News

Introducing ChatGPT’s New Feature: Conversation Recall

The new memory feature can recall past interactions for personalized assistance. OpenAI claims privacy has not been compromised.

Interacting with AI chatbots has often presented a challenge: once a conversation concludes, all context is lost. The AI fails to retain pertinent details, hampering its potential as a true digital assistant capable of providing personalized guidance.

OpenAI has now addressed this limitation by introducing a memory feature to ChatGPT, enabling the bot to recall important information from past interactions and utilize it in subsequent queries.

The mechanism is straightforward: users can prompt ChatGPT to remember specific details, such as a child’s peanut allergy or an email signature preference. Subsequently, the bot stores this information and applies it to future interactions and tasks.

Furthermore, the system accumulates knowledge organically over time, enhancing its understanding of user preferences and requirements.

Each custom GPT instance, like Books GPT, maintains its distinct memory, enabling more tailored experiences. For instance, Books GPT can recall previously read books and preferred genres. This feature is particularly beneficial for those using the diverse range of chatbots available in the GPT Store.

Also Read: Joby To Launch High-Speed Air Taxi Service In Dubai

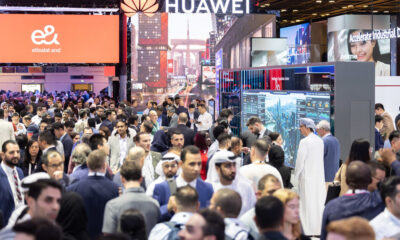

Although no different to the data storage practices of Google and others, concerns regarding privacy persist. OpenAI assures users of control over ChatGPT’s memory, with sensitive topics such as health data not automatically retained. Users can instruct the bot to forget information, supplemented by subtle adjustments accessible through the Manage Memory tab in the settings. For those uncomfortable with the concept, the option to disable the feature entirely also exists.

Currently in beta, the memory feature is being gradually introduced to a limited number of ChatGPT free and Plus users, with plans for broader availability in the future. In the interim, those intrigued by the concept can glimpse into a future that’s beginning to look a lot like the movie “Her”.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.