News

Careem Suspends Its Ride-Hailing Services In Qatar

The announcement comes without any official explanation, though is thought to be due to a lack of regulatory approval.

Yesterday (Monday, February 27), Uber Technologies sent a message to customers informing them that Careem, the Dubai-based company acquired by the ride-hailing giant in 2019 for $3.1 billion, will cease operations in Qatar today.

The surprise announcement comes just two months after Qatar’s soccer World Cup, which saw Careem-branded vehicles forming part of the official transport infrastructure, alongside Uber cars and local taxis from Karwa.

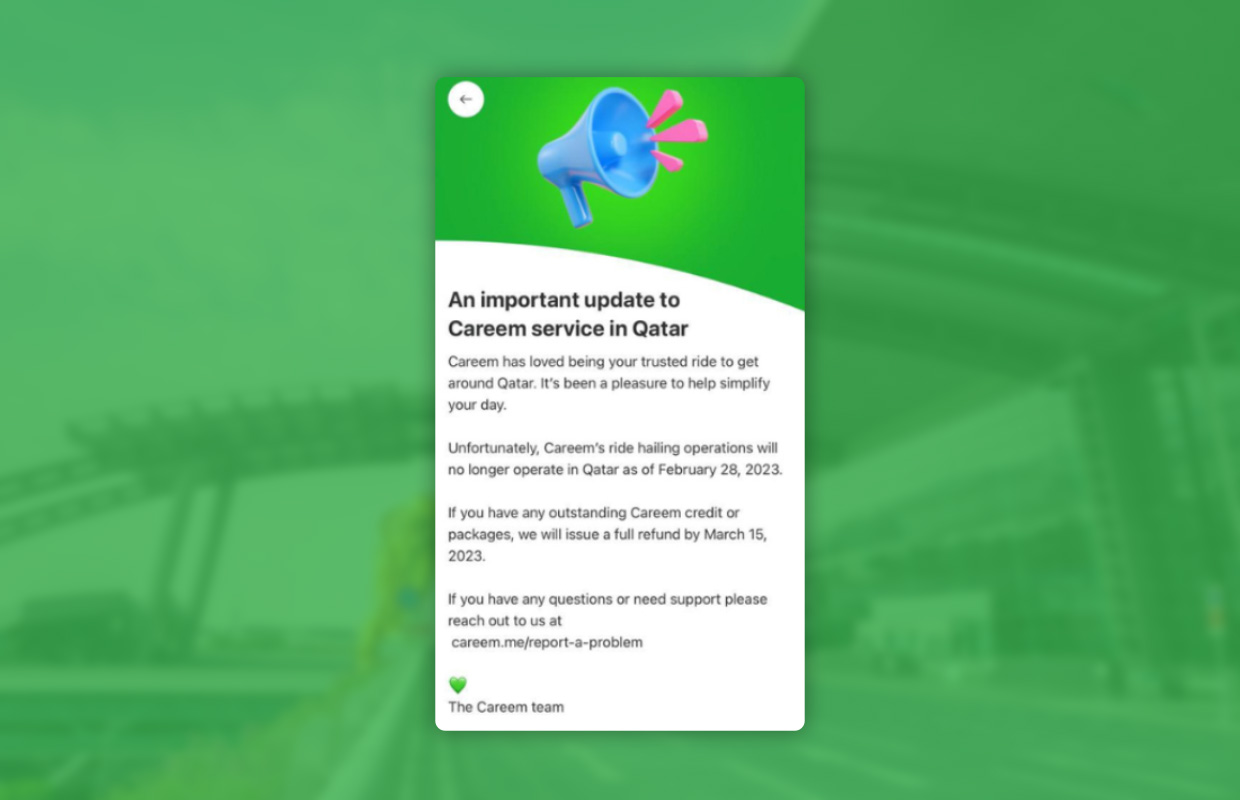

“Unfortunately, Careem’s ride-hailing operations will no longer operate in Qatar as of February 28, 2023,” informed the message, telling customers that Careem credit would be refunded by March 15, 2023.

Also Read: Saudi Arabia To Transform Downtown Riyadh By 2030

Careem’s message did not explain the cancellation of the service, and no one has responded to requests for comment, including parent company Uber.

Careem only offered ride-hailing services in Qatar, unlike larger Middle Eastern markets like the United Arab Emirates, where the super app also provides food delivery, digital payments and courier services.

The company suspended its services in Lebanon last year due to the unfavorable economic situation in the country.

News

PayPal & TerraPay Join Forces For Cross-Border MENA Payments

The collaboration will be especially helpful in regions where traditional banking infrastructure is limited or inconsistent.

PayPal has teamed up with TerraPay to improve cross-border payments across the Middle East and Africa. The move is designed to make it easier and faster for users to send and receive money internationally, especially in regions where traditional banking infrastructure can be limited or inconsistent.

The partnership connects PayPal’s digital payments ecosystem with TerraPay’s global money transfer network. The goal is to streamline real-time transfers between banks, mobile wallets, and financial institutions, significantly improving access for millions of users looking to move money securely and efficiently.

Through the partnership, users will be able to link their PayPal accounts to local banks and mobile wallets using TerraPay’s platform. This means faster transactions and fewer barriers for individuals and businesses across the region.

“The Middle East and Africa are at the forefront of the digital transformation, yet financial barriers still limit growth for many,” said Otto Williams, Senior Vice President, Regional Head and General Manager, Middle East and Africa at PayPal. “At PayPal, we’re committed to changing that […] Together, we’re helping unlock economic opportunity and build a more connected, inclusive financial future”.

For TerraPay, the deal is a chance to scale its reach while reinforcing its mission of frictionless digital transactions.

“Our mission at TerraPay is to create a world where digital transactions are effortless, secure, and accessible to all,” said Ani Sane, Co-Founder and Chief Business Officer at TerraPay. He added that the partnership is a major milestone for enhancing financial access in the Middle East and Africa, helping businesses grow and users move funds with fewer limitations.

Also Read: A Guide To Digital Payment Methods In The Middle East

The integration also aims to support financial inclusion in a region where access to global banking tools is still uneven. With interoperability at the core, TerraPay can bridge the gap between different financial systems — whether that’s a mobile wallet or a traditional bank — making it easier to send money, pay for services, or grow a business across borders.

As the demand for cross-border payment options continues to rise, both PayPal and TerraPay are doubling down on their commitment to provide reliable, secure, and forward-looking financial tools for the region.