News

Fintech In The UAE Is Set To Add $900 Per Capita By 2030

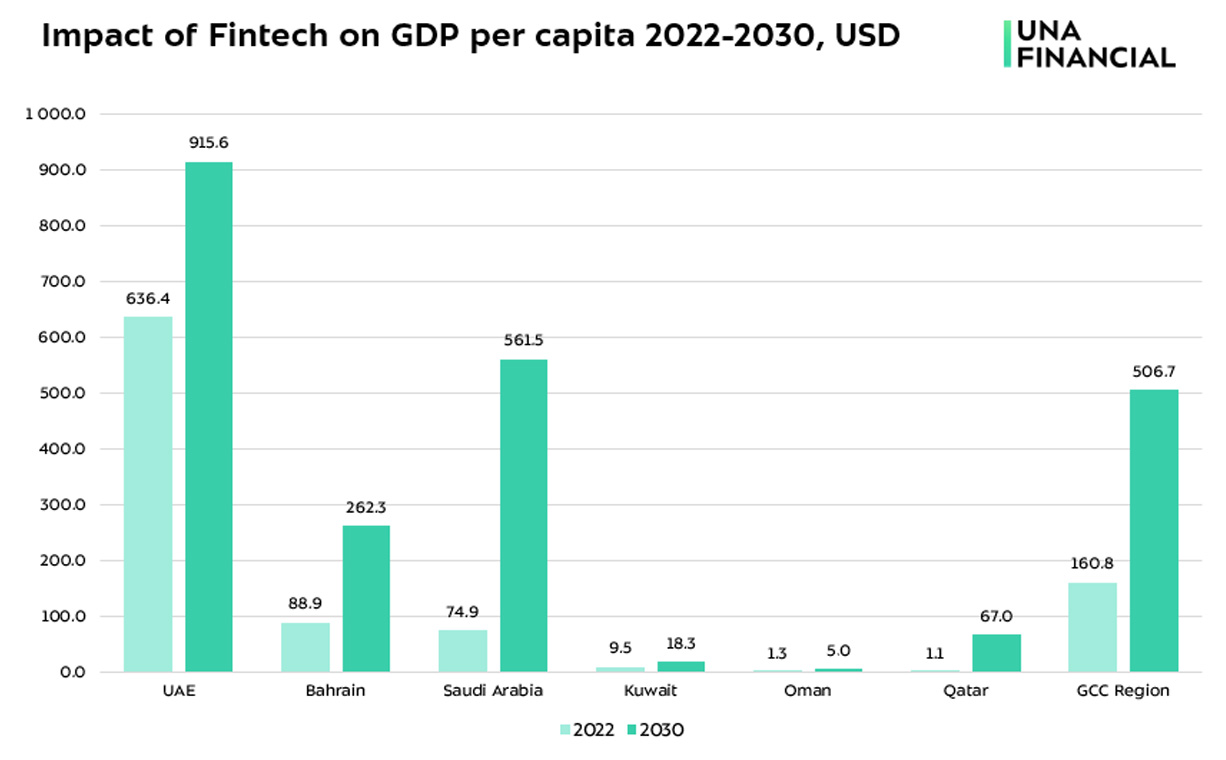

The United Arab Emirates will add the highest value to its GDP per capita, followed by Saudi Arabia and Bahrain.

Analysts from UnaFnancial have calculated the value of fintech investment for the Gulf Coast Countries (GCC) in terms of the per-capita increase to GDP using Tracxn data.

In 2022, the United Arab Emirates was a regional leader, with $636.4 (1.01%) in GDP per capita coming from fintech. It was followed by Bahrain with $89 (0.24%) and Saudi Arabia with $75 (0.18%), highlighting the substantial gap between the UAE and its neighbors.

For the GCC region as a whole, the impact of fintech equaled $161 added to the GDP per citizen. Meanwhile, according to UnaFinancial’s forecast, the UAE will still have the highest value of fintech contribution to GDP per capita by 2030, equaling $915.6 (a 44%-increase over 2022). Saudi Arabia is expected to remain in second place but with a massive 650% increase to $561.5. For the GCC region as a whole, fintech will add $506.7 to the GDP per capita by 2030.

Also Read: A Guide To Digital Payment Methods In The Middle East

UnaFinancial’s analysts commented: “In terms of investment in fintech, the UAE makes up 62% of the entire GCC region. This is explained by the level of economic development of the country compared to other countries in the region. The GDP per capita for the population aged 15+ in the UAE equals $63,359, which is almost 4 times higher than the average in the GCC (excluding the UAE). Saudi Arabia and Bahrain are the countries with high average annual growth rates of fintech influence – 182.4%, which exceeds the region’s average by 1.5 times. Meanwhile, Kuwait, Oman, and Qatar are in a transition phase. The average growth rate of fintech influence on the well-being of their citizens equals 166.3% per year. Yet, there are higher investment risks due to lower economic stability”.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News2 weeks ago

News2 weeks agoGoogle Cloud Opens New Kuwait Office To Aid Digital Transformation