News

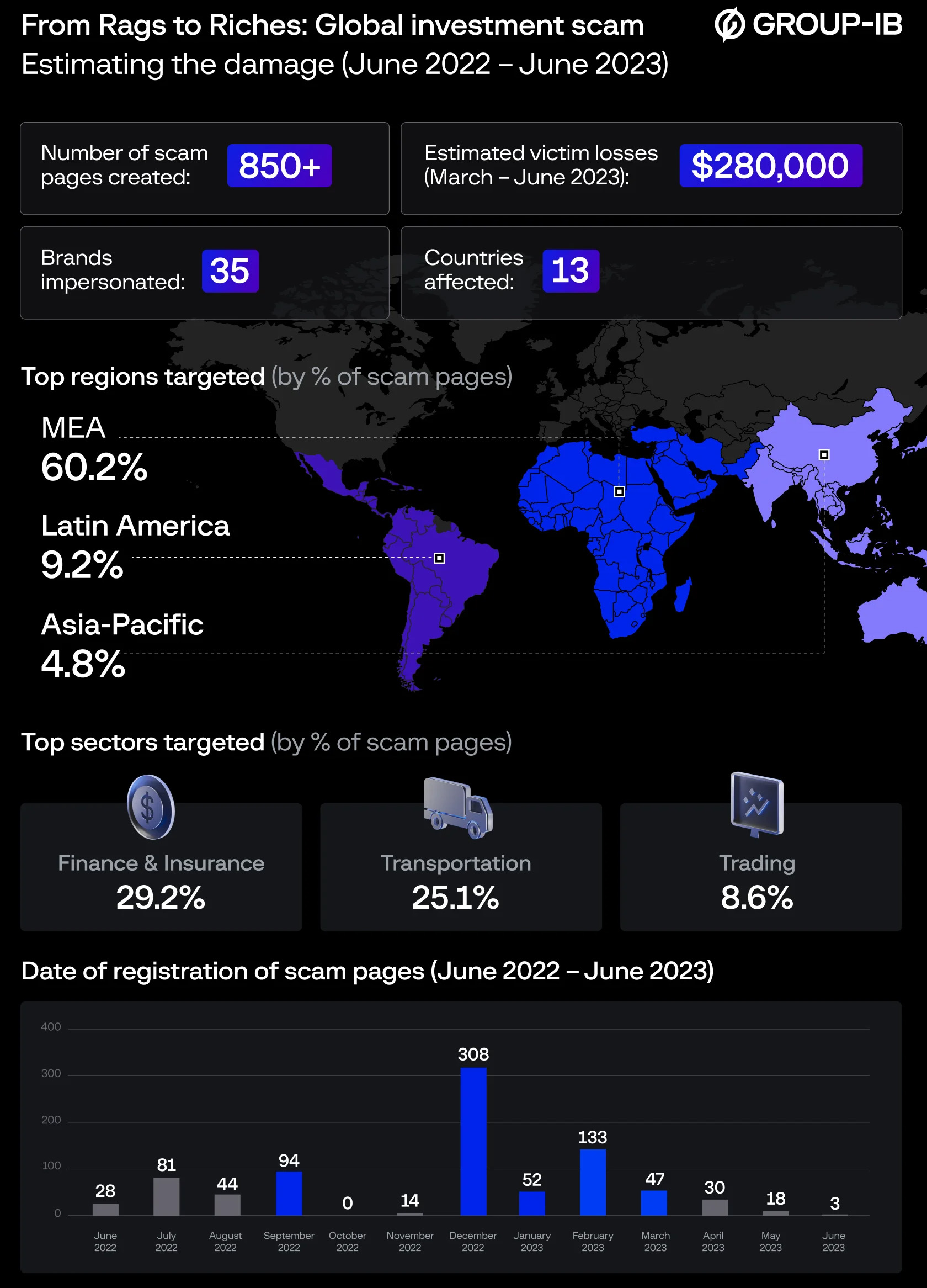

884 Scam Pages Unearthed In $280K Global Investment Scam

Links to the pages were shown in Facebook ads purchased by fraudsters, who lured users into making fake investments in market-leading companies.

Group-IB, a global cybersecurity firm working alongside the UAE Cybersecurity Council, has published new research outlining an international fake investment scam that significantly impacted social media users in the Middle East.

Experts from Group-IB’s Digital Risk Protection team discovered 884 scam pages with traffic coming from Facebook advertisements purchased by the fraudsters. The social media campaign offered users the opportunity to invest in one of 35 market-leading firms, including legitimate financial, insurance, transportation, oil, gas, and construction companies.

Group-IB researchers found English, Arabic, and Spanish Facebook ads. In Arabic-language advertisements, scammers enticed individuals with bold claims that they could “earn millions” by investing “a mere $200” amount.

If a user clicked on an ad, they were redirected to a scam page containing legitimate branding from a prominent company, along with a request for their name, email address, and phone number.

After filling out the form, users would receive daily emails claiming to be from a trading portal. Users would be urged to deposit funds into the fake trading account to begin buying stocks. The scammers would even resort to phone calls if a user didn’t respond. The elaborate con also requested bank details, ID, and passport copies.

Also Read: The Largest Data Breaches In The Middle East

“Retail investing is becoming increasingly popular among individuals who are looking for ways to diversify their income. This particular scam is notable as the cybercriminals leverage multiple communication channels, such as email and direct phone calls, as part of their social engineering efforts. We urge individuals to never share personal information or money with third parties unless you are certain of their legitimacy,” said Sharef Hlal, Head of Group-IB’s MEA Digital Risk Protection Analytics Team.

In total, 60% of the scam pages targeted users from the Middle East and Africa (MEA) region. Based on Group-IB’s research, the criminal campaign is thought to have caused $280,000 in financial damages between March and June 2023.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.