News

UAE-Based Drone Company Plans Wider MENA Expansion

UVL Robotics is broadening the scope of its commercial drone activities across the Middle East.

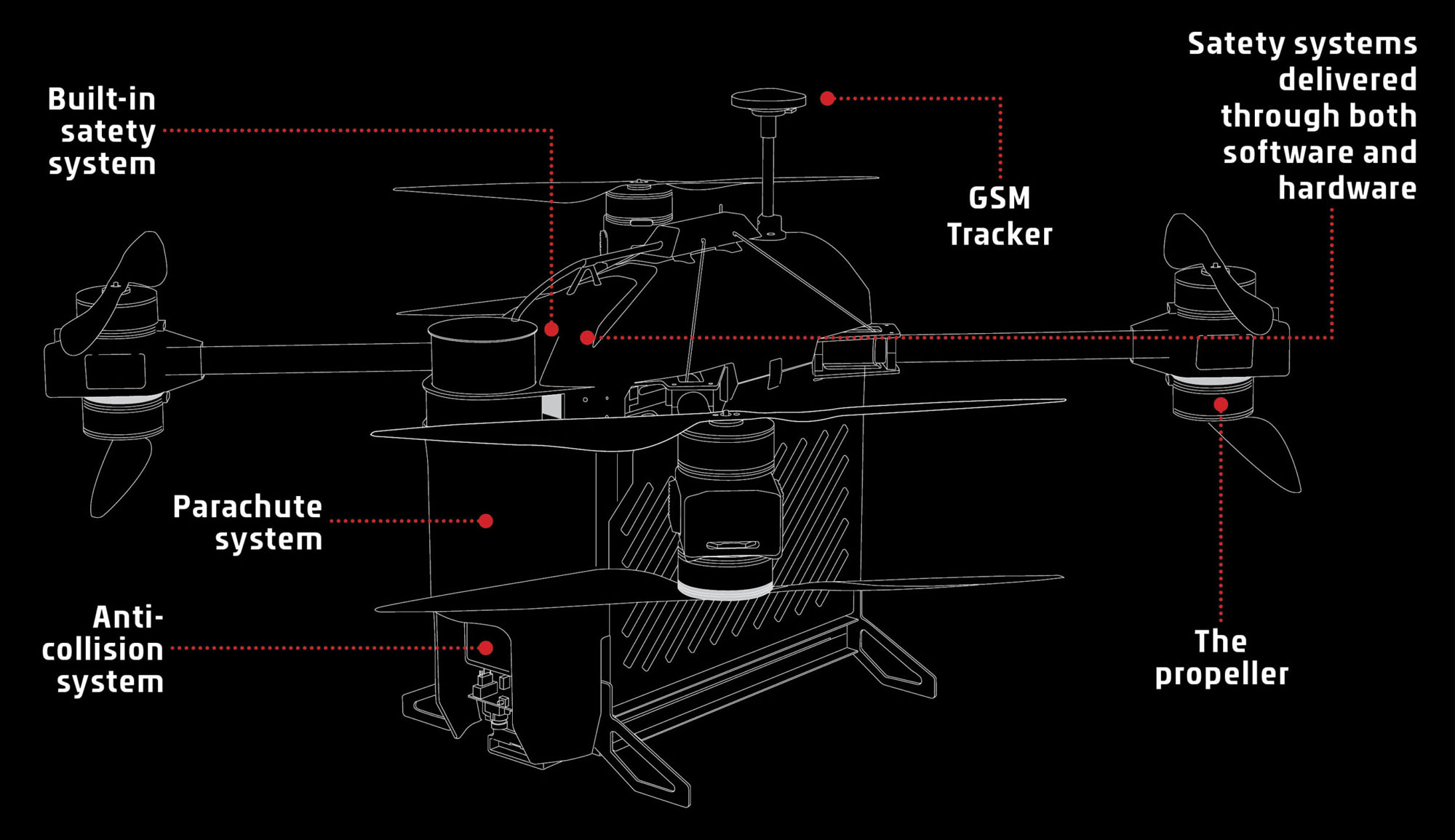

UVL Robotics, a UAE-based robotics startup, is the first company to provide a fully operational commercial drone delivery service in the MENA region. After winning several high-profile contracts, the company is now preparing to trial drone flights in Abu Dhabi — an Emirate with over 200 islands.

“It all depends on the graders,” explains CEO Eugene Grankin. “If they rate us well, we could soon get the permission to fly in Abu Dhabi.” Grankin has good reason to be confident. In 2021, after a tropical cyclone hit Oman, UVL drones were successfully deployed to deliver supplies. “We could deliver medicine to remote areas where it took a long time to reach by car,” the CEO explained.

Today, UVL Robotics is focused on inventory management as well as delivery. In Europe, UVL drones can scan 300-750 pallets in under five seconds. The company now uses drones to perform stocktaking at more than 50 warehouse locations, with global companies like PepsiCo utilizing the service.

