News

Intel Unveils Lunar Lake Chips With AI Capabilities For Copilot+

The CPUs will launch in early Q4 boasting upgrades including an 80% faster GPU and 5 times greater AI performance.

Intel has announced that its upcoming Lunar Lake chips, designed for Copilot+ AI PCs, will be released this fall. However, at this year’s Computex, the company provided more detailed technical information.

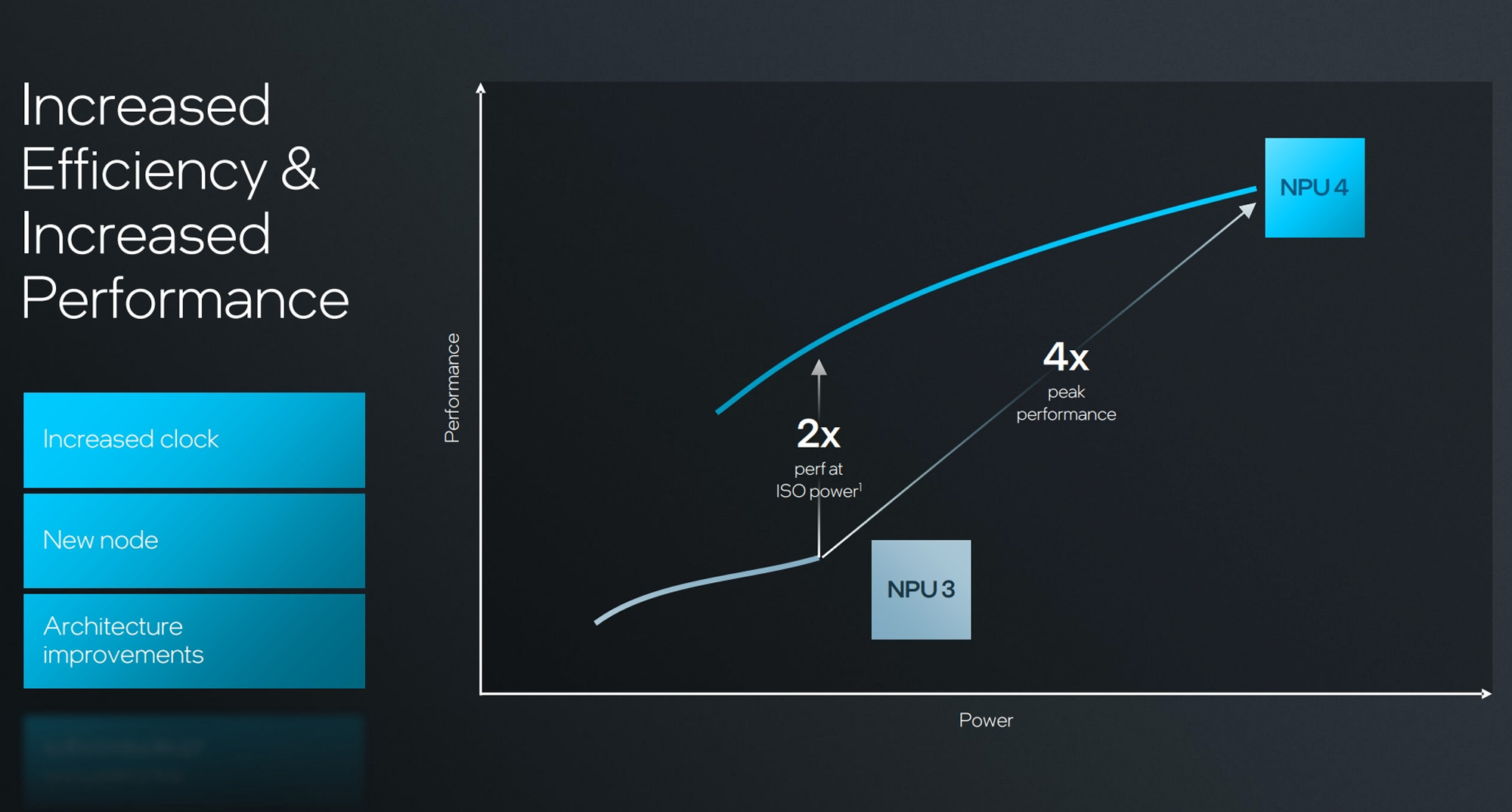

Lunar Lake CPUs will feature an enhanced neural processing unit (NPU), delivering up to 48 TOPs (tera operations per second) of AI performance. This is a significant improvement compared to Intel’s previous Meteor Lake chips, which offered a 10 TOPS NPU.

In addition, the new 8-core CPUs will also feature an Xe2 GPU, promising 80% faster gaming performance compared to the previous generation, plus an AI accelerator with an additional 67 TOPS of performance.

However, the most significant (and unexpected) news is that Lunar Lake will also include onboard memory, in a similar manner to Apple Silicon. Lunar Lake chips will be available in 16GB or 32GB configurations, and allow Intel to reduce latency and system power consumption by up to 40% by positioning the memory closer to the processor cores.

