News

100K+ Compromised ChatGPT Accounts Found On Dark Web

Egypt, Morocco, and Algeria top the list in the Middle Eastern region.

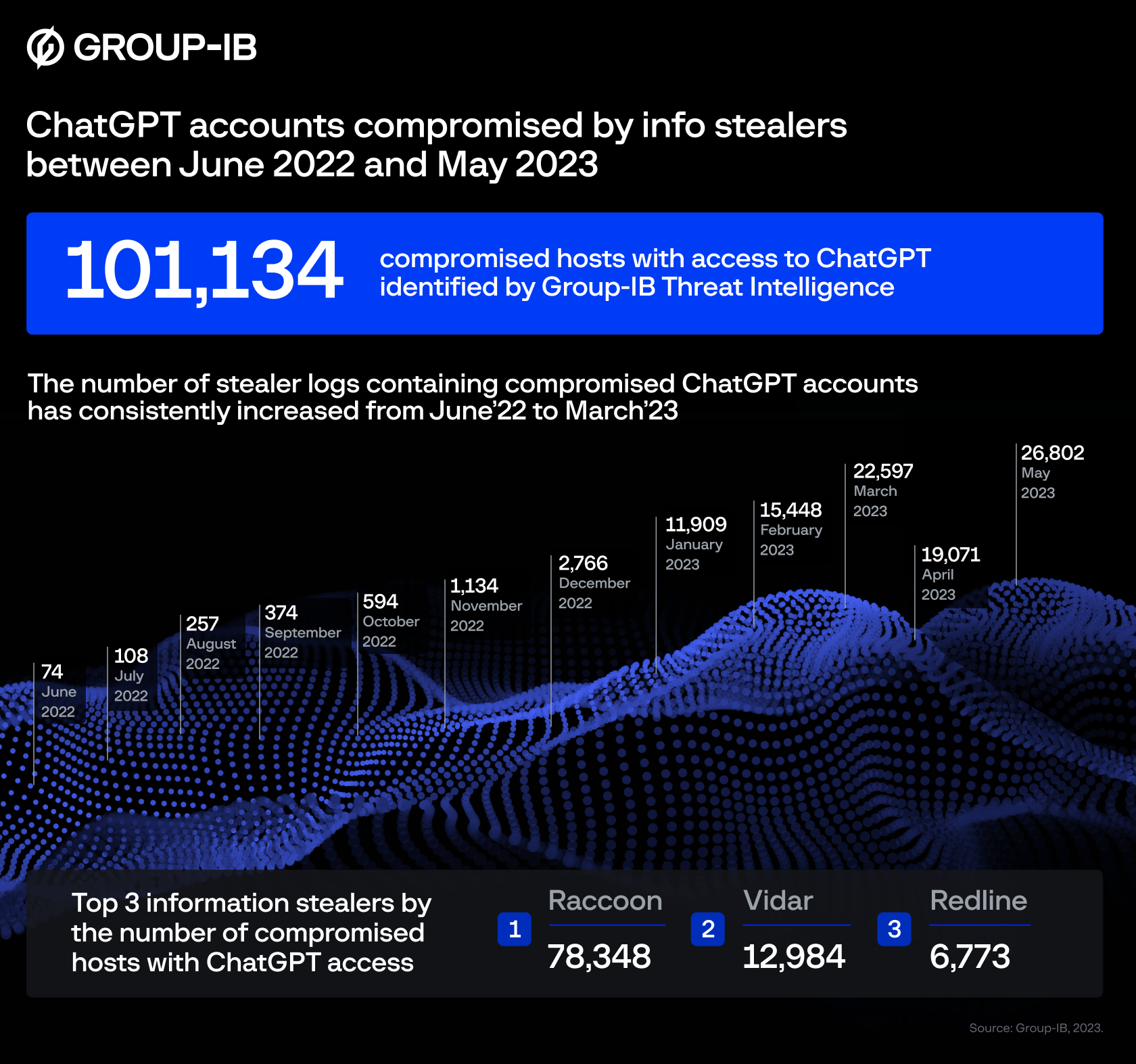

Global cybersecurity leader Group-IB has identified 101,134 infected devices with saved ChatGPT credentials. Throughout 2023, the company’s Threat Intelligence Platform found compromised account details in 26,802 malware logs traded on dark web marketplaces.

