News

Dubai-Based Startup Huspy Helps Emiratis Buy Homes Online

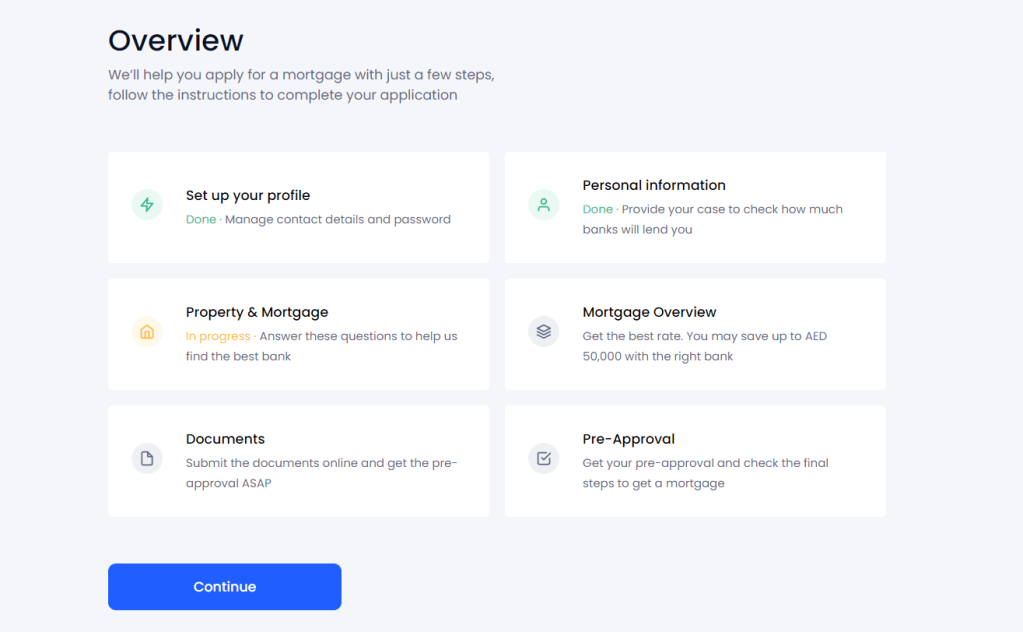

Instead of having to wait months to secure a home mortgage, Huspy lets users search over 500 home loan options in seconds.

Buying a home is a stressful process. Not only is it becoming increasingly difficult to find reasonably priced properties that are also attractive to live in, but the mortgage process, which most buyers have to go through, is time-consuming and full of potential traps. While the first problem won’t most likely be solved any time soon, there’s one Dubai-based startup that’s actively trying to address the second issue, and its name is Huspy.

Essentially, Huspy is an online mortgage platform that facilitates hassle-free financing for people who would like to live in Dubai. It was founded in August 2020 by chief executive officer Jad Antoun and chief technology officer Khalid Al Ashmawy, who understand the local market through first-hand experience.

Huspy Application Process

“We started Huspy with the aim to disrupt one of the largest industries and bring the entire home loan process online. Customers are massively underserved where lack of visibility, poor customer experience, and overpayment are common problems. We want to solve for that,” said Antoun. “The team has built tools and systems to leverage technology in a highly operational business to give us the ability to provide customers with the best rates, faster mortgage close times and a great digital experience,” added Ashmawy.

Also Read: Sarwa Helps UAE Residents Easily Invest In Global Stocks

Instead of having to wait up to 10 weeks to secure a mortgage, Huspy lets its users search over 500 home loan options in seconds to find the one that fits them the best. That way, it’s possible to get a personalized home loan three times faster and secure the best price possible. Best of all, Huspy doesn’t charge its users broker fees at all. Instead, it makes money by charging the banks a commission for every loan.

Huspy is available on iOS as well as Android, and you can download it yourself right now to see what it has to offer. The startup is backed by leading tech investors, including VentureFriends, B&Y Ventures, and Plug and Play, so you know your mortgage will be in good hands.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant