News

Truecaller To Use Microsoft Azure AI Speech For Call Answering

The new service features a powerful speech generation tool to allow users to create AI versions of their voices.

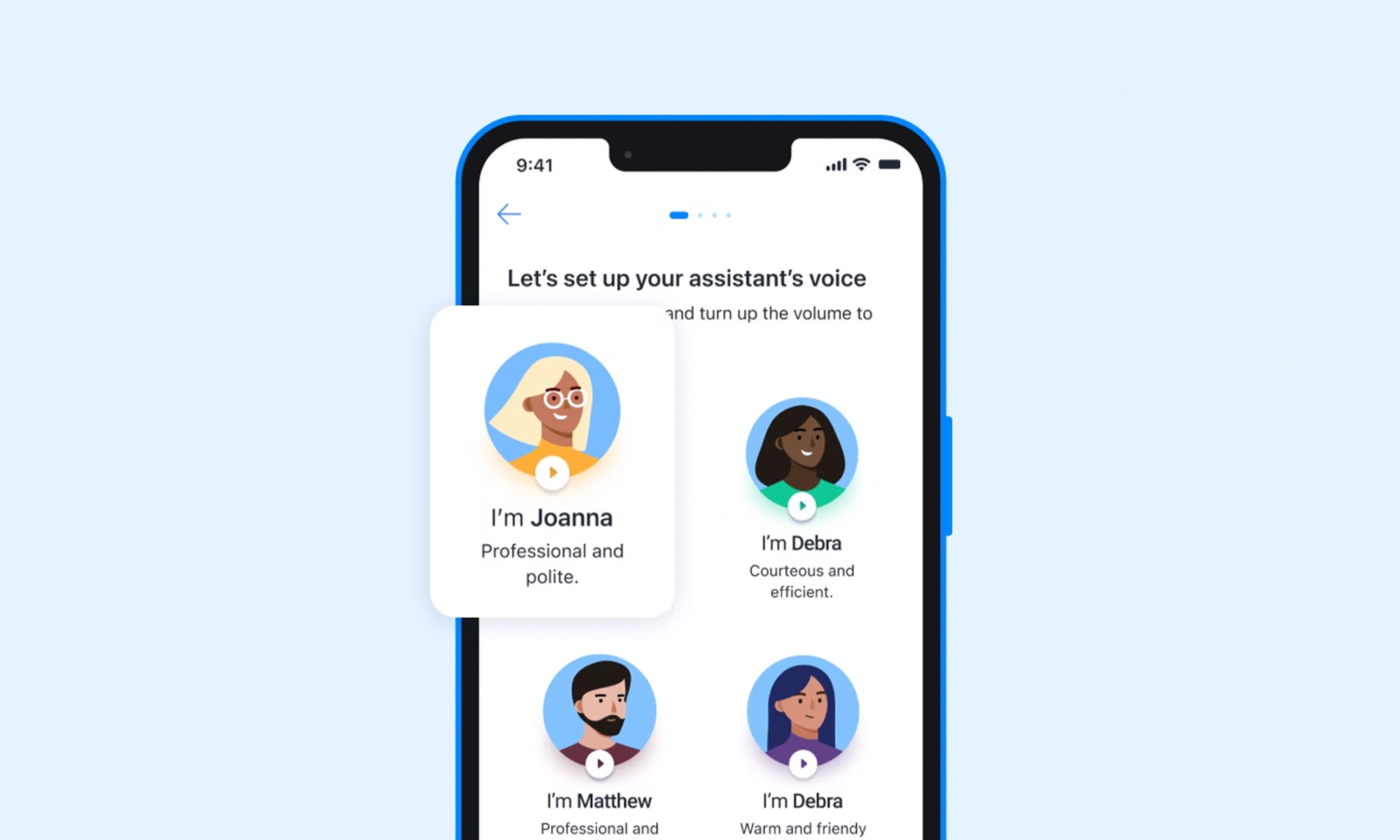

Truecaller, a well-known app for identifying and blocking spam calls, is enhancing its services by allowing users to create AI versions of their voices. The new feature, available to those with access to Truecaller’s AI Assistant, stems from a partnership with Microsoft and its Azure AI Speech tool, allowing the generation of realistic AI voices that accurately mimic users’ speech patterns and tone.

“This groundbreaking capability not only adds a touch of familiarity and comfort for the users but also showcases the power of AI in transforming the way we interact with our digital assistants,” explained Truecaller product director and general manager Raphael Mimoun in a recent blog post.

The AI Assistant in Truecaller screens incoming calls, informing recipients of a caller’s purpose. Based on this information, users can decide whether to answer the call themselves or let the AI Assistant handle it.

When the feature was introduced in 2022, users could only choose from a collection of preset voices. The ability to record one’s own voice represents a significant step towards the complete personalization of the service.

Also Read: Getting Started With Google Gemini: A Beginner’s Guide

Azure AI Speech, showcased during the last Build conference, only recently added a personal voice feature that lets people record and replicate voices. Microsoft explained in a blog post, however, that Personal Voice is available on a limited basis and only for specific use cases like voice assistants.

To maintain ethical standards, Microsoft’s Azure AI Speech automatically adds watermarks to AI-generated voices. Additionally, a code of conduct requires companies to obtain full consent from individuals being recorded and prohibits impersonation.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News3 weeks ago

News3 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant