News

Introducing ChatGPT’s New Feature: Conversation Recall

The new memory feature can recall past interactions for personalized assistance. OpenAI claims privacy has not been compromised.

Interacting with AI chatbots has often presented a challenge: once a conversation concludes, all context is lost. The AI fails to retain pertinent details, hampering its potential as a true digital assistant capable of providing personalized guidance.

OpenAI has now addressed this limitation by introducing a memory feature to ChatGPT, enabling the bot to recall important information from past interactions and utilize it in subsequent queries.

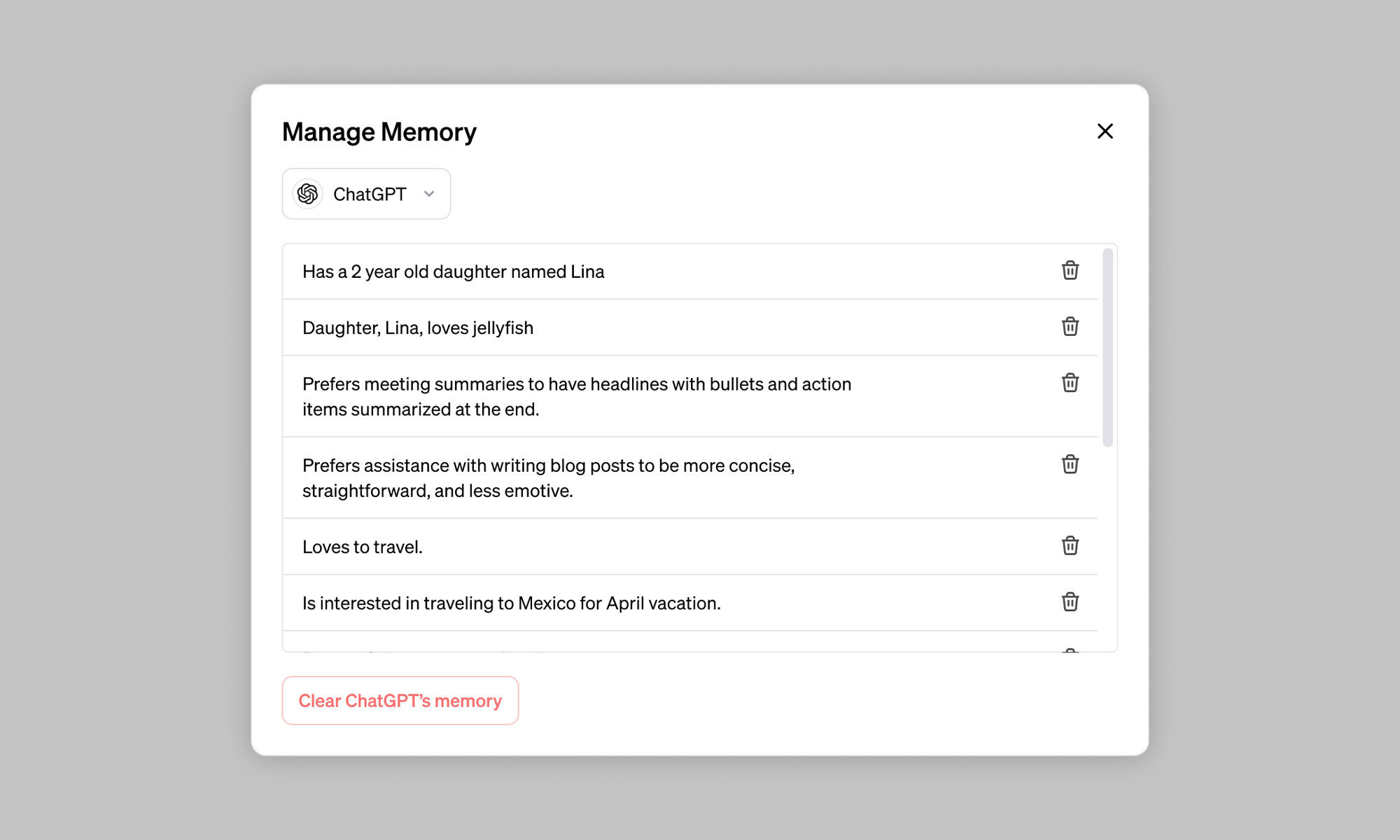

The mechanism is straightforward: users can prompt ChatGPT to remember specific details, such as a child’s peanut allergy or an email signature preference. Subsequently, the bot stores this information and applies it to future interactions and tasks.

Furthermore, the system accumulates knowledge organically over time, enhancing its understanding of user preferences and requirements.

Each custom GPT instance, like Books GPT, maintains its distinct memory, enabling more tailored experiences. For instance, Books GPT can recall previously read books and preferred genres. This feature is particularly beneficial for those using the diverse range of chatbots available in the GPT Store.

Also Read: Joby To Launch High-Speed Air Taxi Service In Dubai

Although no different to the data storage practices of Google and others, concerns regarding privacy persist. OpenAI assures users of control over ChatGPT’s memory, with sensitive topics such as health data not automatically retained. Users can instruct the bot to forget information, supplemented by subtle adjustments accessible through the Manage Memory tab in the settings. For those uncomfortable with the concept, the option to disable the feature entirely also exists.

Currently in beta, the memory feature is being gradually introduced to a limited number of ChatGPT free and Plus users, with plans for broader availability in the future. In the interim, those intrigued by the concept can glimpse into a future that’s beginning to look a lot like the movie “Her”.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.

-

News3 weeks ago

News3 weeks agoRipple Gains DFSA License To Offer Crypto Payments In Dubai

-

News2 weeks ago

News2 weeks agoAre You Ready For Hong Kong’s InnoEX & Electronics Fair?

-

News2 weeks ago

News2 weeks agoWizz Air Abu Dhabi Adds Beirut Flights Amid Tourism Revival

-

News2 weeks ago

News2 weeks agoProtecting Your WhatsApp Account From Hackers: Kaspersky Expert Tips