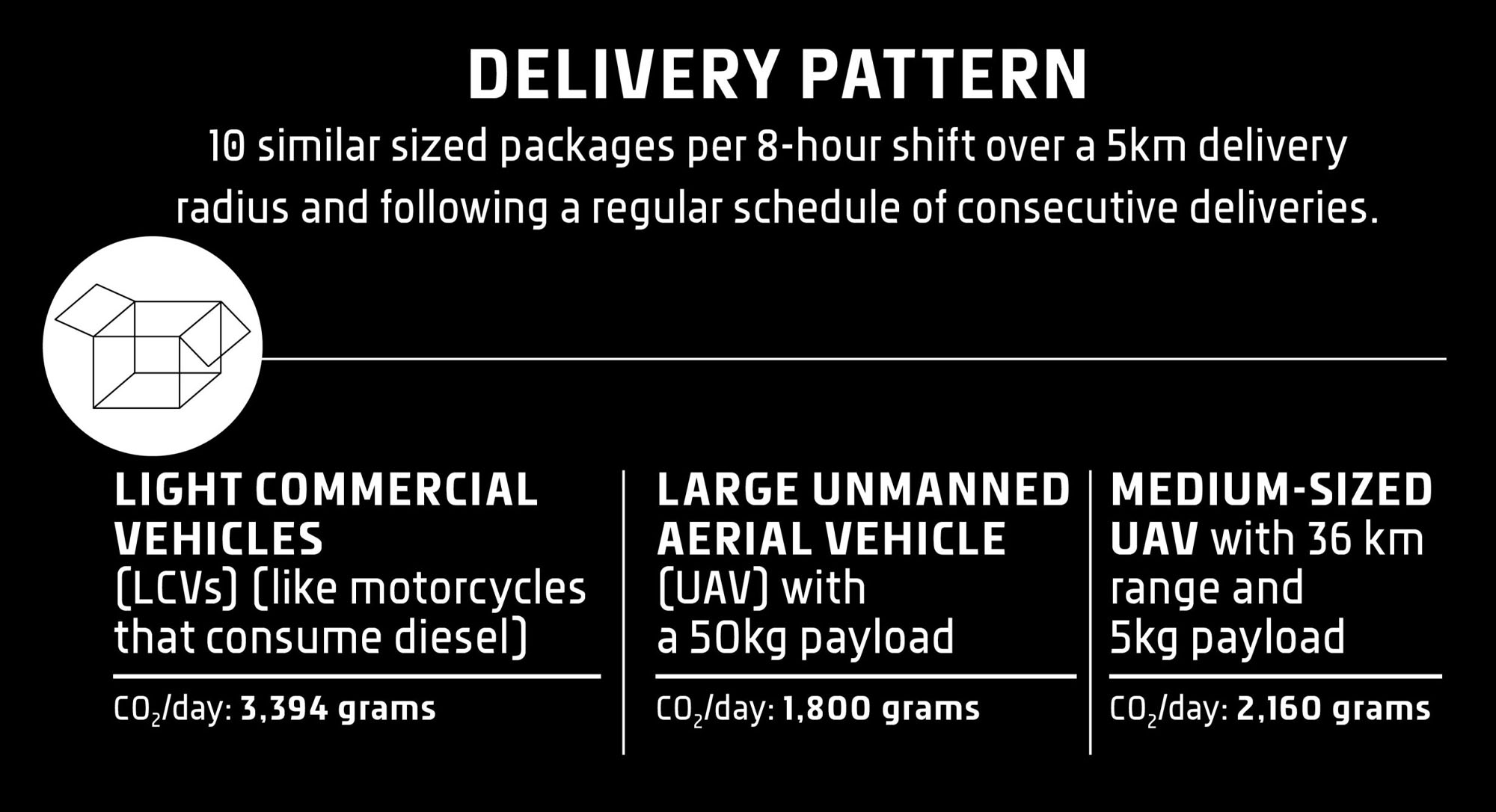

In the Middle East, sustainability and CO₂ reduction are the primary drivers of drone adoption. Saudi Arabia plans to cut carbon emissions by 278 million tonnes per year, while the UAE has plans to reduce its own output by 31%. Research conducted by UVL found that drones produce 36% fewer emissions than moving the equivalent load volume by truck, despite each UAV having a payload of just 10kg.

As well as reducing CO₂, drones can also improve operational efficiency. In Oman, coastlines and rugged terrain mean that food deliveries typically take 30-60 minutes by human courier. With drones, that time is cut to a predictable 15 minutes. In addition, drones can handle over 30 orders daily, compared to just 20 when delivered by regular vehicle.

Also Read: USB-C Will Be Mandatory From 2025 For All Saudi Smart Devices

Meanwhile, at King Abdullah University of Science and Technology (KAUST) in Saudi Arabia, UVL Robotics is preparing to launch campus-wide smart loading stations, which the company hopes will act as a blueprint for future smart city projects across the region.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant