News

Phoenix Group & Green Data City Plan Crypto Farm In Oman

The $300 million facility is expected to be fully operational by Q2 2024.

Muscat-based Green Data City has teamed up with Abu Dhabi’s Phoenix Group to build a $300 million crypto farm facility in the Gulf state of Oman.

The 150-megawatt data farm will be one of the largest crypto-mining centers in the region and is expected to be fully operational by the second quarter of 2024.

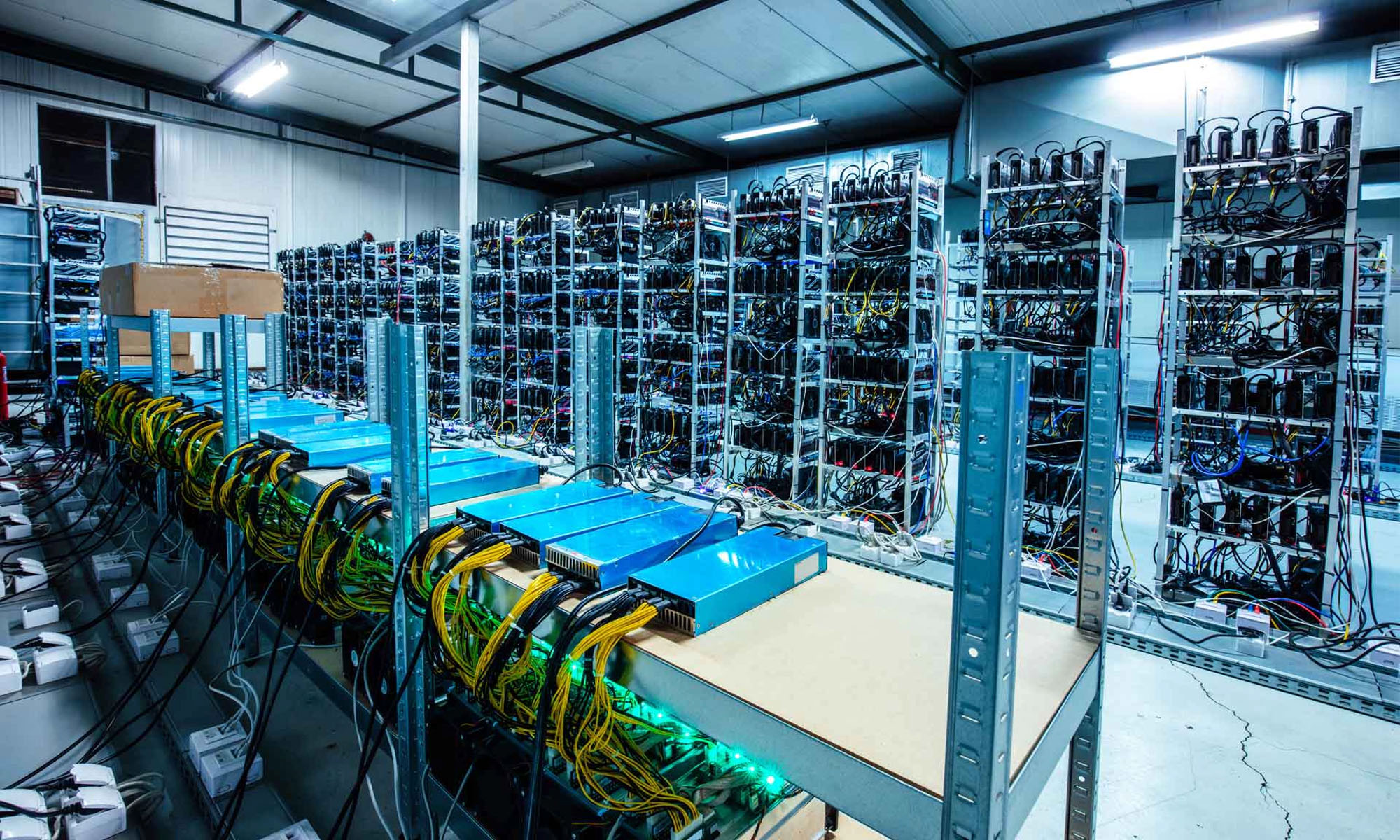

Crypto-mining farms are large facilities filled with racks of PCs sporting high-end GPUs. They are designed to mine cryptocurrencies such as Bitcoin and Ethereum using a complex network of software and computers. The process involves solving intricate mathematical calculations to produce new digital currencies — something that requires massive computer resources and lots of electrical power.

Green Data City and the Phoenix Group chose Oman for their mining farm due to the long-term security of the license terms and the comparatively cooler weather in the country’s Dhofar region, which should help to reduce energy consumption.

The first development phase will output 200MW of mining power, while the second phase will reach 400MW, creating a hyperscale data center with downstream activities that will include renewable energy and hydrogen production, desalination, food production, and cosmetics.

Also Read: Help Scout Review: The Only Help Desk Software You’ll Ever Need

The developers will build the new facility in modular sections to reduce environmental impact and intend to install solar shades and employ specialized local technicians.

Oman’s economy is now on a solid footing as the Gulf country forges ahead with its economic diversification initiatives, backed by favorable oil prices and successful fiscal reforms during a time of stable inflation.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant