News

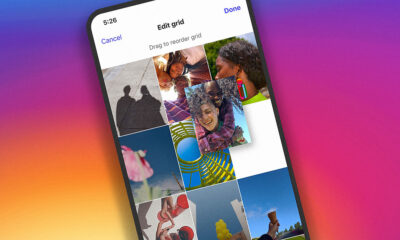

Instagram Tests Vertical Profile Grids Instead Of Squares

A company spokesperson says the “limited test” is happening because the “vast majority” of Instagram uploads are vertically-oriented content.

Instagram is testing a potentially major change to profile pages: making the squares in your profile grid vertical rectangles. Some users recently spotted the test, and there have been indications from at least 2022 that the company has toyed with a rectangular grid.

“The vast majority of what is uploaded to Instagram today is vertical,” Instagram chief Adam Mosseri explained in a Story on Friday, August 16, discussing the test. “It’s either 4 by 3 in a photo or 9 by 16 in a video, and cropping it down to square is pretty brutal”.

Mosseri revealed that “squares are from way back in the day when you could only upload square photos to Instagram,” a limitation the platform removed nearly a decade ago. Mosseri told users that the company knows that the changes may be annoying for those who have spent a great deal of effort and time “curating and making sure everything lines up” but says, “I would really like to do better by the content today”.

“We’re testing a vertical profile grid with a small number of people,” Instagram spokesperson Christine Pai said in a recent statement to journalists. “This is a limited test, and we’ll be listening to feedback from the community before rolling anything out further”.

So it looks as though perfectionists who have planned out their profile grids around squares might be a little annoyed when the entire site moves over to vertical rectangle content.

Also Read: How To Permanently Delete Your Instagram Account

Here’s the full transcript of Mosseri’s explanation:

“We’re actually testing a vertical grid, for those of you who haven’t seen it yet, for your profile, instead of squares. Now, squares are from way back in the day when you can only upload square photos to Instagram. I know this can be annoying for some of you who really spent a lot of time curating and making sure everything lines up, but I would really like to do better by the content today. The vast majority of what is uploaded to Instagram today is vertical. It’s either 4 by 3 in a photo or 9 by 16 in a video, and cropping it down to square is pretty brutal. So, I’m hoping we can figure out a way to manage this transition”.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.

-

News3 weeks ago

News3 weeks agoRipple Gains DFSA License To Offer Crypto Payments In Dubai

-

News2 weeks ago

News2 weeks agoAre You Ready For Hong Kong’s InnoEX & Electronics Fair?

-

News2 weeks ago

News2 weeks agoWizz Air Abu Dhabi Adds Beirut Flights Amid Tourism Revival

-

News2 weeks ago

News2 weeks agoProtecting Your WhatsApp Account From Hackers: Kaspersky Expert Tips