News

New Fintech App Aims To Improve Children’s Financial Literacy

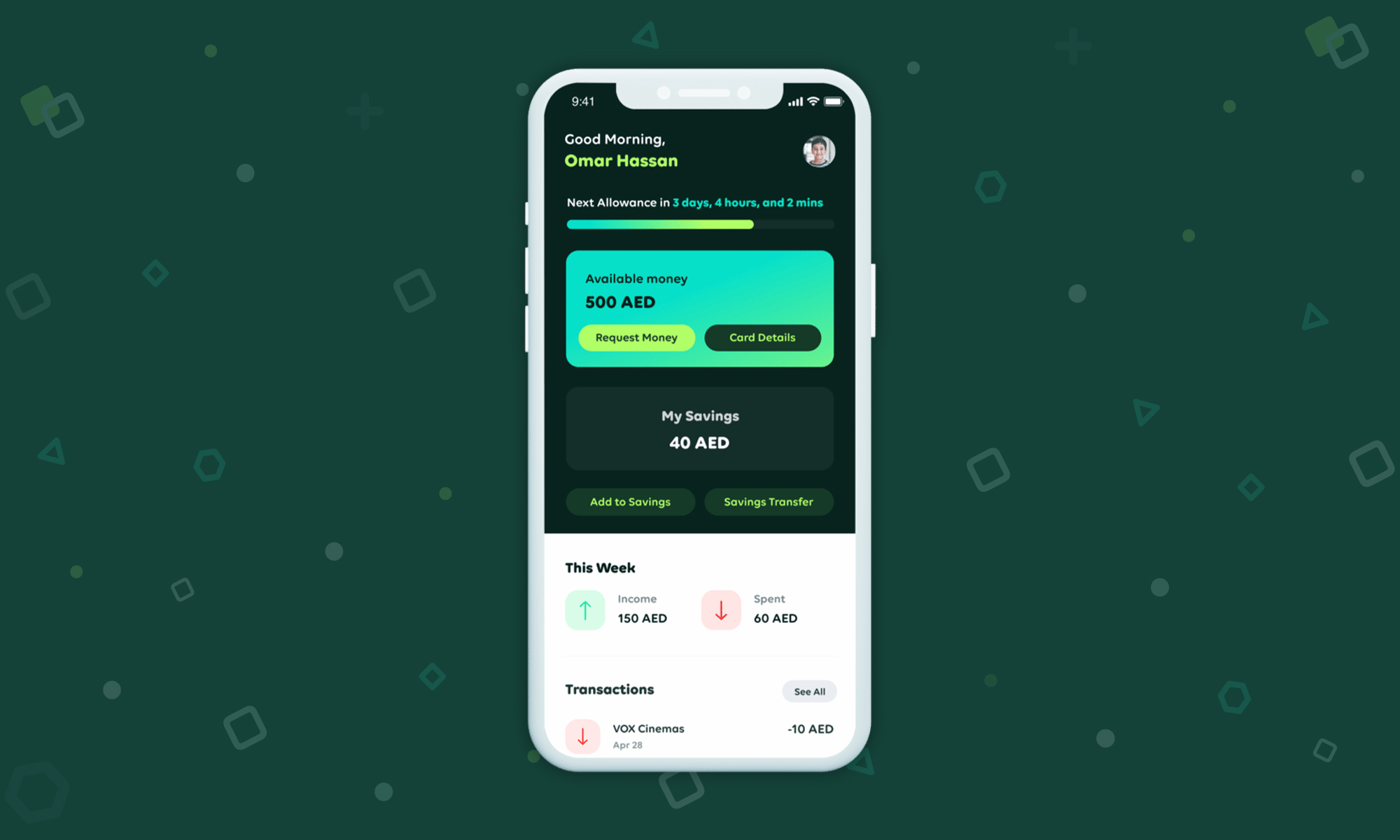

A startup known as Leap has built an app to help kids track where their money is being spent, and to help them save more effectively.

For children and young teens, it can be hard (and not to mention boring!) to get a handle on topics such as budgeting and saving. Money and financial matters aren’t exactly a top priority for youngsters, but they are vital subjects to master in order to be better prepared for adult life.

To that end, UAE-based startup Leap has an ambitious goal of helping young people to make better financial decisions and to improve basic money management skills and literacy. The fintech company has developed an app aimed at young people and their parents, which works to incentivize good budgeting and saving habits.

“Financial literacy is a core life skill that is not readily taught while growing up. Most kids get their first taste of financial responsibility when they go off to college without the oversight and knowledge on managing their money. We’re committed to changing this reality and empowering kids as young as 6 years old to understand, value, and manage their money,” says Ziad Toqan, CEO and Co-founder of Leap.

Parents can transfer a child’s allowance into the app or have funds appear when certain milestones are achieved (such as good school grades). Children using the service will get a prepaid Visa card linked to their Leap account, allowing them to use their balance however they see fit.

Also Read: Egyptian Digital Lending Platform Blnk Raises $32 Million

As well as helping to promote better budgeting and sensible spending, the app also diverts unused funds to a savings account at the end of each week, which Leap hopes will encourage kids to spend less and save more.

The app is available on both Apple and Android devices and is suitable for children between 6 and 18 years of age. Leap is currently focused on the UAE, but has plans to expand into Saudi Arabia and Egypt in the future.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News3 weeks ago

News3 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant