News

WeRide Granted First Self-Driving Vehicle License In UAE

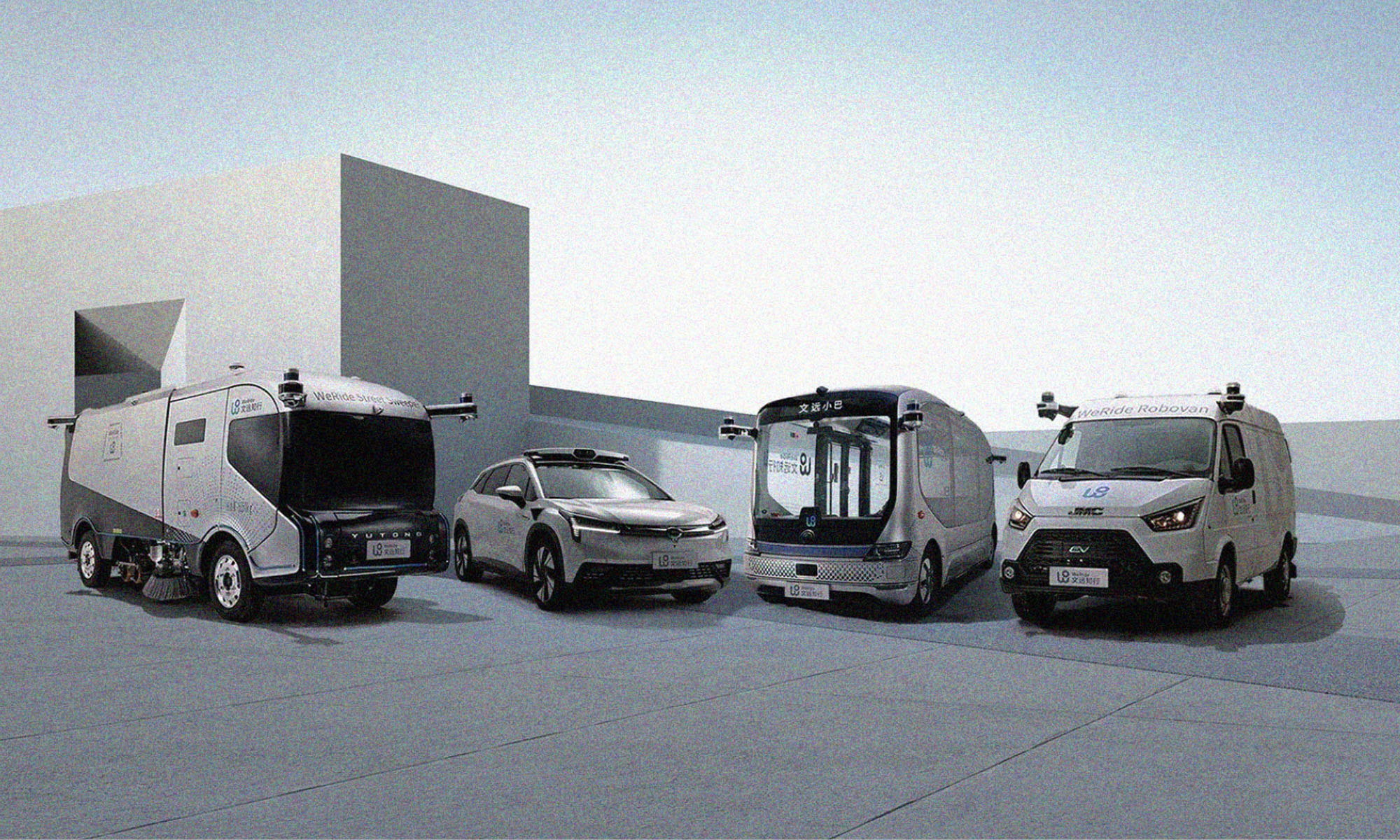

The Chinese autonomous driving company may soon deploy robotaxis and robobusses across the Emirates and beyond.

Chinese autonomous driving startup WeRide was the first company in the world to hold driverless permits for testing in both China and the USA. Now, the autonomous technologies experts have secured a license to deploy self-driving vehicles in the UAE, having already completed public testing on some routes within the Emirate.

Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, announced the news on Twitter: “We approved the first national license for self-driving vehicles on the country’s roads, which was granted to a specialized WeRide company”.

Dubai aims to make 25% of its transportation completely autonomous by 2030, so the permit comes at an ideal time. Last month, as part of the Eid al-Adha holiday services, the Integrated Transport Centre (ITC) of Abu Dhabi announced that visitors to Saadiyat and Yas Islands could experience free autonomous driving car rides, including a vehicle called “TXAI”, which was launched by WeRide in partnership with a local company Bayanat.

Also Read: UAE’s du Teams With Huawei For Net-Zero Telecom Services

WeRide has developed its state-of-the-art technologies through WeRide One, which the company describes as a “one-for-all and all-for-one platform for urban autonomous driving applications. Designed with high flexibility on both the software and hardware levels”. The platform uses self-evolving deep learning systems to prioritize safety, plus AI algorithms and a fusion of camera, LiDAR, and radar to replace human operators.

In a recent press release WeRide said, “In the future, WeRide will continue to deepen its presence in the Middle East region and bring high-quality autonomous driving technology, products, and services to more customers and consumers”.

News

PayPal & TerraPay Join Forces For Cross-Border MENA Payments

The collaboration will be especially helpful in regions where traditional banking infrastructure is limited or inconsistent.

PayPal has teamed up with TerraPay to improve cross-border payments across the Middle East and Africa. The move is designed to make it easier and faster for users to send and receive money internationally, especially in regions where traditional banking infrastructure can be limited or inconsistent.

The partnership connects PayPal’s digital payments ecosystem with TerraPay’s global money transfer network. The goal is to streamline real-time transfers between banks, mobile wallets, and financial institutions, significantly improving access for millions of users looking to move money securely and efficiently.

Through the partnership, users will be able to link their PayPal accounts to local banks and mobile wallets using TerraPay’s platform. This means faster transactions and fewer barriers for individuals and businesses across the region.

“The Middle East and Africa are at the forefront of the digital transformation, yet financial barriers still limit growth for many,” said Otto Williams, Senior Vice President, Regional Head and General Manager, Middle East and Africa at PayPal. “At PayPal, we’re committed to changing that […] Together, we’re helping unlock economic opportunity and build a more connected, inclusive financial future”.

For TerraPay, the deal is a chance to scale its reach while reinforcing its mission of frictionless digital transactions.

“Our mission at TerraPay is to create a world where digital transactions are effortless, secure, and accessible to all,” said Ani Sane, Co-Founder and Chief Business Officer at TerraPay. He added that the partnership is a major milestone for enhancing financial access in the Middle East and Africa, helping businesses grow and users move funds with fewer limitations.

Also Read: A Guide To Digital Payment Methods In The Middle East

The integration also aims to support financial inclusion in a region where access to global banking tools is still uneven. With interoperability at the core, TerraPay can bridge the gap between different financial systems — whether that’s a mobile wallet or a traditional bank — making it easier to send money, pay for services, or grow a business across borders.

As the demand for cross-border payment options continues to rise, both PayPal and TerraPay are doubling down on their commitment to provide reliable, secure, and forward-looking financial tools for the region.