News

New Fintech App Aims To Improve Children’s Financial Literacy

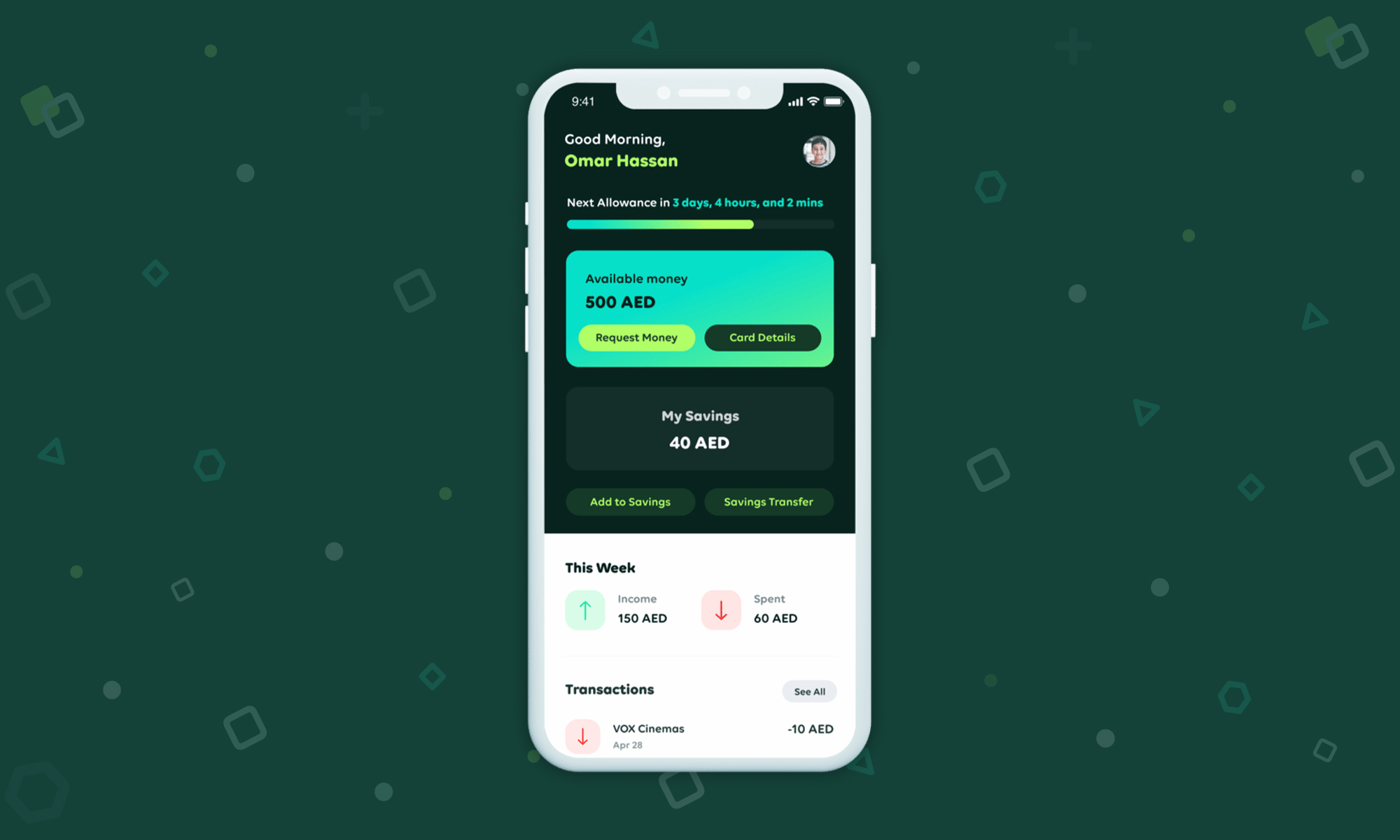

A startup known as Leap has built an app to help kids track where their money is being spent, and to help them save more effectively.

For children and young teens, it can be hard (and not to mention boring!) to get a handle on topics such as budgeting and saving. Money and financial matters aren’t exactly a top priority for youngsters, but they are vital subjects to master in order to be better prepared for adult life.

To that end, UAE-based startup Leap has an ambitious goal of helping young people to make better financial decisions and to improve basic money management skills and literacy. The fintech company has developed an app aimed at young people and their parents, which works to incentivize good budgeting and saving habits.

“Financial literacy is a core life skill that is not readily taught while growing up. Most kids get their first taste of financial responsibility when they go off to college without the oversight and knowledge on managing their money. We’re committed to changing this reality and empowering kids as young as 6 years old to understand, value, and manage their money,” says Ziad Toqan, CEO and Co-founder of Leap.

Parents can transfer a child’s allowance into the app or have funds appear when certain milestones are achieved (such as good school grades). Children using the service will get a prepaid Visa card linked to their Leap account, allowing them to use their balance however they see fit.

Also Read: Egyptian Digital Lending Platform Blnk Raises $32 Million

As well as helping to promote better budgeting and sensible spending, the app also diverts unused funds to a savings account at the end of each week, which Leap hopes will encourage kids to spend less and save more.

The app is available on both Apple and Android devices and is suitable for children between 6 and 18 years of age. Leap is currently focused on the UAE, but has plans to expand into Saudi Arabia and Egypt in the future.

News

Influencer Growth Fuels Saudi Creator Economy Surge

The Kingdom’s creator economy grew over 32% in Q1 2025, fueled by TikTok, UGC, and cost-per-action (CPA) influencer models.

Saudi Arabia’s creator economy saw a significant 32.37% growth in the first quarter of 2025, driven by an uptick in influencer marketing, content-driven e-commerce, and the increasing influence of user-generated content (UGC). These insights come from a recent study by Admitad and the Stllr Network.

Much of this momentum is coming from video-based platforms, where brands are leaning on creators who feel more relatable than polished ad campaigns. The trend shows a clear preference for authenticity, as audiences gravitate toward content that feels real and personal.

Mohannad Alzahrani, Co-founder and VP KSA of Stllr Network, highlighted the shift: “The rise of user-generated content (UGC) is changing the way brands engage with consumers. Audiences trust real creators more than traditional advertising, making UGC a key driver of authenticity and sales”.

TikTok remains the dominant platform in this space, reportedly reaching 88% of the Saudi population. It also showed the sharpest rise in influencer-led transactions. Other platforms followed with solid, if less dramatic, growth: X was up 17%, Instagram increased by 12%, and Telegram by 10%.

In terms of content niches, beauty led the pack with a 56% growth rate, followed by lifestyle at 45.8% and fashion at 18.2%. Tech content also showed healthy traction at 10.6%, while entertainment, food, fitness, parenting, and gaming posted smaller — but still positive — gains.

Also Read: Top E-Commerce Websites In The Middle East In 2025

The report analyzed more than 300,000 influencer-driven purchases. These efforts translated into a 15% year-on-year jump in Gross Merchandise Value (GMV) and a 5% increase in the number of orders in 2024. Influencers themselves are seeing the benefit, with average order values hitting $54 and creator earnings rising by 14%.

A noticeable trend is the move away from fixed-rate deals. More influencers in Saudi Arabia are embracing hybrid compensation models — especially cost-per-action (CPA) setups that tie their earnings directly to performance.

As Anna Gidirim, CEO of Admitad, explains, “The CPA model brings much-needed transparency to influencer marketing. Brands only pay for actual results, and influencers benefit by securing long-term partnerships while offering their audiences exclusive promo codes and special discounts”.

However, the ecosystem still shows a gender imbalance. The data indicates that 63% of creators in Saudi Arabia are men, while women account for just 37%.