News

Telegram Is Getting Ready To Paywall Some Features

The good news is that the premium subscription won’t limit non-premium users in any way because all existing features will remain free.

Since its launch in 2013, cross-platform messaging app Telegram has gained over 550 million monthly active users. To continue providing unrivaled limits on chats, media, and file uploads, Telegram’s founder, Pavel Durov, has recently announced the plan to launch a paid premium subscription plan.

According to Durov, a portion of Telegram’s user base has been asking for even higher limits than what the messaging app currently offers. Unfortunately, that’s not something Telegram can afford to do for all of its 550 million monthly active users because its infrastructure expenses would skyrocket.

“After giving it some thought, we realized that the only way to let our most demanding fans get more while keeping our existing features free is to make those raised limits a paid option,” Durov explains. “That’s why this month we will introduce Telegram Premium, a subscription plan that allows anyone to acquire additional features, speed, and resources.”

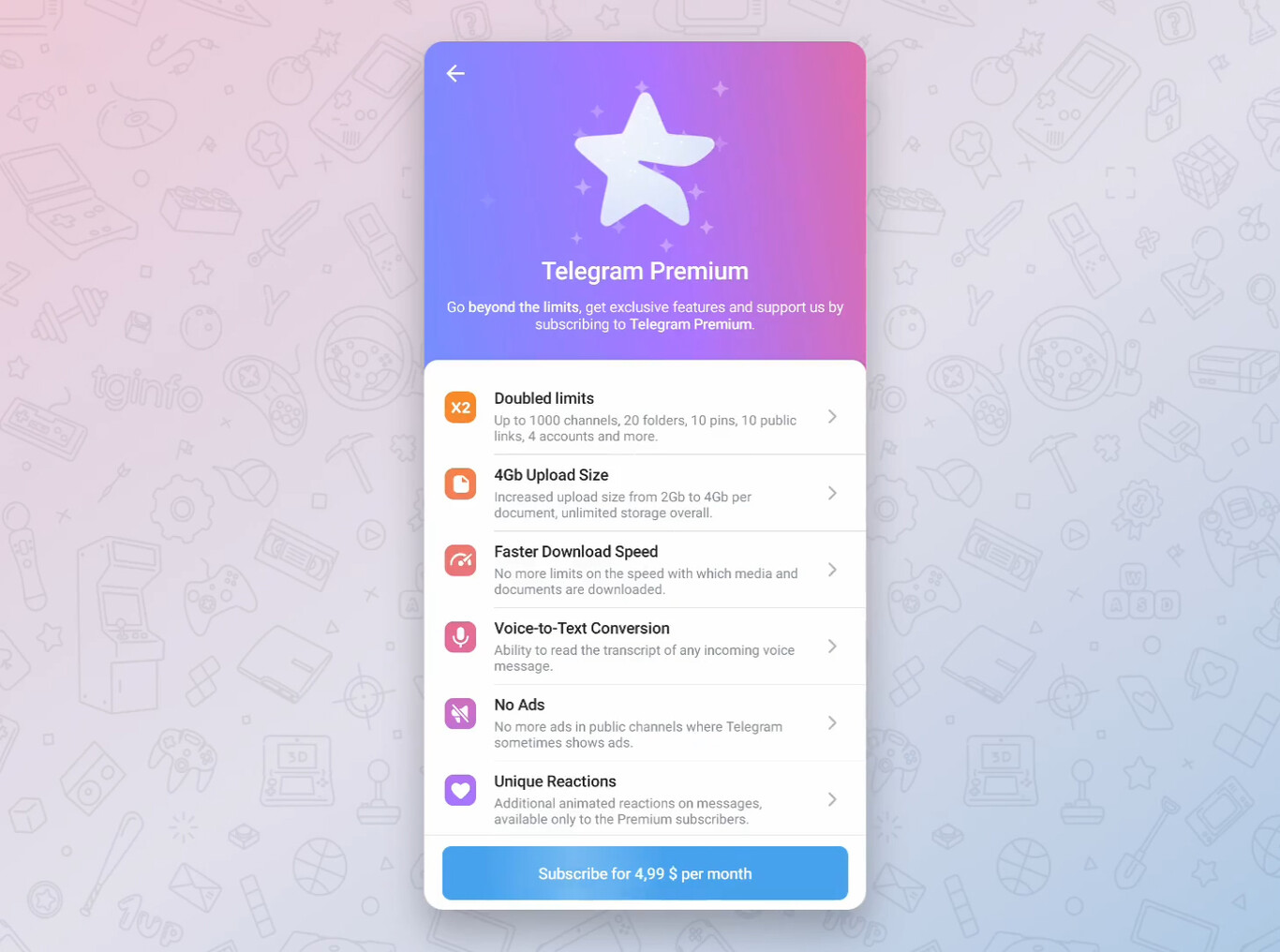

The subscription plan should be available later this month, and some of the features it will unlock were previewed in a recent version of Telegram. According to information obtained by people who analyzed the beta version, the plan should cost $4.99 a month, which is only half of what Discord charges for its Nitro subscription.

Also Read: Instagram’s Amber Alert Feature Is Coming To The UAE

The good news is that the introduction of the premium subscription won’t limit non-premium users in any way because all existing features will remain free. What’s more, they will be able to view extra-large documents, media, and stickers sent by premium users, and more.

As such, the introduction of the premium subscription plan seems like good news all around because it enables Telegram to become an even better version of itself without depending solely on ad revenue, which would give advertisers the power to indirectly influence the future of the messenger. Would you pay for the Telegram premium subscription?

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.