News

Bahrain-Based Cryptocurrency Exchange Rain Raises $110 Million

The financial injection provided by the Series B funding round is supposed to help Rain double the number of its employees, which currently sits at 400.

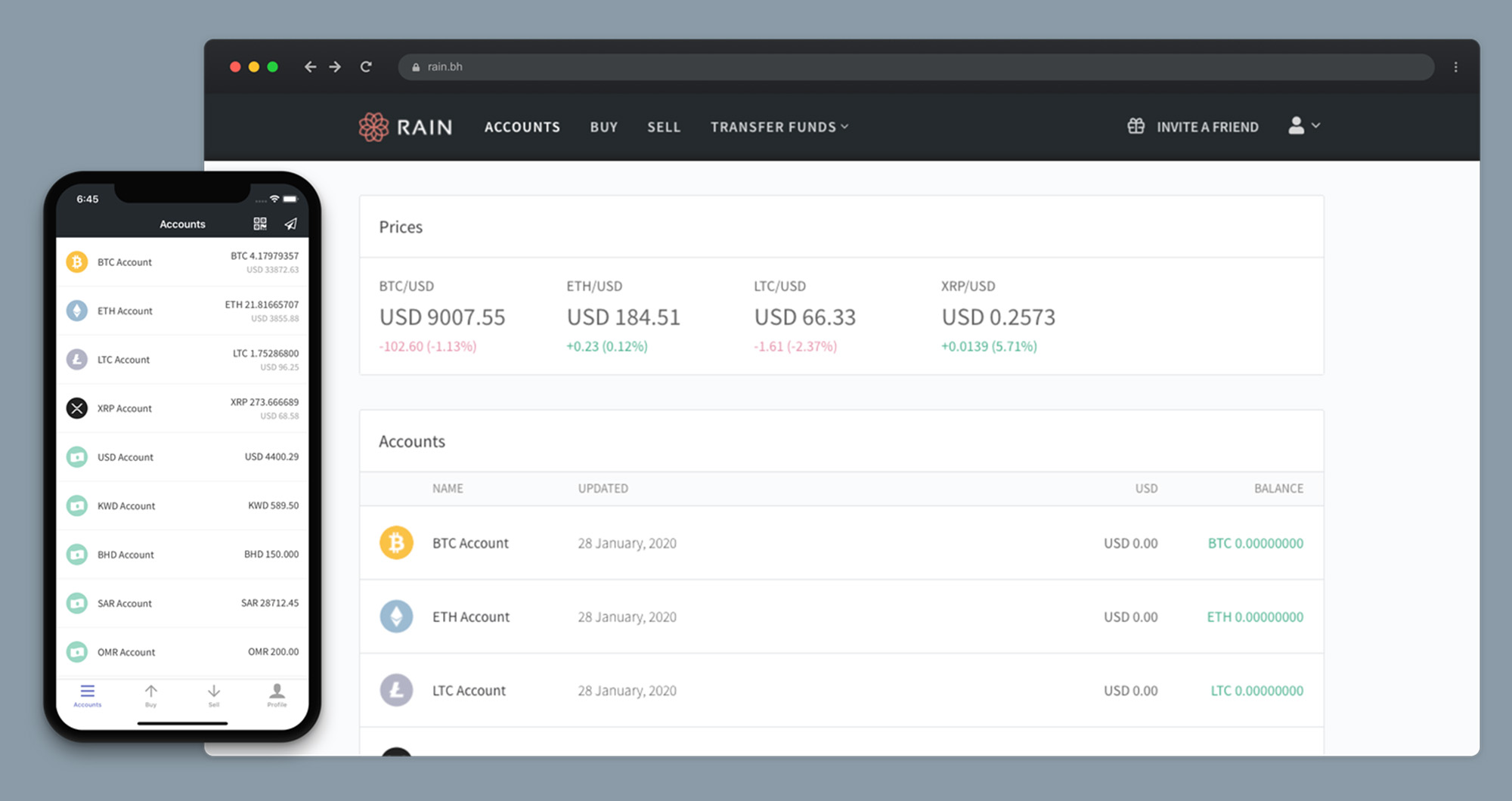

After raising $6 million in a Series A led by MEVP in January 2021, Bahrain-based cryptocurrency exchange Rain has another reason to celebrate: the recent $110 million Series B funding round.

Co-led by Paradigm and Kleiner Perkins, with participation from Coinbase Ventures, Global Founders Capital, Cadenza Ventures, and others, the round is one of the largest ones for any startup in the Middle East & North Africa.

“We are very excited about this funding opportunity as it allows us to continue conversations with regulators across the MENA region, Turkey, and Pakistan about the benefits and potential of cryptocurrency” stated the co-founding team. “It will also support our overarching mission of providing education and access to cryptocurrency to all of our supported markets”.

Rain was founded in 2017 by Abdullah Almoaiqel, AJ Nelson, Joseph Dallago, and Yehia Badawy. The exchange allows customers from the Middle East to easily buy and sell cryptocurrencies like Bitcoin, Ethereum, and Litecoin. So far, it has processed transactions worth more than $1.9 billion, serving 185,000 users across 50 countries.

The financial injection provided by the Series B funding round is supposed to help the exchange double the number of its employees, which currently sits at 400.

Also Read: 5 Gaming Cryptos That Will Explode In 2023

“We believe that Rain is a crucial piece of the puzzle for bringing the Middle East deeper into the new crypto economy” said Casey Caruso, investing partner at Paradigm.

Indeed, the interest in cryptocurrency has been booming across the MENA region, with both individual retail investors and institutions embracing cryptocurrencies as the future of finance.

Dubai, for example, wants to become the world’s cryptocurrency capital by creating a comprehensive ecosystem for cryptocurrencies and providers of related services in the form of a special crypto zone at the Dubai World Trade Center.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.