News

Abu Dhabi Developer To Build World’s First Healthy Living Island

The exclusive resort will be situated halfway between Abu Dhabi and Dubai, and will feature a helipad, 86 residential villas, and 49 apartments.

Abu Dhabi-based real estate developer IMKAN has formed a partnership with the world-renowned SHA Wellness Clinic to construct a unique private island resort at Al Jurf, halfway between Abu Dhabi and Dubai.

The development is known as SHA Residences Emirates and will combine a holistic health resort with 86 residential villas and 49 apartments — two of which will be penthouses. The “healthy living island” will also offer easy beach access, a fantastic climate, and even a former royal palace.

Raed Al Hadad, chief of marketing and sales at IMKAN, explained why the idyllic location was chosen: “We have turquoise water here, cooler temperatures, and breezes. This is the place where the late Sheikh Zayed bin Sultan Al Nahyan used to come and reflect on key policies. This palace is where one of the first talks about the formation of the UAE took place”.

IMKAN is currently working alongside Abu Dhabi’s Department of Culture and Tourism to rejuvenate the historic palace and turn it into a tourist attraction.

Also Read: Abu Dhabi To Develop $1 Billion eSports Island Facility

Construction of the resort will begin in July and should be finished by 2025. The island will eventually be home to a full staff of doctors, therapists, yoga instructors, personal trainers, and world-class chefs. Residents and visitors will benefit from a full suite of services, including wellness programs, detox treatments, spas, and blood tests.

“Al Jurf as a destination has all the potential to promote wellness tourism. People from Saudi Arabia, India, and Russia are just a few hours away from this place,” Raed Al Hadad added.

The exclusive healthy living island will be accessible by road and also feature a helipad. Meanwhile the developers plan to add connections by water from Abu Dhabi and Dubai.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

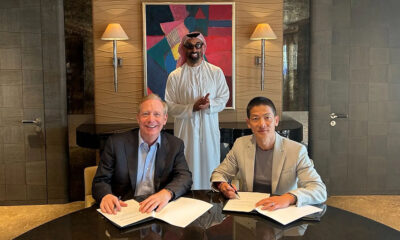

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News3 weeks ago

News3 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant