News

LinkedIn Adds Message Safety Tools And Focused Inbox

The business networking and recruitment platform is cracking down on spam messages and scams.

LinkedIn has just made some changes to its direct messaging service to help its 875 million members avoid spam and attempted scams. The business networking site is seeing growth rates of up to 34% a year, with 21 inMails sent every second, so it is keen to ensure that new and existing users are kept safe.

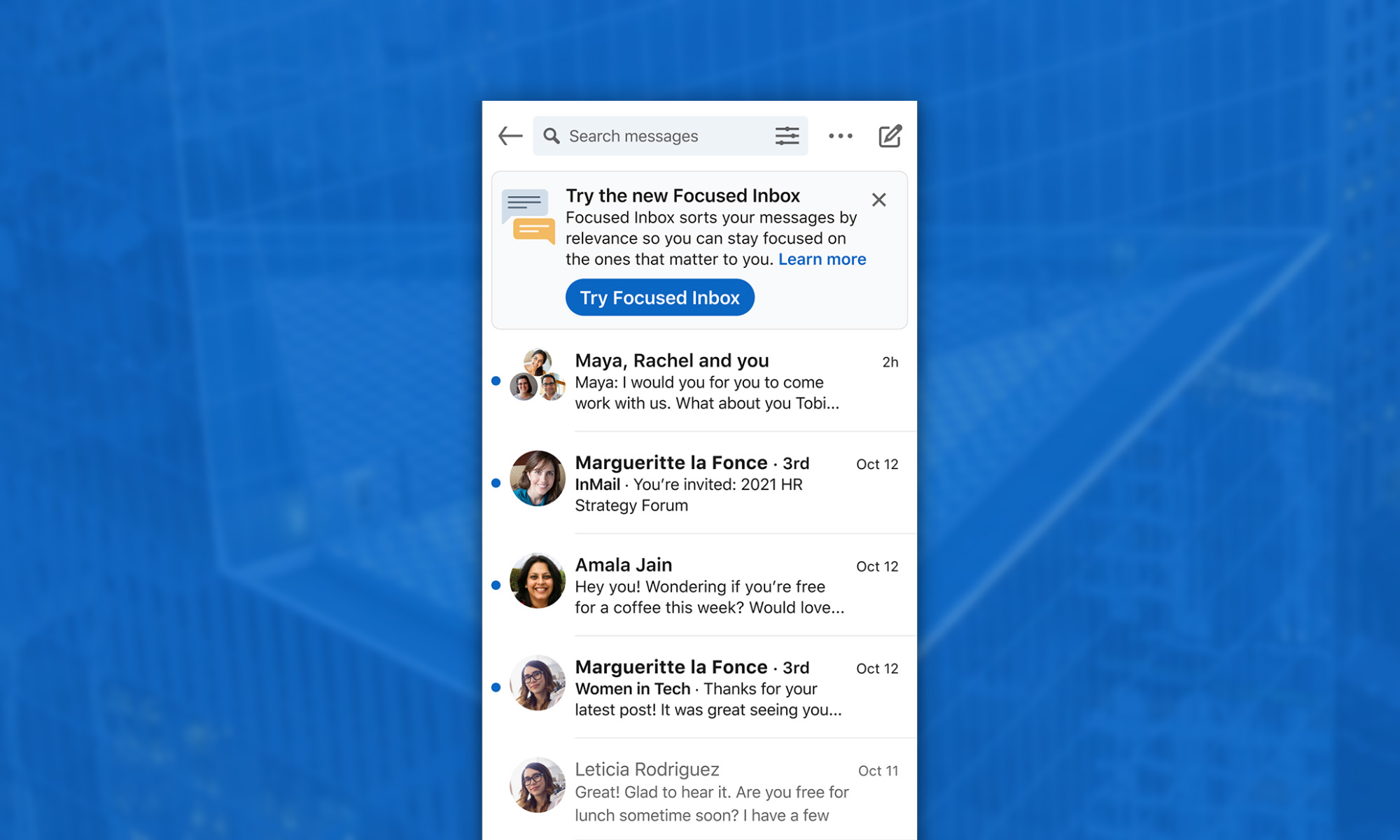

LinkedIn’s first change is the rollout of a new “focused” option for incoming messages, which will relegate unwanted mail to an “Other” box. Switchable automatic spam and harassment detection should help to send spam and legitimate mail to the right places, and a new feature is also available to report unwanted messages.

The company states that Focused Messages will help to present “the most relevant new opportunities and outreach”. LinkedIn says that the feature uses AI algorithms which learn from what you open and interact with to tailor a custom inbox experience.

Also Read: How To Find The Best Remote Work Opportunities In The Middle East

Alongside these messaging additions, LinkedIn says it will also add live captioning to video messages to improve accessibility — a move that is thought to signal the platform’s greater focus on messaging as a more standalone service.

The new features were being tried out in smaller control groups to gauge their effectiveness but are now going global, with all users expected to see the updates soon.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.