News

Visa Partnership Takes X Closer Toward Musk’s “Everything App” Vision

The real-time payment service will launch in the US later this year, as the platform evolves into a Western equivalent of China’s WeChat.

X is taking another step toward becoming an “everything app” by partnering with Visa to introduce a real-time payment service known as the X Money Account. The news marks a significant milestone in Elon Musk’s vision for the platform, which has been evolving since his $44 billion acquisition in 2022.

According to X CEO Linda Yaccarin, the new feature will enable users to make peer-to-peer payments via an in-platform digital wallet. The transactions will link to users’ debit cards, allowing them to send money to others or transfer funds to their bank accounts.

Visa confirmed the partnership in its own announcement, stating that X Money will leverage Visa Direct, the company’s instant transfer service. Initially, the feature will be available only in the US, with no details yet on whether it will expand internationally.

Yaccarino described the Visa deal as a “milestone for the Everything App” and hinted at more major announcements for X Money in the near future.

Also Read: A Guide To Digital Payment Methods In The Middle East

Musk’s ambition to create a super app has been well-documented. Even before acquiring Twitter, the billionaire frontman of SpaceX and Tesla had spoken about turning it into a Western equivalent of China’s WeChat — a single platform combining messaging, video, streaming, and payments.

However, entering the financial services space is a risky undertaking for X, putting it in direct competition with other tech heavyweights such as Apple, Google, and Meta.

Finally, as X moves forward with its payment service, it remains to be seen how the platform will navigate regulatory challenges and competition. Whether Musk’s long-standing dream of an “everything app” will materialize is still uncertain, but this partnership with Visa signals a determined step in that direction.

News

Fintech Galaxy Gains Approval To Pilot Open Banking In Jordan

The Central Bank has given the go-ahead to test fintech services through JoRegBox — Jordan’s regulatory sandbox for fintech innovation.

Fintech Galaxy has secured approval from the Central Bank of Jordan (CBJ) to join JoRegBox, the country’s regulatory sandbox for fintech innovation. The green light allows the company to test and implement Open Banking services within a controlled, real-world setting, and makes Fintech Galaxy the first Open Banking provider to gain regulatory backing in Jordan.

This move aligns with CBJ’s long term vision for financial innovation, introduced in August 2023 as part of the Economic Modernization Vision (2023–2025). The program’s purpose is to establish Jordan as a fintech hub, attracting investment in high-tech financial solutions. JoRegBox provides a supervised testing environment for fintech firms, in a bid to foster widespread financial inclusion and build more consumer-centric financial services.

Riyadh Al Zamil, Chairman of Fintech Galaxy’s Board of Directors, expressed his enthusiasm: “We are proud and honored to receive the Central Bank of Jordan’s approval to test and introduce Open Banking services to the country through the JoRegBox regulatory sandbox. This milestone underscores our commitment to fostering financial inclusion, enabling innovation, and empowering Jordan’s economy through Open Banking”.

Also Read: Visa Partnership Takes X Closer Toward Musk’s “Everything App” Vision

Mirna Sleiman, Founder and CEO of Fintech Galaxy, echoed the sentiment: “The Central Bank of Jordan’s approval is a testament to our shared vision of fostering innovation and inclusivity in the financial sector. By leveraging FINX Connect, we aim to empower financial institutions and third-party providers with data aggregation and payment initiation services, ultimately improving the lives of consumers across Jordan”.

Open Banking services allow banks and payment providers to share customer data securely with third-party providers (with their prior consent). Fintech Galaxy’s FINX Connect platform enables real-time bank account data aggregation and payment initiation, enhancing customer access to personalized financial services and simplifying payment processing.

To support its expansion, Fintech Galaxy has raised $9 million for platform development and market growth. The Jordanian arm, led by Zaid Khatib, will integrate with banks and financial institutions country-wide, focusing on Personal Finance Management (PFM) and Business Finance Management (BFM) applications.

-

News3 weeks ago

News3 weeks agoSamsung Galaxy S25 Release Date Confirmed For January 2025

-

News3 weeks ago

News3 weeks agoThe Quantum Visionary: Malak Trabelsi Loeb On Leadership And QIS 2025

-

News2 weeks ago

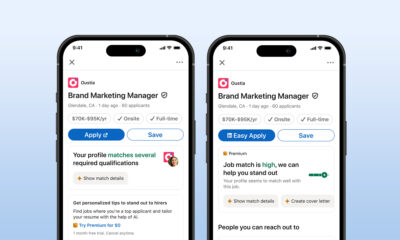

News2 weeks agoLinkedIn Is Trying To Help You Apply For Fewer Jobs

-

News3 weeks ago

News3 weeks agoNVIDIA’s RTX 50-Series Laptop GPUs Bring Blackwell To Mobile