Regarding connectivity, the new chips will support the latest standards: Wi-Fi 7, Bluetooth 5.4, PCIe Gen5, and Thunderbolt 4. It is surprising, however, that Intel has not committed to Thunderbolt 5, even though it plans to introduce the standard later this year.

Also Read: Top Free AI Chatbots Available In The Middle East

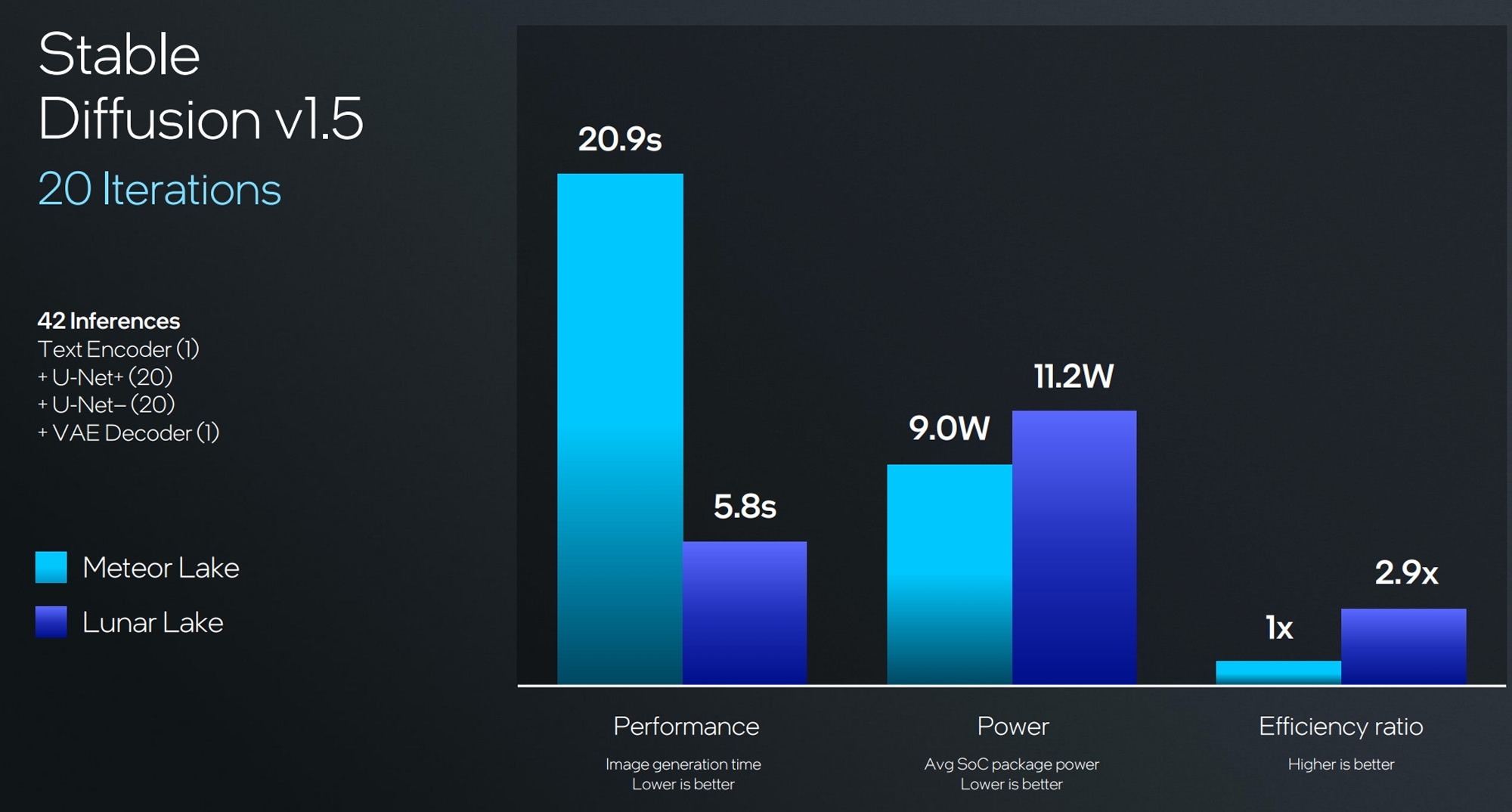

With the release still some months away, Intel has yet to disclose specific chip models or detailed specifications. Nonetheless, based on company benchmarks, Lunar Lake is expected to outperform Meteor Lake significantly. When running Stable Diffusion, Lunar Lake completed 20 iterations in 5.8 seconds, compared to 20.9 seconds for Meteor Lake.

Intel’s game-changing new chips certainly look like something for enthusiasts to get excited about, especially as over 80 different AI laptop models from 20 manufacturers will ship with the new hardware before 2024 is out.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant