News

UAE To Unleash Hordes Of Cloud-Triggering Drones

The United Arab Emirates (UAE) has a massive problem with a limited supply of rainwater. With an average rainfall of just 100 mm per year, the constitutional monarchy is ranked among the most water-stressed countries in the world.

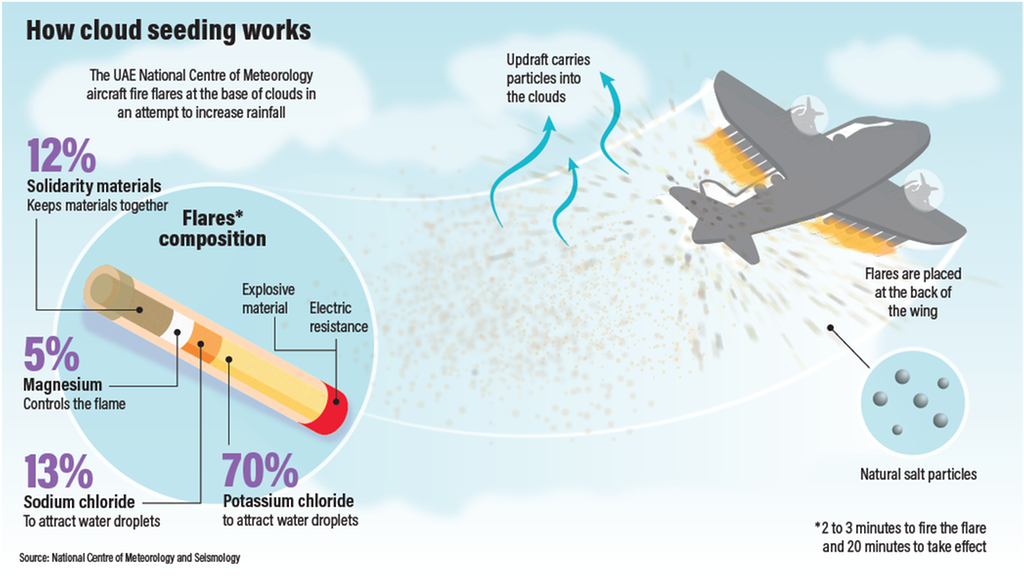

For years now, the country’s government has been investing heavily in various cloud-seeding missions aimed to increase the annual rainfall. For example, the UAE has been relatively successfully triggering rain by firing salt particles into clouds from airplanes to make individual water particles heavier and more likely to punch holes in the clouds.

National Centre Of Meteorology & Seismology

Now, UAE scientists have partnered with their colleagues from the University of Reading, England, to make it rain more in the parched country by literary giving clouds electric shocks.

“Equipped with a payload of electric charge-emitting instruments and custom sensors, these drones will fly at low altitudes and provide an electric charge to air molecules, which should stimulate precipitation,” explains Alya Al-Mazroui, the Director of the UAE Research Program for Rain Enhancement Science.

By deploying an electric current with negative and positive ions, the drones will basically attempt to recreate the natural phenomenon that causes dry hair to be attracted to a plastic comb. Since particles with opposite charges attract each other, the electricity unleashing drones should theoretically cause small droplets of water to merge into more subscription cloud formations and eventually lead to rain.

Also Read: Amazon Is Planning To Create Over 1,500 Jobs In Saudi Arabia

“Our project aims to evaluate the importance of charge in affecting the cloud droplet size distribution and rainfall generation through modifying the behavior of droplets and particles and studying the microphysical and electric properties of fog events,” says Professor Giles Harrison, a Professor of Atmospheric Physics in the Department of Meteorology at the University of Reading.

The effectiveness and safety of various cloud-seeding practices, including those explored by the UAE, are still debated by scientists. Concerns have been raised about their geopolitical implications, with wealthy, technologically advanced countries potentially “stealing” rainwater that would otherwise naturally end up in poorer countries.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News3 weeks ago

News3 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant