News

Telegram Introduces Support For Group Video Calls & Many Other Features

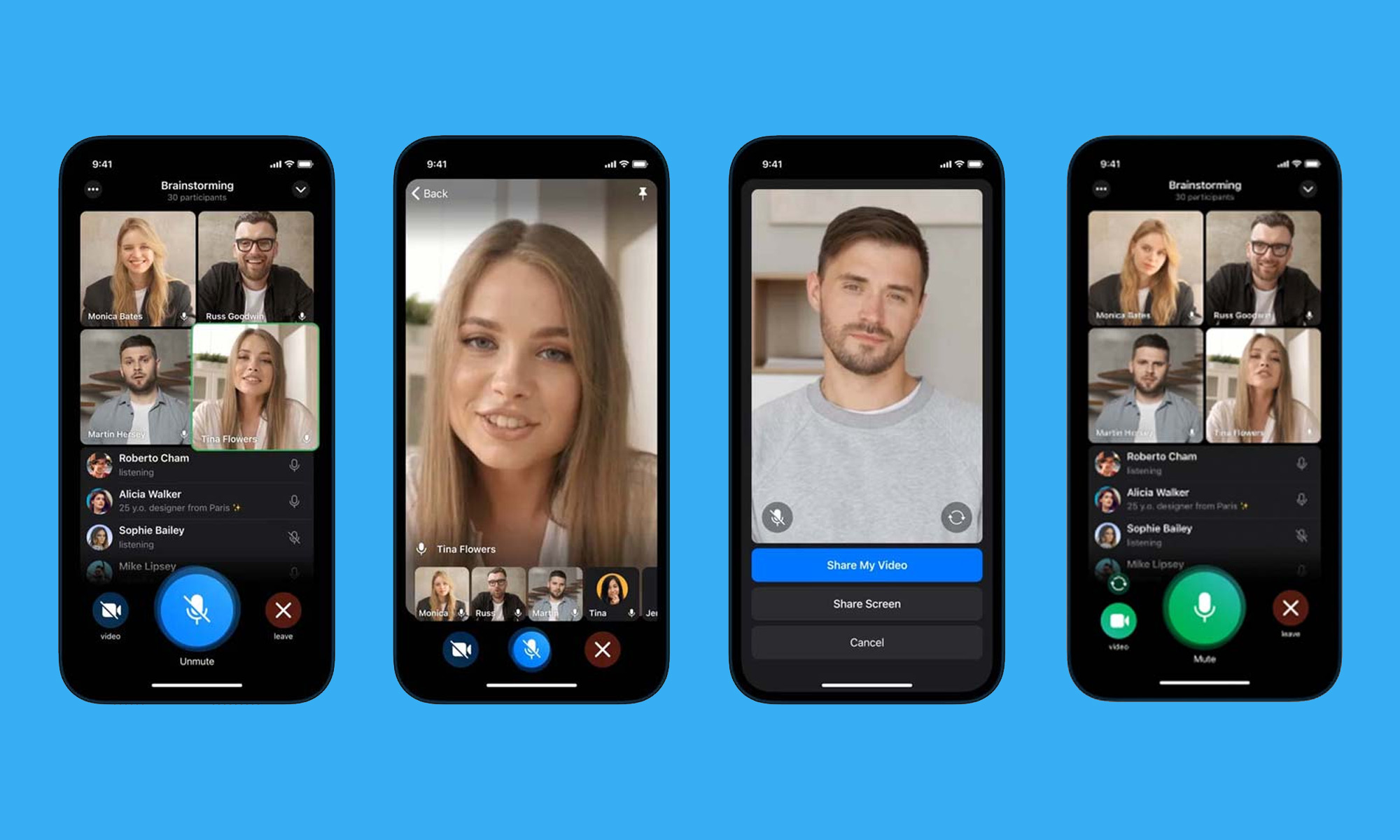

The biggest limitation at the moment is the fact that group video calls are limited to the first 30 people who join a voice chat.

Telegram users have a good reason to celebrate because their favorite instant messaging software now supports group video calls.

To use the new feature, you need to first start a voice chat by tapping or clicking the hamburger menu in the profile of any group where you are an admin and selecting the Start Voice Chat option. From there, simply tap the camera icon to switch your video on.

“Tap on any video to make it full screen,” explains Telegram on its blog. “If you pin a video, it will stay focused as new users join the call and turn on their cameras.”

The Telegram app lets you seamlessly share your screen with others, and you don’t even have to turn off your camera feed. The screen sharing option can be accessed by clicking the hamburger menu icon during a group video call. The same menu is also where you can find the toggle for the improved noise suppression option.

Telegram

All in all, the group video calls feature seems to be polished and well-implemented, which isn’t all that surprising considering that Telegram first promised to release it by the end of last year, later extending the deadline to May.

The biggest limitation at the moment is the fact that group video calls are limited to the first 30 people who join a voice chat. Telegram is already working on increasing this limit, but we don’t know how long it will take.

Also Read: The Top 3 VPN Services For Android (2023 Edition)

Other notable features introduced alongside group video calls include algorithmically generated animated backgrounds for chats, seamless message sending animations, login information reminders, new animated emoji, improved creation of new sticker packs, two new app icons on iOS, and better communication with bots.

Telegram currently has around 500 million users around the world, and new features such as these are guaranteed to make its user base grow even larger.

News

Rabbit Expands Hyperlocal Delivery Service In Saudi Arabia

The e-commerce startup is aiming to tap into the Kingdom’s underdeveloped e-grocery sector with a tech-first, locally rooted strategy.

Rabbit, an Egyptian-born hyperlocal e-commerce startup, is expanding into the Saudi Arabian market, setting its sights on delivering 20 million items across major cities by 2026.

The company, founded in 2021, is already operational in the Kingdom, with its regional headquarters now open in Riyadh and an established network of strategically located fulfillment centers — commonly known as “dark stores” — across the capital.

The timing is strategic: Saudi Arabia’s online grocery transactions currently sit at 1.3%, notably behind the UAE (5.3%) and the United States (4.8%). With the Kingdom’s food and grocery market estimated at $60 billion, even a modest increase in online adoption could create a multi-billion-dollar opportunity.

Rabbit also sees a clear alignment between its business goals and Saudi Arabia’s Vision 2030, which aims to boost retail sector innovation, support small and medium-sized enterprises, attract foreign investment, and develop a robust digital economy.

The company’s e-commerce model is based on speed and efficiency. Delivery of anything from groceries and snacks to cosmetics and household staples is promised in 20 minutes or less, facilitated by a tightly optimized logistics system — a crucial component in a sector where profit margins and delivery expectations are razor-thin.

Despite the challenges, Rabbit has already found its stride in Egypt. In just over three years, the app has been used by 1.4 million customers to deliver more than 40 million items. Revenue has surged, growing more than eightfold in the past two years alone.

Also Read: Top E-Commerce Websites In The Middle East In 2025

CEO and Co-Founder Ahmad Yousry commented: “We are delighted to announce Rabbit’s expansion into the Kingdom. We pride ourselves on being a hyperlocal company, bringing our bleeding-edge tech and experience to transform the grocery shopping experience for Saudi households, and delivering the best products – especially local favorites, in just 20 minutes”.

The company’s growth strategy avoids the pitfalls of over-reliance on aggressive discounting. Instead, Rabbit leans on operational efficiency, customer retention, and smart scaling. The approach is paying off, having already attracted major investment from the likes of Lorax Capital Partners, Global Ventures, Raed Ventures, and Beltone Venture Capital, alongside earlier investors such as Global Founders Capital, Goodwater Capital, and Hub71.