News

Dubai Roads & Transport Authority Introduces Smart Solutions

A range of innovative digital services now aid mobility and improve efficiency.

Dubai’s Roads and Transport Authority (RTA) has introduced a range of smart technology solutions to automate services and make life easier and more convenient for citizens as the Emirate continues its digital transformation plan leading up to 2025.

Here are some of the services that have been improved using cutting-edge tech:

Smart Kiosks

Citizens can now renew vehicle registrations, pay parking fines, and recharge their nol cards 24/7 at 32 separate smart kiosks featuring biometric login. In total, 28 digital services are available, with payment options including cash, credit cards, and NFC digital wallets.

Taxi App

As well as an hourly rental service, residents and tourists can book taxis and limos 24 hours a day. The new Dubai Taxi Corporation app also features a “Lost and Found” section, along with location sharing, route details, and estimated arrival times.

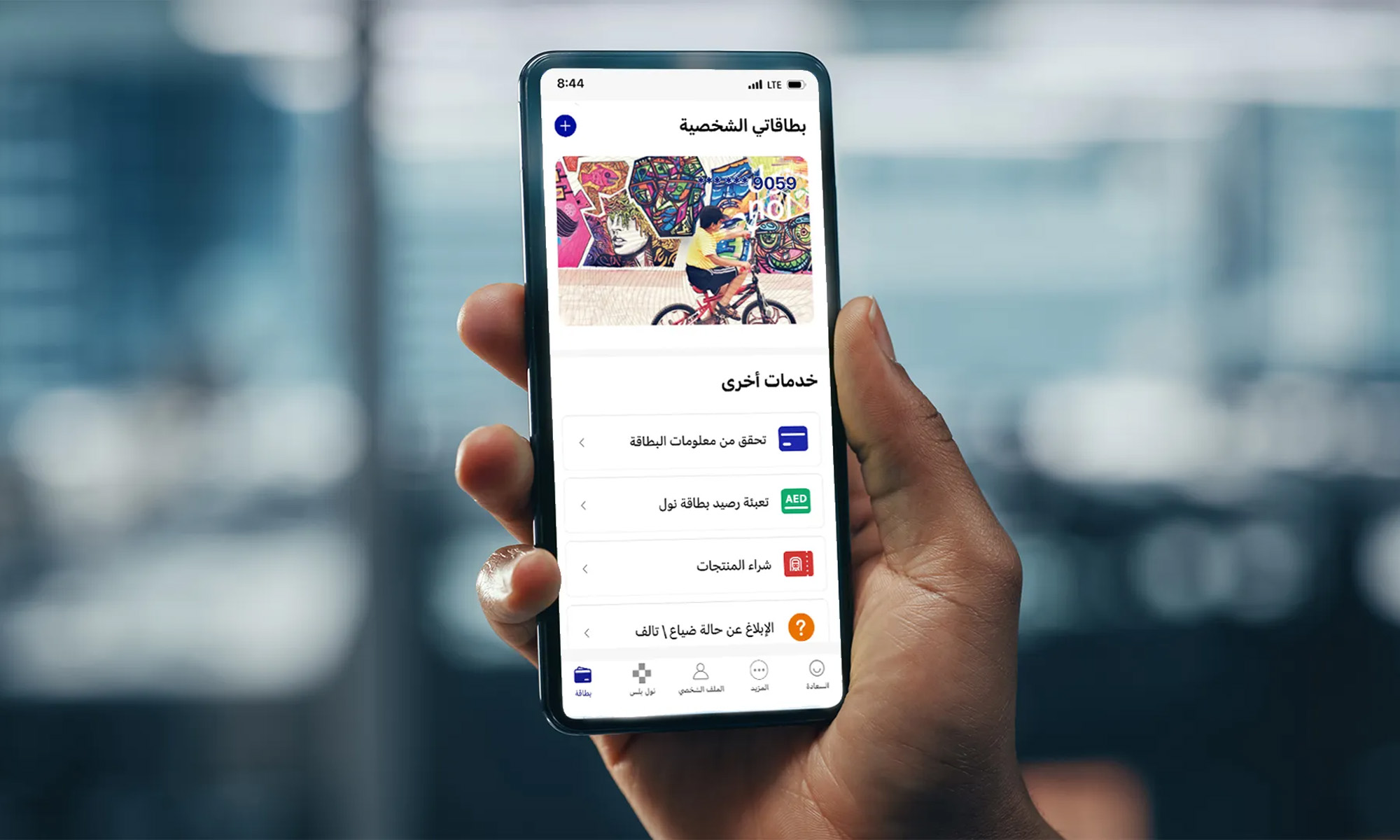

nol Pay App

An updated version of the nol Pay app can now be used for transport fares, parking, tourist attractions, and even shopping. Instant balance top-ups are available, along with integration of digital IDs for simplified registration.

Driving Licenses

A “Click and Drive” initiative for obtaining driving licenses has digitized the entire admin process, reducing wait times by 75%. The new service even includes a mobile eye-testing facility.

Free Parking Permits

Parking permits are now available digitally and don’t need to be printed or displayed. The service allows users to add up to 5 vehicles, with each activated at a time through the RTA Dubai app.

Unified Booking

The RTA plans to streamline transport bookings and tickets over the next couple of years, unifying regulations across all providers, which currently includes the likes of Careem, Udrive, Uber, ekar, and Hala.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant