News

Careem Is Officially Suspending Its Services In Lebanon

Careem customers who have outstanding Careem credit or REWARDS points are encouraged to use them before March 25, 2022.

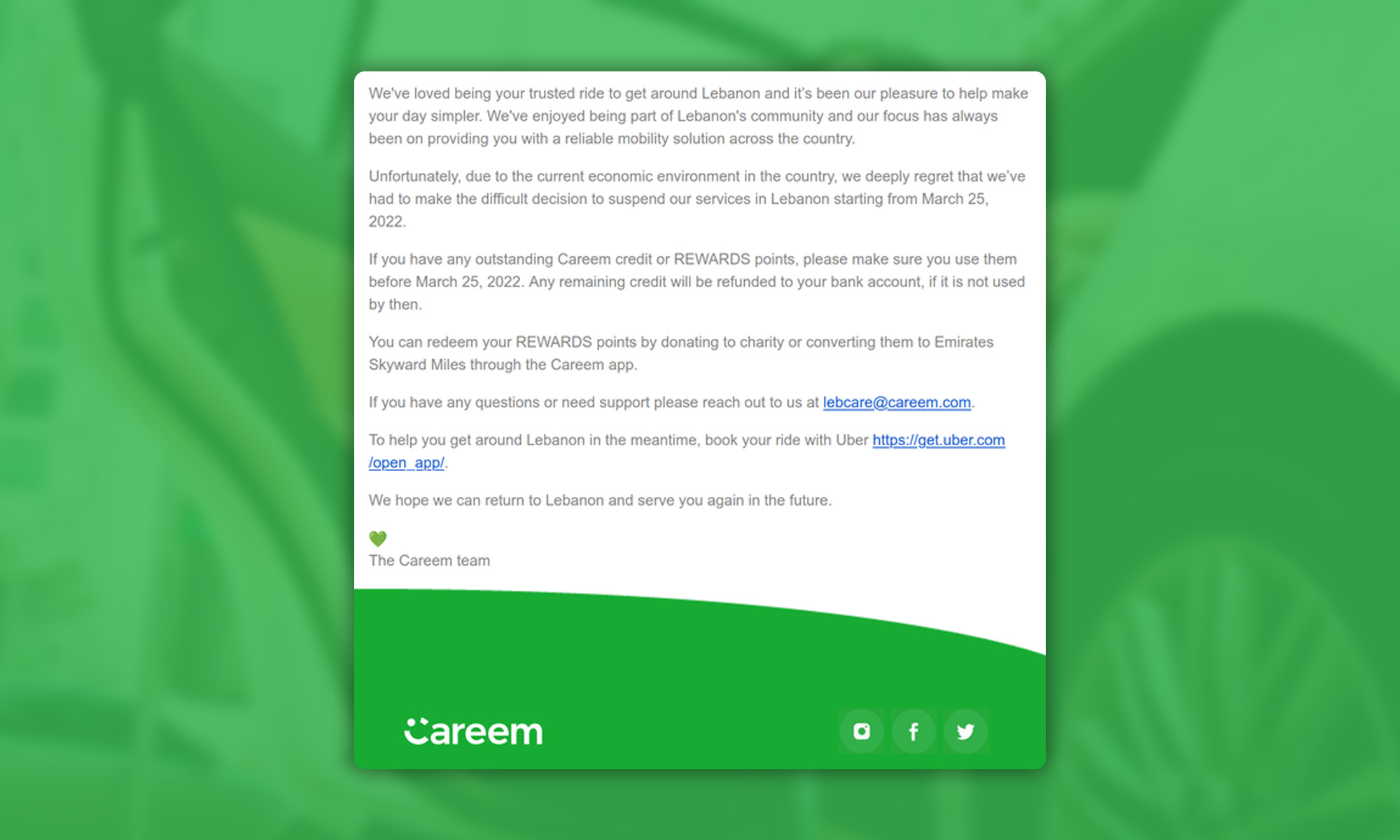

Recently, vehicle for hire company Careem has announced its decision to leave Lebanon due to the unfavorable economic situation in the country.

“Unfortunately, due to the current economic environment in the country, we deeply regret that we’ve had to make the difficult decision to suspend our services in Lebanon starting from March 25, 2022” said the Careem team in the official statement.

Careem customers who have outstanding Careem credit or REWARDS points are encouraged to use them before March 25, 2022. If they don’t make the deadline, their remaining credit will be automatically refunded.

REWARDS points can be redeemed through the Careem app, by converting them to Emirates Skyward Miles or donating them to charity.

Careem was founded in 2012 as a service for corporate car bookings. The service gradually expanded to include personal ride-hailing and food delivery. In 2019, Careem was acquired by Uber for $3.1 billion, which made it the first unicorn startup company in the Middle East (not including Israeli unicorn startups).

Also Read: PayPal In Lebanon: Everything You Need To Know

During the first 10 months of 2021, Careem recorded 4.3 million rides, with 52 percent of its customers using the service to commute to work, and 46 percent using it for leisure trips.

It’s now clear that Careem’s success hasn’t been enough to offset the worsening economic situation in Lebanon. Since the start of the economic crisis, the Lebanese pound has lost more than 90 percent of its value, following a 58.1 percent contraction of Lebanon’s GDP between 2019 and 2021.

What’s more, the company has faced stiff competition from Bolt, which currently charges approximately the same as regular taxi drivers do for shorter trips. It’s tough to see yet another business leave Lebanon, but during times like this, there’s only one thing to say – yalla, bye!

News

PayPal & TerraPay Join Forces For Cross-Border MENA Payments

The collaboration will be especially helpful in regions where traditional banking infrastructure is limited or inconsistent.

PayPal has teamed up with TerraPay to improve cross-border payments across the Middle East and Africa. The move is designed to make it easier and faster for users to send and receive money internationally, especially in regions where traditional banking infrastructure can be limited or inconsistent.

The partnership connects PayPal’s digital payments ecosystem with TerraPay’s global money transfer network. The goal is to streamline real-time transfers between banks, mobile wallets, and financial institutions, significantly improving access for millions of users looking to move money securely and efficiently.

Through the partnership, users will be able to link their PayPal accounts to local banks and mobile wallets using TerraPay’s platform. This means faster transactions and fewer barriers for individuals and businesses across the region.

“The Middle East and Africa are at the forefront of the digital transformation, yet financial barriers still limit growth for many,” said Otto Williams, Senior Vice President, Regional Head and General Manager, Middle East and Africa at PayPal. “At PayPal, we’re committed to changing that […] Together, we’re helping unlock economic opportunity and build a more connected, inclusive financial future”.

For TerraPay, the deal is a chance to scale its reach while reinforcing its mission of frictionless digital transactions.

“Our mission at TerraPay is to create a world where digital transactions are effortless, secure, and accessible to all,” said Ani Sane, Co-Founder and Chief Business Officer at TerraPay. He added that the partnership is a major milestone for enhancing financial access in the Middle East and Africa, helping businesses grow and users move funds with fewer limitations.

Also Read: A Guide To Digital Payment Methods In The Middle East

The integration also aims to support financial inclusion in a region where access to global banking tools is still uneven. With interoperability at the core, TerraPay can bridge the gap between different financial systems — whether that’s a mobile wallet or a traditional bank — making it easier to send money, pay for services, or grow a business across borders.

As the demand for cross-border payment options continues to rise, both PayPal and TerraPay are doubling down on their commitment to provide reliable, secure, and forward-looking financial tools for the region.