News

Bahrain-Based Cryptocurrency Exchange Rain Raises $110 Million

The financial injection provided by the Series B funding round is supposed to help Rain double the number of its employees, which currently sits at 400.

After raising $6 million in a Series A led by MEVP in January 2021, Bahrain-based cryptocurrency exchange Rain has another reason to celebrate: the recent $110 million Series B funding round.

Co-led by Paradigm and Kleiner Perkins, with participation from Coinbase Ventures, Global Founders Capital, Cadenza Ventures, and others, the round is one of the largest ones for any startup in the Middle East & North Africa.

“We are very excited about this funding opportunity as it allows us to continue conversations with regulators across the MENA region, Turkey, and Pakistan about the benefits and potential of cryptocurrency” stated the co-founding team. “It will also support our overarching mission of providing education and access to cryptocurrency to all of our supported markets”.

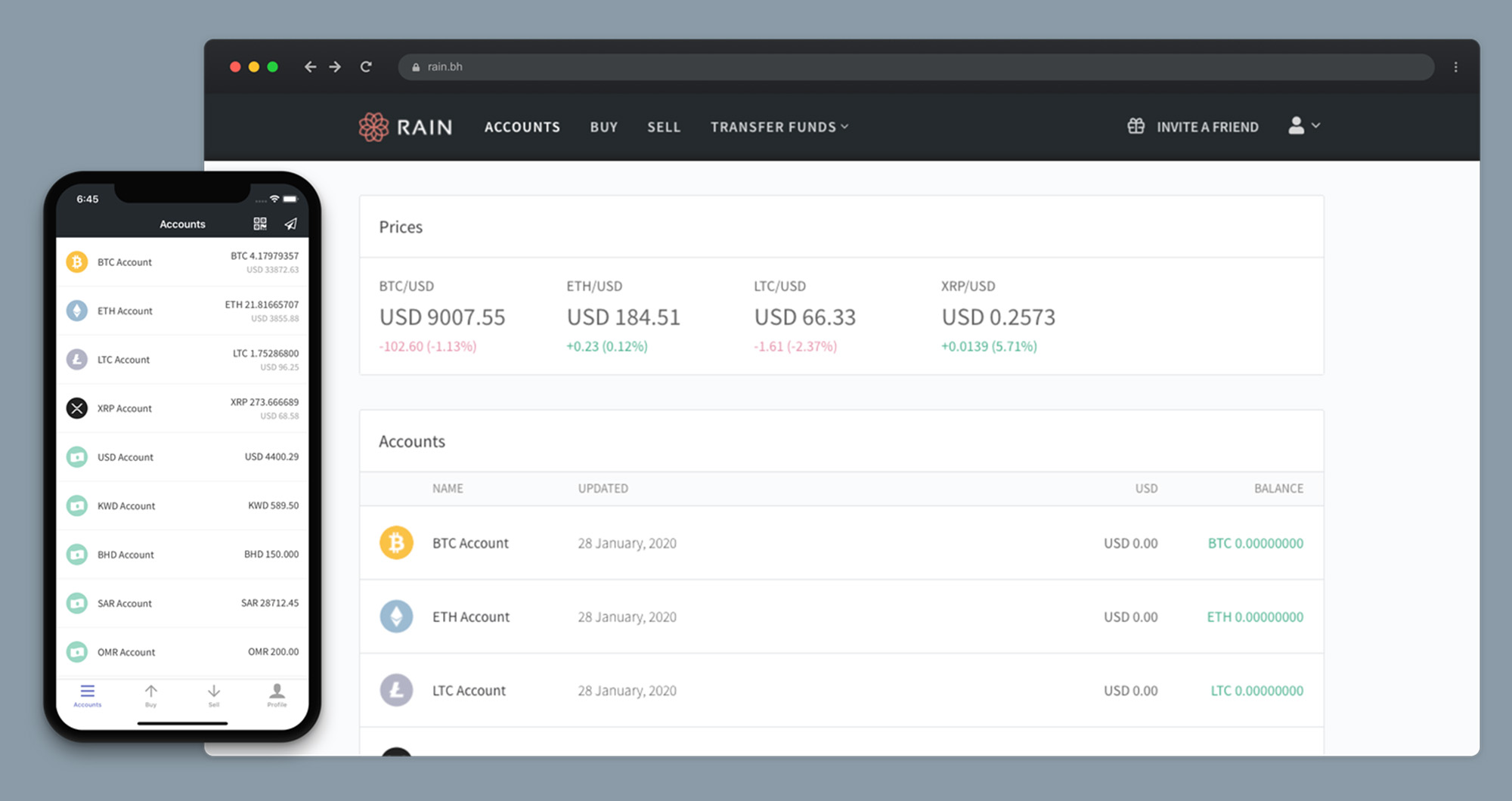

Rain was founded in 2017 by Abdullah Almoaiqel, AJ Nelson, Joseph Dallago, and Yehia Badawy. The exchange allows customers from the Middle East to easily buy and sell cryptocurrencies like Bitcoin, Ethereum, and Litecoin. So far, it has processed transactions worth more than $1.9 billion, serving 185,000 users across 50 countries.

The financial injection provided by the Series B funding round is supposed to help the exchange double the number of its employees, which currently sits at 400.

Also Read: 5 Gaming Cryptos That Will Explode In 2023

“We believe that Rain is a crucial piece of the puzzle for bringing the Middle East deeper into the new crypto economy” said Casey Caruso, investing partner at Paradigm.

Indeed, the interest in cryptocurrency has been booming across the MENA region, with both individual retail investors and institutions embracing cryptocurrencies as the future of finance.

Dubai, for example, wants to become the world’s cryptocurrency capital by creating a comprehensive ecosystem for cryptocurrencies and providers of related services in the form of a special crypto zone at the Dubai World Trade Center.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant