News

Sarwa’s New Cash Accounts Boost Growth By 250% In 3 Months

Despite some financial institutions suffering during the economic downturn, Sarwa’s reliability and trustworthiness seem to be paying dividends.

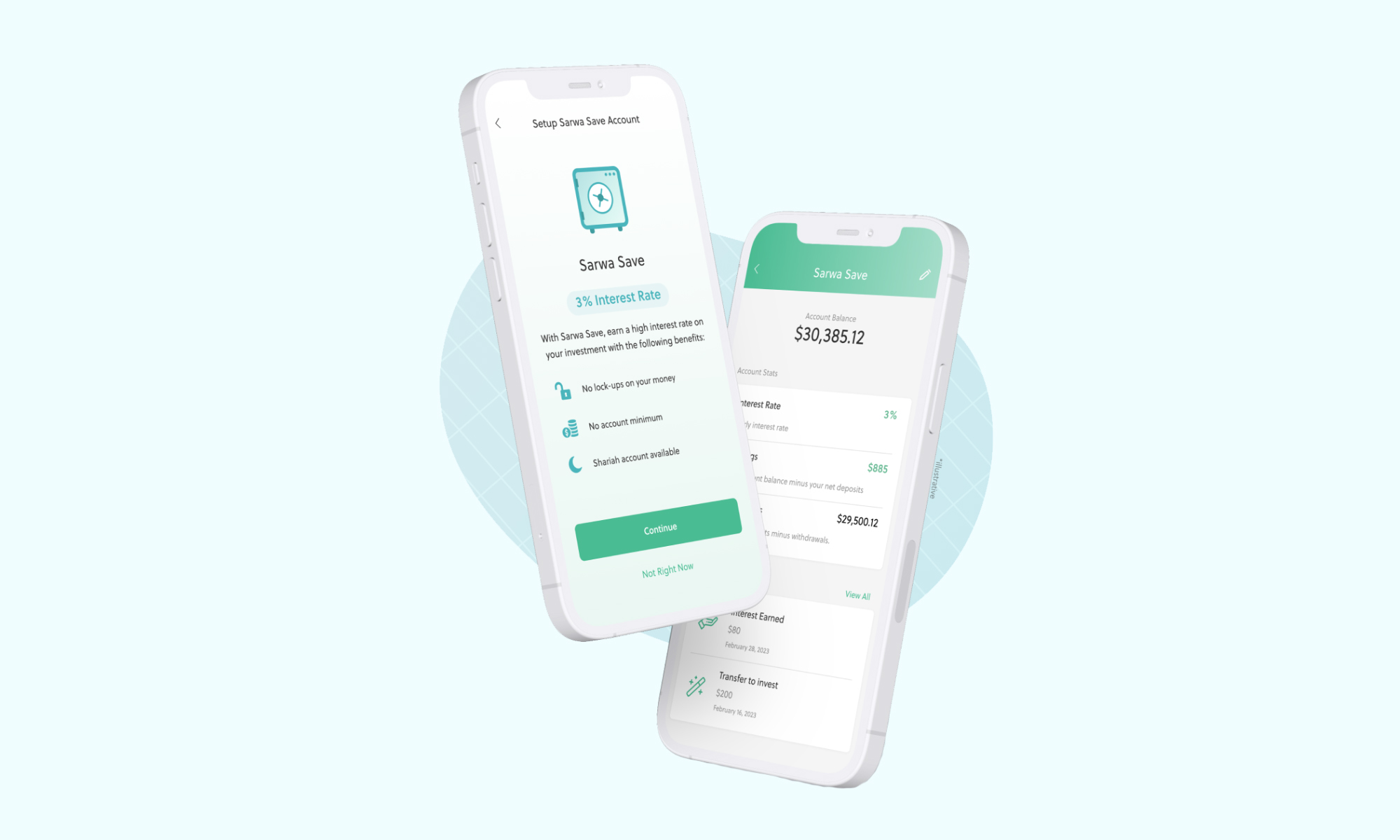

Sarwa, the personal finance and investment platform, recently launched a new high-yield cash account known as Sarwa Save. Despite the gloomy worldwide economic outlook of late, the new service has been a roaring success, with monthly deposits growing by 250% in just three months.

Sarwa users are increasingly prioritizing short-term savings with generous interest levels, as historically high inflation and aggressive Federal Reserve policies have led to challenging investment conditions.

“We are thrilled to see the rapid adoption of Sarwa Save, which reflects the growing demand for secure high-yield, low-risk products. Sarwa’s customers recognize the value in the offering and trust it with their hard-earned money. This trust has played a pivotal role in the impressive growth. Sarwa Save is a testament to the company’s commitment to providing innovative financial solutions and empowering clients to navigate the evolving economic landscape confidently,” says Shane Shin, Co-founder and Managing Partner, Shorooq Ventures.

Also Read: A Guide To Digital Payment Methods In The Middle East

In the UAE, most savings accounts offer low to zero interest, while Sarwa Save delivers a rate of 3% — nearly four times the average amount. As well as tempting short-term yields, the new accounts have no monthly or low-balance fees. When combined with hassle-free account setup, Sarwa’s platform makes for an appealing choice compared to traditional banks, especially as the startup offers a special, Sharia-compliant option known as Sarwa Save Halal.

Disclaimer: Sarwa Save is a product offered through Sarwa Digital Wealth (Capital) Limited that is regulated by the FSRA in the ADGM. This offering is not regulated by the DFSA. Sarwa is not a bank. We can unlock high-yield accounts through our banking partners.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.