News

Sarwa’s New Cash Accounts Boost Growth By 250% In 3 Months

Despite some financial institutions suffering during the economic downturn, Sarwa’s reliability and trustworthiness seem to be paying dividends.

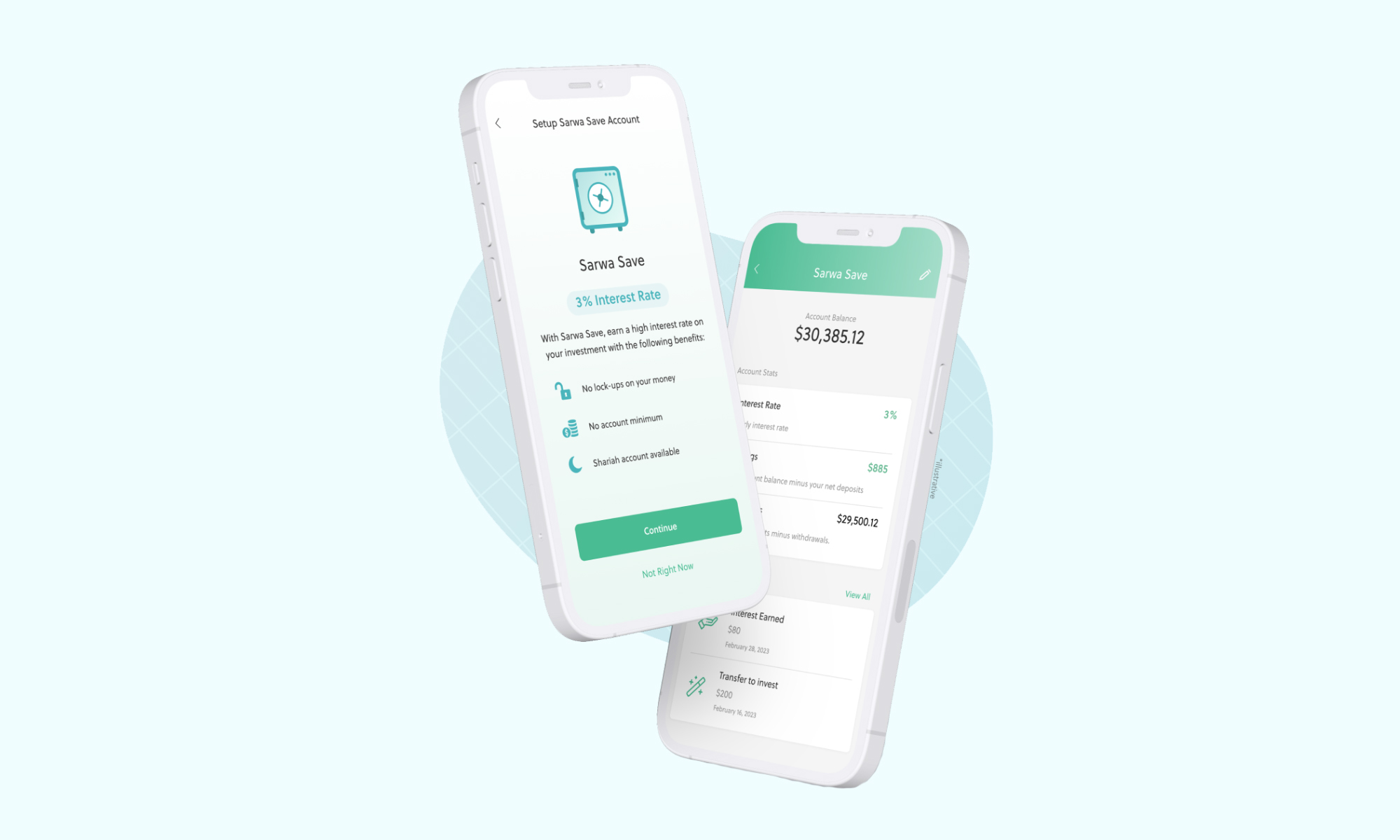

Sarwa, the personal finance and investment platform, recently launched a new high-yield cash account known as Sarwa Save. Despite the gloomy worldwide economic outlook of late, the new service has been a roaring success, with monthly deposits growing by 250% in just three months.

Sarwa users are increasingly prioritizing short-term savings with generous interest levels, as historically high inflation and aggressive Federal Reserve policies have led to challenging investment conditions.

“We are thrilled to see the rapid adoption of Sarwa Save, which reflects the growing demand for secure high-yield, low-risk products. Sarwa’s customers recognize the value in the offering and trust it with their hard-earned money. This trust has played a pivotal role in the impressive growth. Sarwa Save is a testament to the company’s commitment to providing innovative financial solutions and empowering clients to navigate the evolving economic landscape confidently,” says Shane Shin, Co-founder and Managing Partner, Shorooq Ventures.

Also Read: A Guide To Digital Payment Methods In The Middle East

In the UAE, most savings accounts offer low to zero interest, while Sarwa Save delivers a rate of 3% — nearly four times the average amount. As well as tempting short-term yields, the new accounts have no monthly or low-balance fees. When combined with hassle-free account setup, Sarwa’s platform makes for an appealing choice compared to traditional banks, especially as the startup offers a special, Sharia-compliant option known as Sarwa Save Halal.

Disclaimer: Sarwa Save is a product offered through Sarwa Digital Wealth (Capital) Limited that is regulated by the FSRA in the ADGM. This offering is not regulated by the DFSA. Sarwa is not a bank. We can unlock high-yield accounts through our banking partners.

News

PayPal & TerraPay Join Forces For Cross-Border MENA Payments

The collaboration will be especially helpful in regions where traditional banking infrastructure is limited or inconsistent.

PayPal has teamed up with TerraPay to improve cross-border payments across the Middle East and Africa. The move is designed to make it easier and faster for users to send and receive money internationally, especially in regions where traditional banking infrastructure can be limited or inconsistent.

The partnership connects PayPal’s digital payments ecosystem with TerraPay’s global money transfer network. The goal is to streamline real-time transfers between banks, mobile wallets, and financial institutions, significantly improving access for millions of users looking to move money securely and efficiently.

Through the partnership, users will be able to link their PayPal accounts to local banks and mobile wallets using TerraPay’s platform. This means faster transactions and fewer barriers for individuals and businesses across the region.

“The Middle East and Africa are at the forefront of the digital transformation, yet financial barriers still limit growth for many,” said Otto Williams, Senior Vice President, Regional Head and General Manager, Middle East and Africa at PayPal. “At PayPal, we’re committed to changing that […] Together, we’re helping unlock economic opportunity and build a more connected, inclusive financial future”.

For TerraPay, the deal is a chance to scale its reach while reinforcing its mission of frictionless digital transactions.

“Our mission at TerraPay is to create a world where digital transactions are effortless, secure, and accessible to all,” said Ani Sane, Co-Founder and Chief Business Officer at TerraPay. He added that the partnership is a major milestone for enhancing financial access in the Middle East and Africa, helping businesses grow and users move funds with fewer limitations.

Also Read: A Guide To Digital Payment Methods In The Middle East

The integration also aims to support financial inclusion in a region where access to global banking tools is still uneven. With interoperability at the core, TerraPay can bridge the gap between different financial systems — whether that’s a mobile wallet or a traditional bank — making it easier to send money, pay for services, or grow a business across borders.

As the demand for cross-border payment options continues to rise, both PayPal and TerraPay are doubling down on their commitment to provide reliable, secure, and forward-looking financial tools for the region.