News

MENA’s Biggest Online Piracy Site Shahed4U Shuts Down

The platform had been operating since 2015, and notched up 155 million monthly visits and around 18,700 movie files.

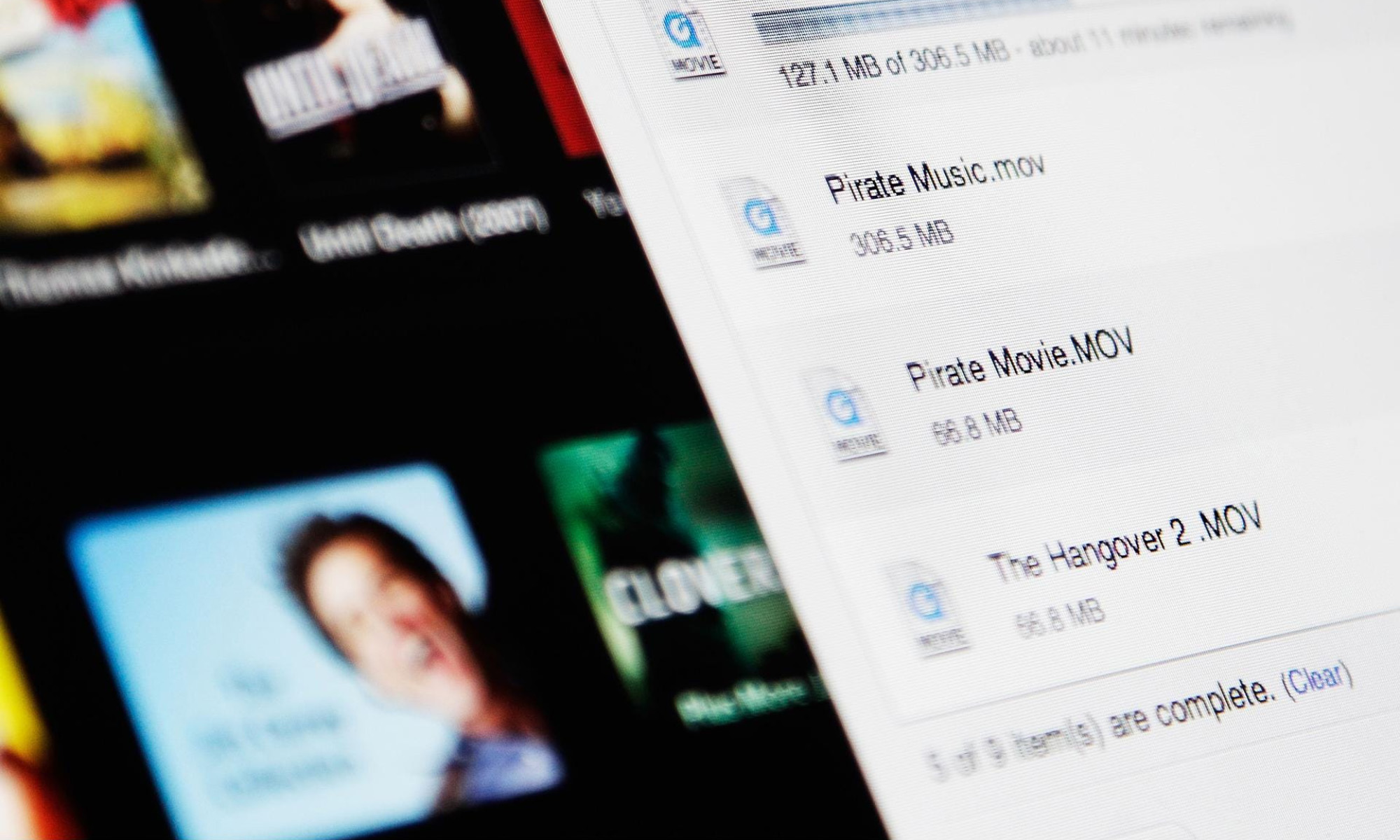

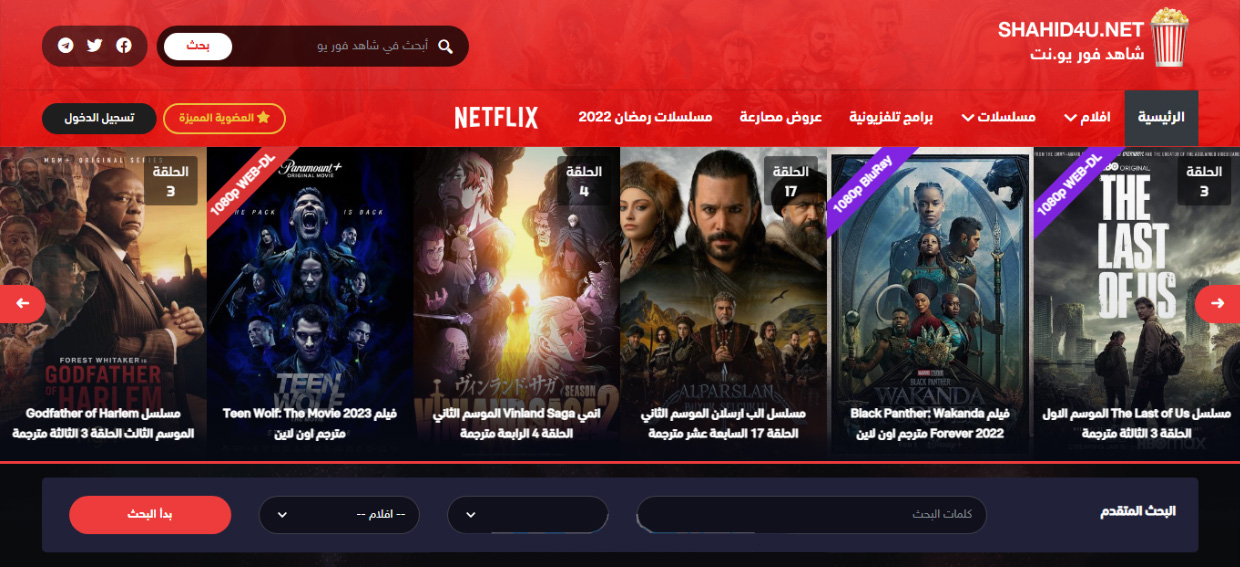

Egyptian authorities have shut down one of the Middle East and North Africa’s largest online platforms for downloading pirated media, Shahed4U. The site’s servers were located in Alexandria and Cairo and offered access to 68,000 TV titles and 18,700 films.

At its peak, the site’s traffic hit 155 million monthly visits across 118 domains and various copycat sites. Shahed4U had been distributing pirated content since 2015, and the closure follows those of Egybest and MyCima. Egyptian authorities were helped with the shutdown by the Alliance for Creativity and Entertainment (ACE), the world’s foremost anti-piracy coalition.

Also Read: Best Video Streaming Services In The Middle East

“This spate of unprecedented ACE actions in the MENA region underscores our ever-expanding global reach and our growing relationships with law enforcement and local industry around the world [and is] core to ACE’s global goal of eradicating the illegal distribution of content and protecting the legal marketplace for content creators,” says Charles Rivkin, Chairman and CEO of the Motion Picture Association and Chairman of ACE.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.