News

chatlyn Unveils Hospitality Chatbot At Arabian Travel Market 2024

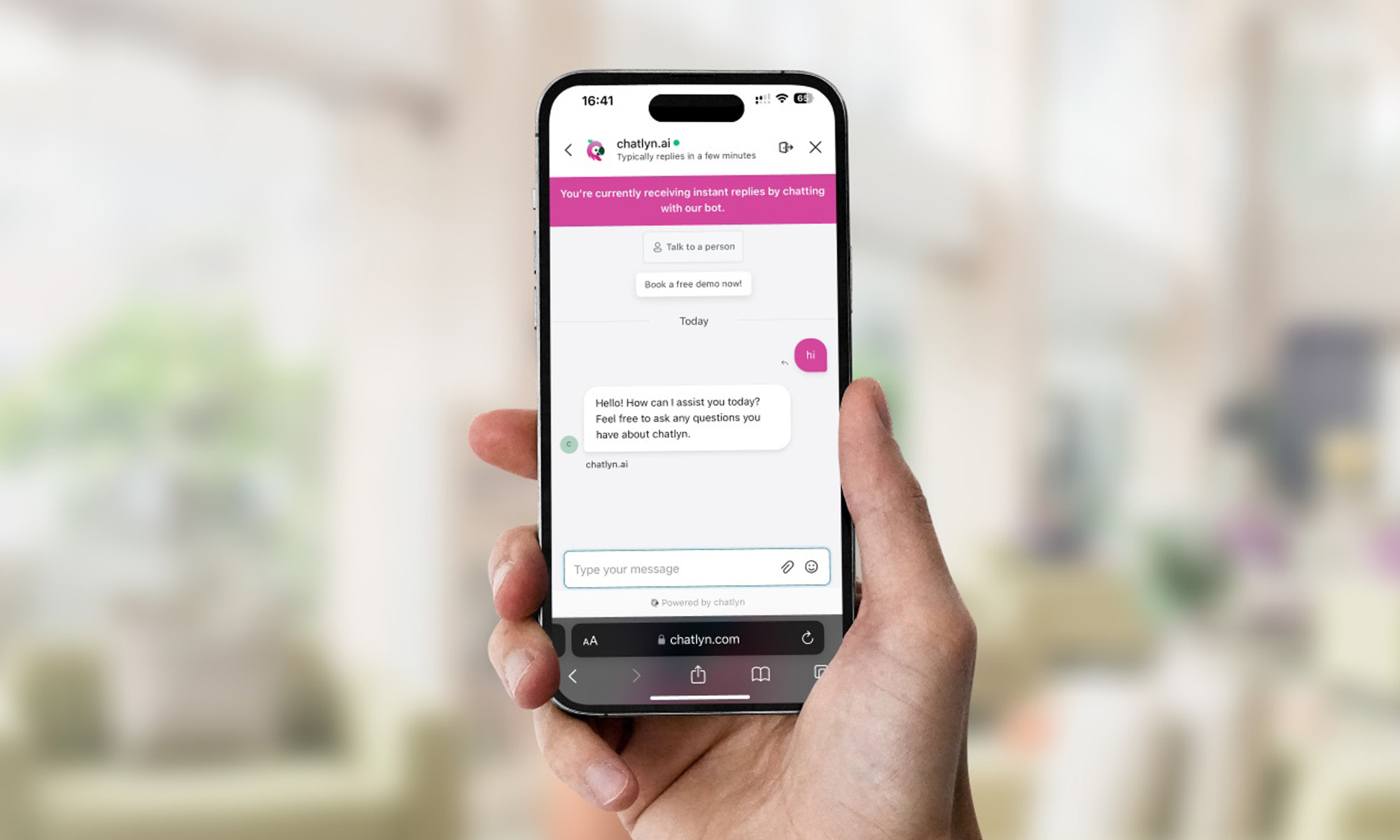

The advanced AI software sets new industry standards and can understand and respond to detailed customer queries.

chatlyn, a leading provider of guest experience software for the travel and hospitality sector, has unveiled its latest AI chatbot at the Arabian Travel Market (ATM) 2024 as part of a strategic expansion into the Middle East.

