeing 777 aircraft with Starlink technology. However, by the end of 2024, the airline will have upgraded 12 Boeing 777-300s with this service. Further ahead, the entire Boeing 777 fleet is set to be Starlink-equipped by 2025, one year earlier than originally scheduled, with the Airbus A350 fleet following suit by mid-2025.

This rollout demonstrates Qatar Airways’ dedication to enhancing in-flight connectivity and will enable passengers to stay in touch with family and friends, stream media, watch live sports, work remotely, and even play online games — all at 35,000 feet.

Qatar Airways Group Chief Executive Officer, Engr. Badr Mohammed Al-Meer expressed excitement about the debut flight, stating: “We are thrilled to launch our first Starlink-equipped flight, proving once again why Qatar Airways is at the forefront of the aviation industry”.

Also Read: A Guide To Digital Payment Methods In The Middle East

He continued, “Paired with our commitment to rapidly rollout Starlink across our entire modern fleet, [Qatar Airways] demonstrates our relentless pursuit of offering passengers an in-flight experience that transcends the constraints of traditional air travel”.

By launching its first Starlink-equipped aircraft, Qatar Airways has achieved several milestones, including operating the world’s first Boeing 777 widebody with the service onboard. Qatar Airways’ strategic partnership with SpaceX ensures passengers will continue to enjoy an unmatched in-flight experience, and not only represents a breakthrough for Qatar Airways but also sets a new standard for in-flight connectivity globally.