News

Sarwa’s New Cash Accounts Boost Growth By 250% In 3 Months

Despite some financial institutions suffering during the economic downturn, Sarwa’s reliability and trustworthiness seem to be paying dividends.

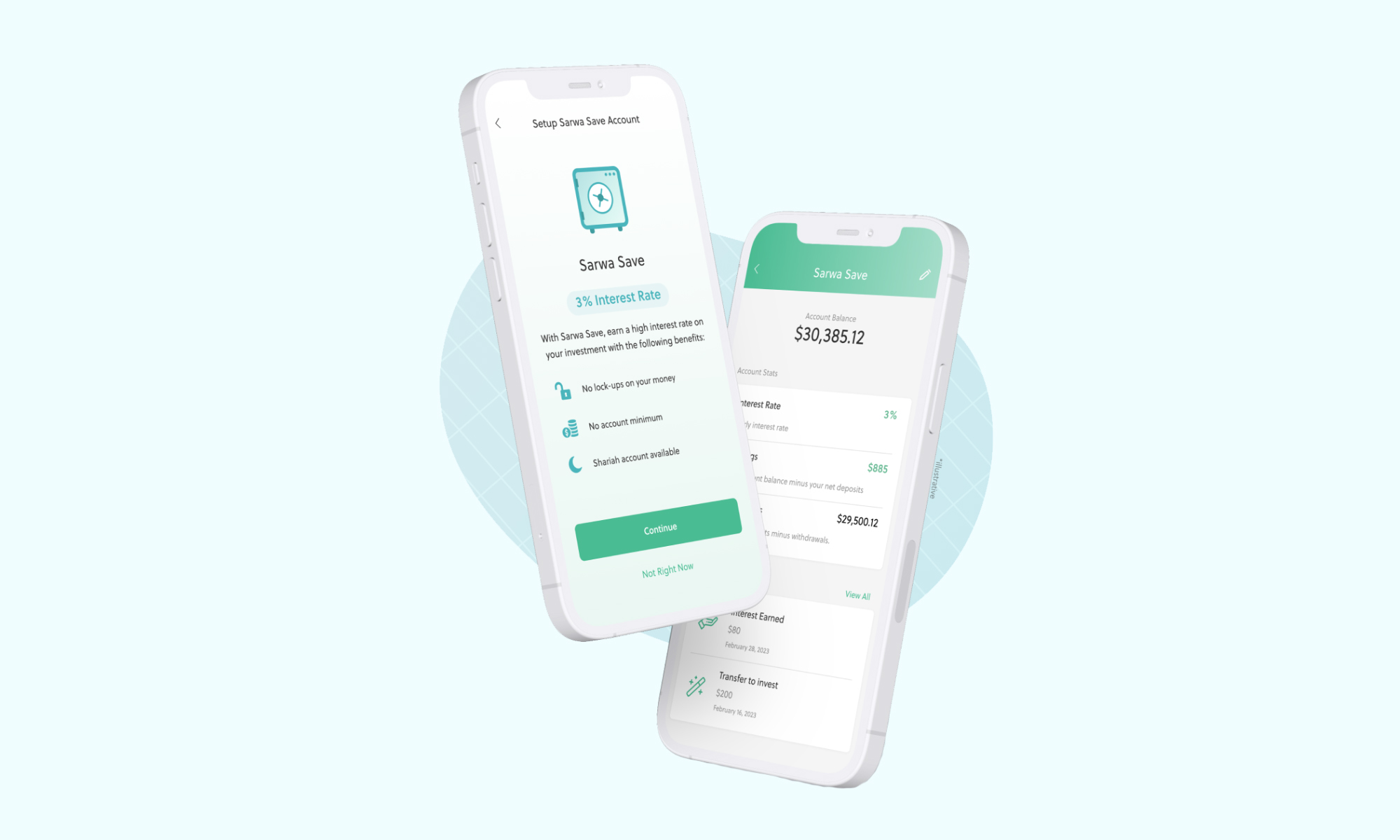

Sarwa, the personal finance and investment platform, recently launched a new high-yield cash account known as Sarwa Save. Despite the gloomy worldwide economic outlook of late, the new service has been a roaring success, with monthly deposits growing by 250% in just three months.

Sarwa users are increasingly prioritizing short-term savings with generous interest levels, as historically high inflation and aggressive Federal Reserve policies have led to challenging investment conditions.

“We are thrilled to see the rapid adoption of Sarwa Save, which reflects the growing demand for secure high-yield, low-risk products. Sarwa’s customers recognize the value in the offering and trust it with their hard-earned money. This trust has played a pivotal role in the impressive growth. Sarwa Save is a testament to the company’s commitment to providing innovative financial solutions and empowering clients to navigate the evolving economic landscape confidently,” says Shane Shin, Co-founder and Managing Partner, Shorooq Ventures.

Also Read: A Guide To Digital Payment Methods In The Middle East

In the UAE, most savings accounts offer low to zero interest, while Sarwa Save delivers a rate of 3% — nearly four times the average amount. As well as tempting short-term yields, the new accounts have no monthly or low-balance fees. When combined with hassle-free account setup, Sarwa’s platform makes for an appealing choice compared to traditional banks, especially as the startup offers a special, Sharia-compliant option known as Sarwa Save Halal.

Disclaimer: Sarwa Save is a product offered through Sarwa Digital Wealth (Capital) Limited that is regulated by the FSRA in the ADGM. This offering is not regulated by the DFSA. Sarwa is not a bank. We can unlock high-yield accounts through our banking partners.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.