The new chatbot demonstrates exceptional proficiency in understanding natural language nuances and grammatical structures, and can accommodate various languages, including Arabic. The AI bot’s capability ensures prompt, accurate responses, benefiting hotels with diverse international guest lists and significantly reducing response times.

According to chatlyn, its latest creation has “the capacity to process up to 4,000 tokens and a doubled data capacity,” and is able to outperform competitors in depth and responsiveness during every interaction. Moreover, users can upload business PDFs to receive precise answers instantly, showcasing the chatbot’s effectiveness as a dynamic knowledge repository.

“During the BETA phase, we saw customers increase their success rate in resolving queries by fifteen times simply by uploading a PDF with their information and integrating the chatbot into their main communication channels,” explained Michael Urbanek, chatlyn’s CTO.

Also Read: Joby To Establish All-Electric Air Taxi Ecosystem Across The UAE

Since its inception in late 2022, chatlyn has experienced rapid expansion, and now serves over 1,000 properties globally, including numerous renowned brands in the travel and hospitality sector.

The company’s product suite is focused on improving customer engagement in hospitality, featuring an omnichannel inbox, AI assistants, and Automation Studio, for seamless interaction across web chat, WhatsApp, email, and social media. This AI-powered platform enhances customer interactions, prioritizing satisfaction and operational efficiency.

chatlyn has already established a strong foothold in the Middle East, and now collaborates with various hospitality companies and properties, including GoMosafer, La Quinta by Wyndham, Luxury Bookings, and Amsaan Tours.

News

Rabbit Expands Hyperlocal Delivery Service In Saudi Arabia

The e-commerce startup is aiming to tap into the Kingdom’s underdeveloped e-grocery sector with a tech-first, locally rooted strategy.

Rabbit, an Egyptian-born hyperlocal e-commerce startup, is expanding into the Saudi Arabian market, setting its sights on delivering 20 million items across major cities by 2026.

The company, founded in 2021, is already operational in the Kingdom, with its regional headquarters now open in Riyadh and an established network of strategically located fulfillment centers — commonly known as “dark stores” — across the capital.

The timing is strategic: Saudi Arabia’s online grocery transactions currently sit at 1.3%, notably behind the UAE (5.3%) and the United States (4.8%). With the Kingdom’s food and grocery market estimated at $60 billion, even a modest increase in online adoption could create a multi-billion-dollar opportunity.

Rabbit also sees a clear alignment between its business goals and Saudi Arabia’s Vision 2030, which aims to boost retail sector innovation, support small and medium-sized enterprises, attract foreign investment, and develop a robust digital economy.

The company’s e-commerce model is based on speed and efficiency. Delivery of anything from groceries and snacks to cosmetics and household staples is promised in 20 minutes or less, facilitated by a tightly optimized logistics system — a crucial component in a sector where profit margins and delivery expectations are razor-thin.

Despite the challenges, Rabbit has already found its stride in Egypt. In just over three years, the app has been used by 1.4 million customers to deliver more than 40 million items. Revenue has surged, growing more than eightfold in the past two years alone.

Also Read: Top E-Commerce Websites In The Middle East In 2025

CEO and Co-Founder Ahmad Yousry commented: “We are delighted to announce Rabbit’s expansion into the Kingdom. We pride ourselves on being a hyperlocal company, bringing our bleeding-edge tech and experience to transform the grocery shopping experience for Saudi households, and delivering the best products – especially local favorites, in just 20 minutes”.

The company’s growth strategy avoids the pitfalls of over-reliance on aggressive discounting. Instead, Rabbit leans on operational efficiency, customer retention, and smart scaling. The approach is paying off, having already attracted major investment from the likes of Lorax Capital Partners, Global Ventures, Raed Ventures, and Beltone Venture Capital, alongside earlier investors such as Global Founders Capital, Goodwater Capital, and Hub71.