News

MENA Region Is World’s Fastest-Growing Crypto Market

According to a newly released report, cryptocurrency adoption is surging in the MENA region, with Egypt now home to the largest cryptocurrency industry.

The Middle East and North Africa (MENA) have adopted cryptocurrency at a staggering rate, according to a new report by Chainalysis, with the MENA region as a whole accounting for 9.2% of global crypto transactions over the last year.

According to the research, although the MENA region is one of the smallest crypto markets, cryptocurrency growth of over $550 billion happened between July 2021 and June 2022, with three of the world’s “Top 30” countries coming from the MENA zone:

- Turkey (12/30)

- Egypt (14/30)

- Morocco (24/30)

In the case of both Egypt and Turkey, unstable and rapidly devaluing fiat currencies have strengthened the appeal of crypto. Turkey made $192 billion in transactions, making it the region’s biggest player, though at a growth rate of 10.5%, the country’s crypto market didn’t expand as quickly as others.

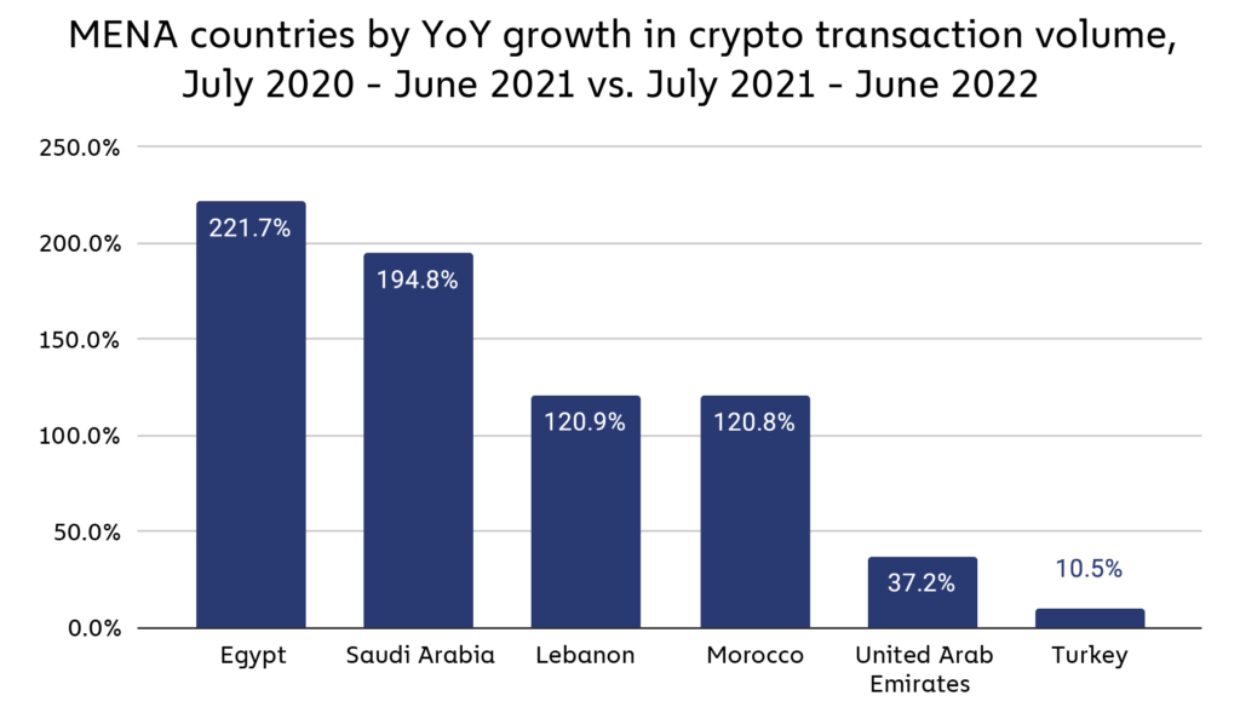

So, which countries seem to be adopting crypto at breakneck speeds? Chainalysis found that Egypt was the MENA region’s fastest-growing, with transaction volumes leaping by over 220%. Saudi Arabia saw similar progress, with volumes increasing by 195%.

“Digital currencies are being used in Egypt as a way to preserve savings. Using cryptocurrencies to hedge against currency devaluation is appealing,” says Kim Grauer, Director of Research, Chainalysis.

Also Read: 3 Best Cold Storage Wallets For Crypto In 2023

In other significant news, unlike many countries, Egypt’s national bank has enthusiastically embraced crypto. It is currently in the process of building a crypto-based remittance corridor between Egypt and the UAE, as many Egyptians are based there for work.

One of the reasons crypto is surging in the MENA is down to demographics: Populations in MENA countries are young, and growth is being fueled by a class of tech-savvy early adopters with high disposable incomes. Overall though, it’s clear that with financial institutions and retail adopting the technology at a rapid pace, the future looks bright for cryptocurrency in North Africa and the Middle East.

News

Rabbit Expands Hyperlocal Delivery Service In Saudi Arabia

The e-commerce startup is aiming to tap into the Kingdom’s underdeveloped e-grocery sector with a tech-first, locally rooted strategy.

Rabbit, an Egyptian-born hyperlocal e-commerce startup, is expanding into the Saudi Arabian market, setting its sights on delivering 20 million items across major cities by 2026.

The company, founded in 2021, is already operational in the Kingdom, with its regional headquarters now open in Riyadh and an established network of strategically located fulfillment centers — commonly known as “dark stores” — across the capital.

The timing is strategic: Saudi Arabia’s online grocery transactions currently sit at 1.3%, notably behind the UAE (5.3%) and the United States (4.8%). With the Kingdom’s food and grocery market estimated at $60 billion, even a modest increase in online adoption could create a multi-billion-dollar opportunity.

Rabbit also sees a clear alignment between its business goals and Saudi Arabia’s Vision 2030, which aims to boost retail sector innovation, support small and medium-sized enterprises, attract foreign investment, and develop a robust digital economy.

The company’s e-commerce model is based on speed and efficiency. Delivery of anything from groceries and snacks to cosmetics and household staples is promised in 20 minutes or less, facilitated by a tightly optimized logistics system — a crucial component in a sector where profit margins and delivery expectations are razor-thin.

Despite the challenges, Rabbit has already found its stride in Egypt. In just over three years, the app has been used by 1.4 million customers to deliver more than 40 million items. Revenue has surged, growing more than eightfold in the past two years alone.

Also Read: Top E-Commerce Websites In The Middle East In 2025

CEO and Co-Founder Ahmad Yousry commented: “We are delighted to announce Rabbit’s expansion into the Kingdom. We pride ourselves on being a hyperlocal company, bringing our bleeding-edge tech and experience to transform the grocery shopping experience for Saudi households, and delivering the best products – especially local favorites, in just 20 minutes”.

The company’s growth strategy avoids the pitfalls of over-reliance on aggressive discounting. Instead, Rabbit leans on operational efficiency, customer retention, and smart scaling. The approach is paying off, having already attracted major investment from the likes of Lorax Capital Partners, Global Ventures, Raed Ventures, and Beltone Venture Capital, alongside earlier investors such as Global Founders Capital, Goodwater Capital, and Hub71.