News

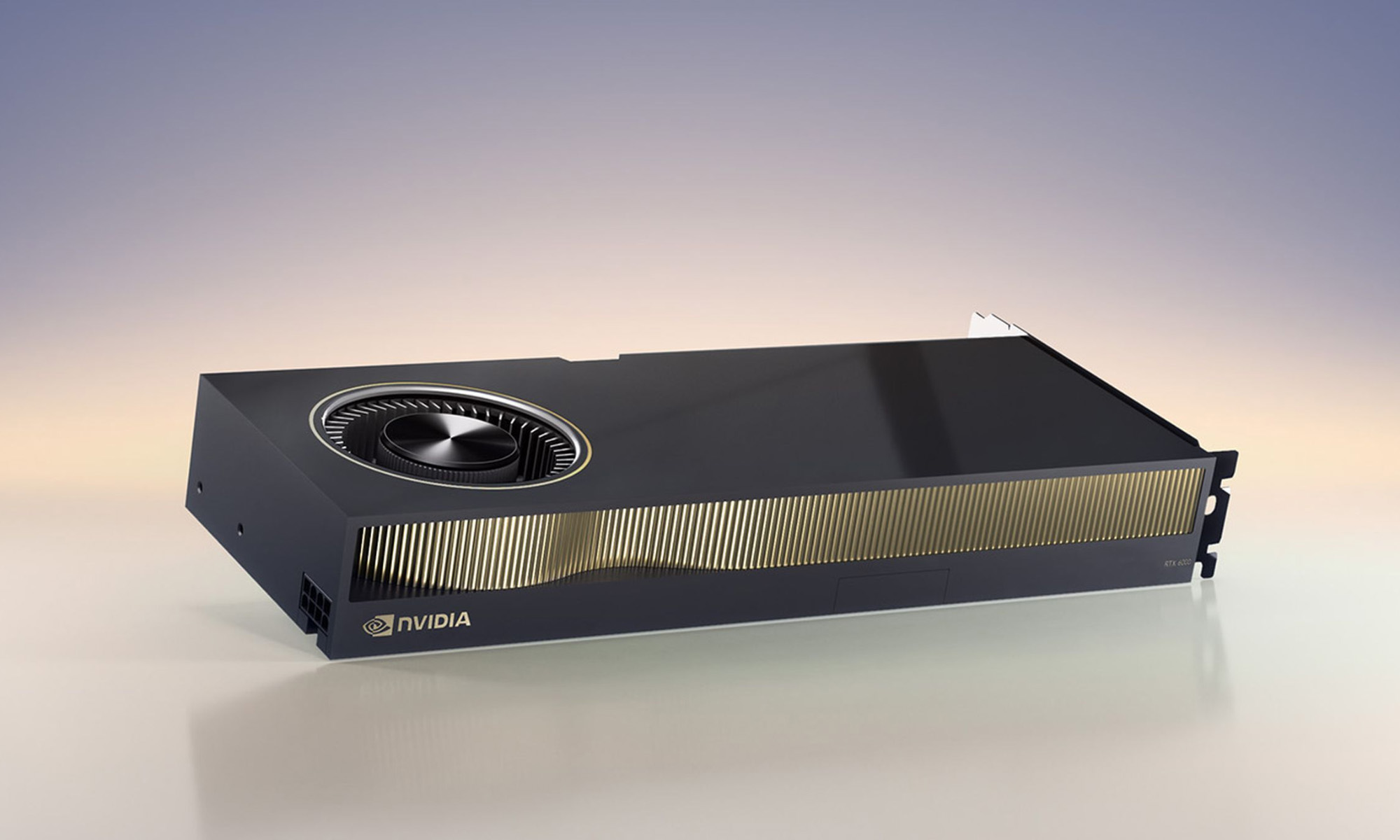

NVIDIA Announces RTX 6000 Ada Professional GPU

The new graphics card promises to be a powerhouse, but you’ll need to fork out over $8,000 for the privilege of owning one.

NVIDIA has just announced a new workstation-focused graphics card — the RTX 6000 Ada. The 48GB powerhouse is the latest model to join the company’s family of high-end, enterprise-grade GPUs designed for demanding content creation. NVIDIA sees the RTX 6000 being used for metaverse projects, thanks to the card’s Ada Lovelace generation AI, massively improved ray tracing and other cutting-edge features.

It’s important to point out that NVIDIA doesn’t view this GPU as something the general public will buy — the predicted $8,000 price will undoubtedly prevent that from happening — but instead is positioning the card as a tool for TV broadcasters, scientists and other professional applications.

“The new workstation GPUs are truly game-changing, providing us with over 300% performance increases — allowing us to improve the quality of video and the value of our products,” says Andrew Cross, CEO of Grass Valley (TV broadcast equipment).

Also Read: PicSo Review: A Popular AI-Based Text-To-Image App

So what do the specs look like in NVIDIA’s new RTX 6000 Ada? For starters, there are over 18,000 CUDA cores, 48GB of GDDR6 memory and a power rating of 450 watts. 568 Tensor cores and 142 RT cores help to triple the video encoding performance, and Nvidia virtual GPU (vGPU) software enables multiple remote users to share resources and workloads.

“The NVIDIA RTX 6000 is ready to power this new era for engineers, designers and scientists to meet the need for demanding content-creation, rendering, AI and simulation workloads required to build worlds in the metaverse,” says Bob Pette, NVIDIA vice president of professional visualization.

The NVIDIA RTX 6000 Ada will be available from December 2022 through global distribution channels and manufacturing partners.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News2 weeks ago

News2 weeks agoGoogle Cloud Opens New Kuwait Office To Aid Digital Transformation