News

Sarwa Launches High-Yield Cash Accounts In The Sarwa App

The account will offer nearly 4x the interest of regular UAE savings accounts, and deep integration with the Sarwa investing platform.

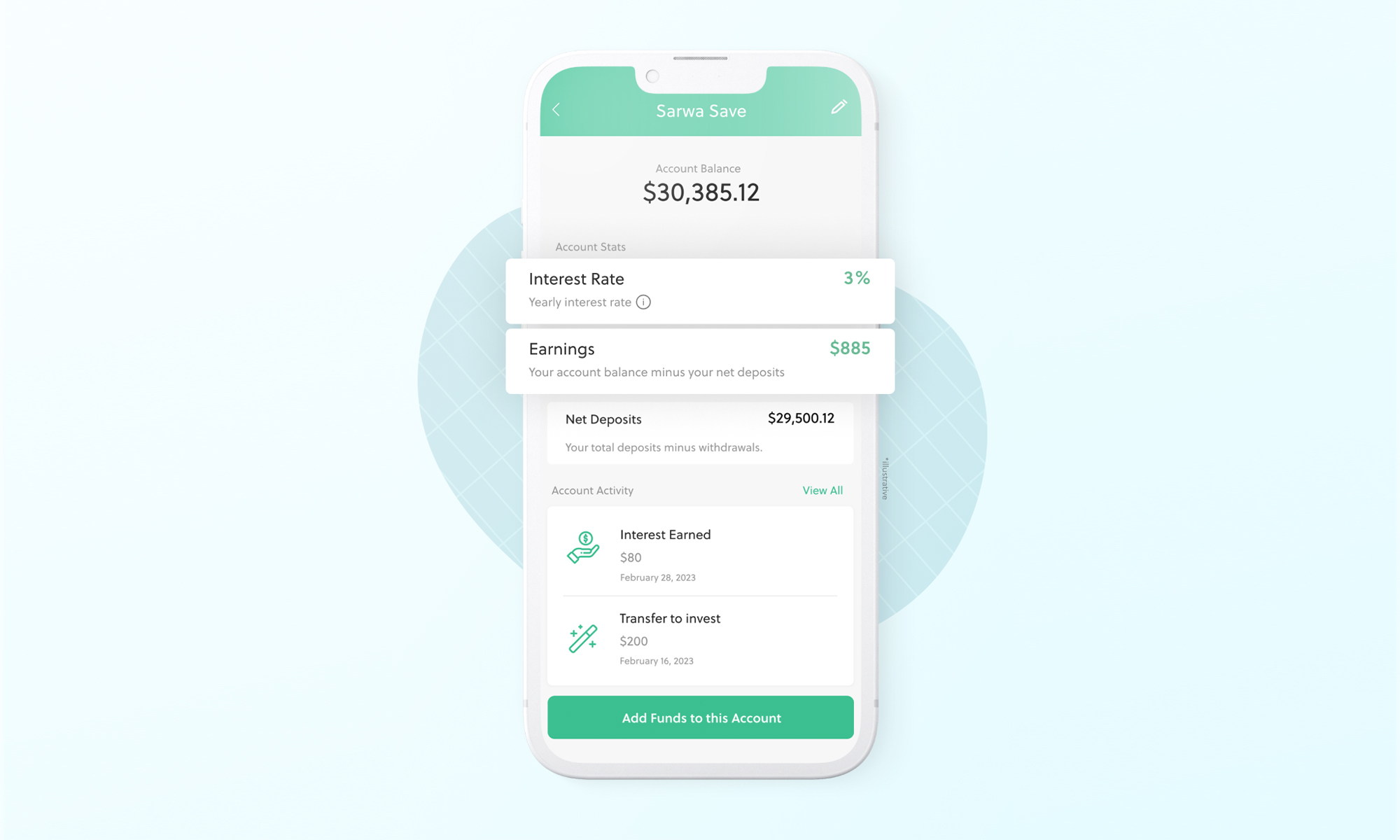

Sarwa, a popular UAE investing platform and app, has launched a new feature known as Sarwa Save. The latest offering is a high-yield cash saving account with several exciting features, the foremost of which is a very respectable 3% interest rate. The idea behind the account is that it will serve as a parking place for cash earned while investing and comes with zero transfer costs for AED local accounts, no account minimums, no management fees, plus fast online setup through the app.

“While we are strong believers in long-term passive investing, we are also conscious of how market conditions might affect short/medium-term goals. A short-term investing option is an important part of a good financial plan. Our clients were asking for a product to park their cash while earning returns, with the same easy access and simple experience as their Sarwa Invest, Sarwa Trade, and Sarwa Crypto accounts. As always, we listened to our community and decided to launch our fourth pillar,” says Mark Chahwan, Co-founder and CEO of Sarwa.

Sarwa’s 100,000 active users will now find it easier than ever to centralize the entire investment process in a single app, whether they’re taking a hands-off, long-term approach or prefer the convenience of self-directed trading using a single service. It’s also worth noting that Sarwa offers Save Halal, a low-risk money market funds portfolio, which also projects a return of 3%.

Overview of Sarwa Save features:

- 3% interest rate.

- Easy online setup and access to real human support.

- Zero withdrawal fees. No lock-in period.

- No account minimums.

- No management fees.

- No transfer costs for AED local accounts.

- Deep integration with Sarwa Invest accounts.

- Partition and label funds to enhance saving.

Sarwa Save looks like a promising financial product, especially as the average yield on a UAE savings account currently stands at around 0.8%.

Interested in setting up an account? Sarwa Save is available to new and existing users through the Sarwa website and mobile app.

Disclaimer: Sarwa Save is a product offered through Sarwa Digital Wealth (Capital) Limited that is regulated by the FSRA in the ADGM. This offering is not regulated by the DFSA. Sarwa is not a bank. We can unlock high-yield accounts through our banking partners.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.