News

Careem Suspends Its Ride-Hailing Services In Qatar

The announcement comes without any official explanation, though is thought to be due to a lack of regulatory approval.

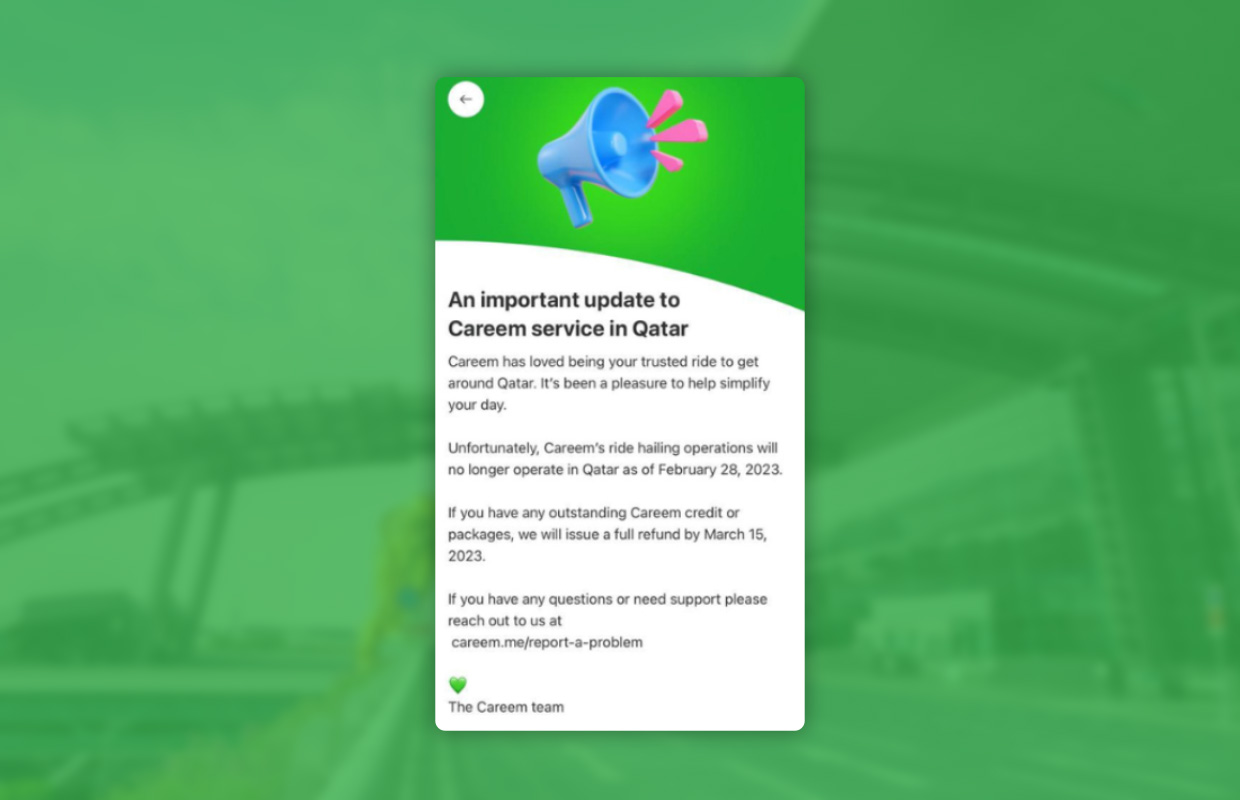

Yesterday (Monday, February 27), Uber Technologies sent a message to customers informing them that Careem, the Dubai-based company acquired by the ride-hailing giant in 2019 for $3.1 billion, will cease operations in Qatar today.

The surprise announcement comes just two months after Qatar’s soccer World Cup, which saw Careem-branded vehicles forming part of the official transport infrastructure, alongside Uber cars and local taxis from Karwa.

“Unfortunately, Careem’s ride-hailing operations will no longer operate in Qatar as of February 28, 2023,” informed the message, telling customers that Careem credit would be refunded by March 15, 2023.

Also Read: Saudi Arabia To Transform Downtown Riyadh By 2030

Careem’s message did not explain the cancellation of the service, and no one has responded to requests for comment, including parent company Uber.

Careem only offered ride-hailing services in Qatar, unlike larger Middle Eastern markets like the United Arab Emirates, where the super app also provides food delivery, digital payments and courier services.

The company suspended its services in Lebanon last year due to the unfavorable economic situation in the country.

News

Rabbit Expands Hyperlocal Delivery Service In Saudi Arabia

The e-commerce startup is aiming to tap into the Kingdom’s underdeveloped e-grocery sector with a tech-first, locally rooted strategy.

Rabbit, an Egyptian-born hyperlocal e-commerce startup, is expanding into the Saudi Arabian market, setting its sights on delivering 20 million items across major cities by 2026.

The company, founded in 2021, is already operational in the Kingdom, with its regional headquarters now open in Riyadh and an established network of strategically located fulfillment centers — commonly known as “dark stores” — across the capital.

The timing is strategic: Saudi Arabia’s online grocery transactions currently sit at 1.3%, notably behind the UAE (5.3%) and the United States (4.8%). With the Kingdom’s food and grocery market estimated at $60 billion, even a modest increase in online adoption could create a multi-billion-dollar opportunity.

Rabbit also sees a clear alignment between its business goals and Saudi Arabia’s Vision 2030, which aims to boost retail sector innovation, support small and medium-sized enterprises, attract foreign investment, and develop a robust digital economy.

The company’s e-commerce model is based on speed and efficiency. Delivery of anything from groceries and snacks to cosmetics and household staples is promised in 20 minutes or less, facilitated by a tightly optimized logistics system — a crucial component in a sector where profit margins and delivery expectations are razor-thin.

Despite the challenges, Rabbit has already found its stride in Egypt. In just over three years, the app has been used by 1.4 million customers to deliver more than 40 million items. Revenue has surged, growing more than eightfold in the past two years alone.

Also Read: Top E-Commerce Websites In The Middle East In 2025

CEO and Co-Founder Ahmad Yousry commented: “We are delighted to announce Rabbit’s expansion into the Kingdom. We pride ourselves on being a hyperlocal company, bringing our bleeding-edge tech and experience to transform the grocery shopping experience for Saudi households, and delivering the best products – especially local favorites, in just 20 minutes”.

The company’s growth strategy avoids the pitfalls of over-reliance on aggressive discounting. Instead, Rabbit leans on operational efficiency, customer retention, and smart scaling. The approach is paying off, having already attracted major investment from the likes of Lorax Capital Partners, Global Ventures, Raed Ventures, and Beltone Venture Capital, alongside earlier investors such as Global Founders Capital, Goodwater Capital, and Hub71.