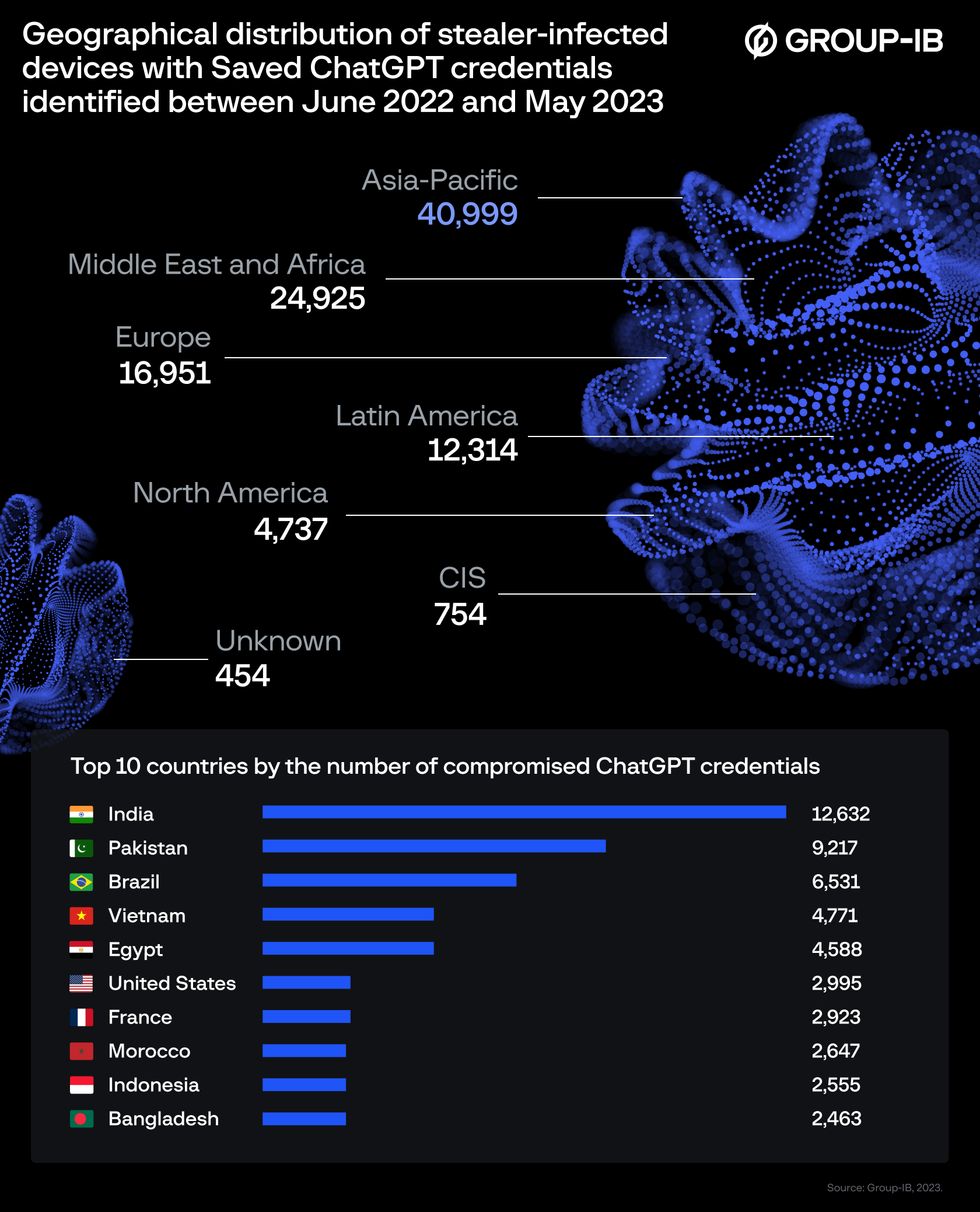

According to Group-IB’s findings, the Asia-Pacific region suffered the greatest concentration of ChatGPT credentials offered for sale, followed by the Middle East and Africa (MEA) region in second place.

Group-IB tech experts explained that when employees take advantage of ChatGPT to optimize business communications and marketing texts, the queries and responses are stored within the AI app. Consequently, any unauthorized access to a ChatGPT account could unearth a wealth of sensitive information.

Also Read: The Largest Data Breaches In The Middle East

Group-IB’s dark web analysis revealed that most compromised ChatGPT accounts were breached by a popular malware program known as “Raccoon Info Stealer”. The virus is often sent by email and can be used by hackers to gain access to sensitive data stored in internet browsers.

In the MENA area, accounts from users in Egypt, Morocco, Algeria, and Turkey topped the “most-infected” list, potentially exposing companies in the region to multiple threat actors.

“Many enterprises are integrating ChatGPT into their operational flow,” explained Dmitry Shestakov, Head of Threat Intelligence at Group-IB. “Employees enter classified correspondences or use the bot to optimize proprietary code. Given that ChatGPT’s standard configuration retains all conversations, this could inadvertently offer a trove of sensitive intelligence to threat actors if they obtain account credentials. At Group-IB, we continuously monitor underground communities to identify such accounts promptly”.

To mitigate the risks posed by compromised ChatGPT accounts, Group-IB suggests that users update passwords using current best practices while also implementing two-factor authentication.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.