News

UAE-Based Drone Company Plans Wider MENA Expansion

UVL Robotics is broadening the scope of its commercial drone activities across the Middle East.

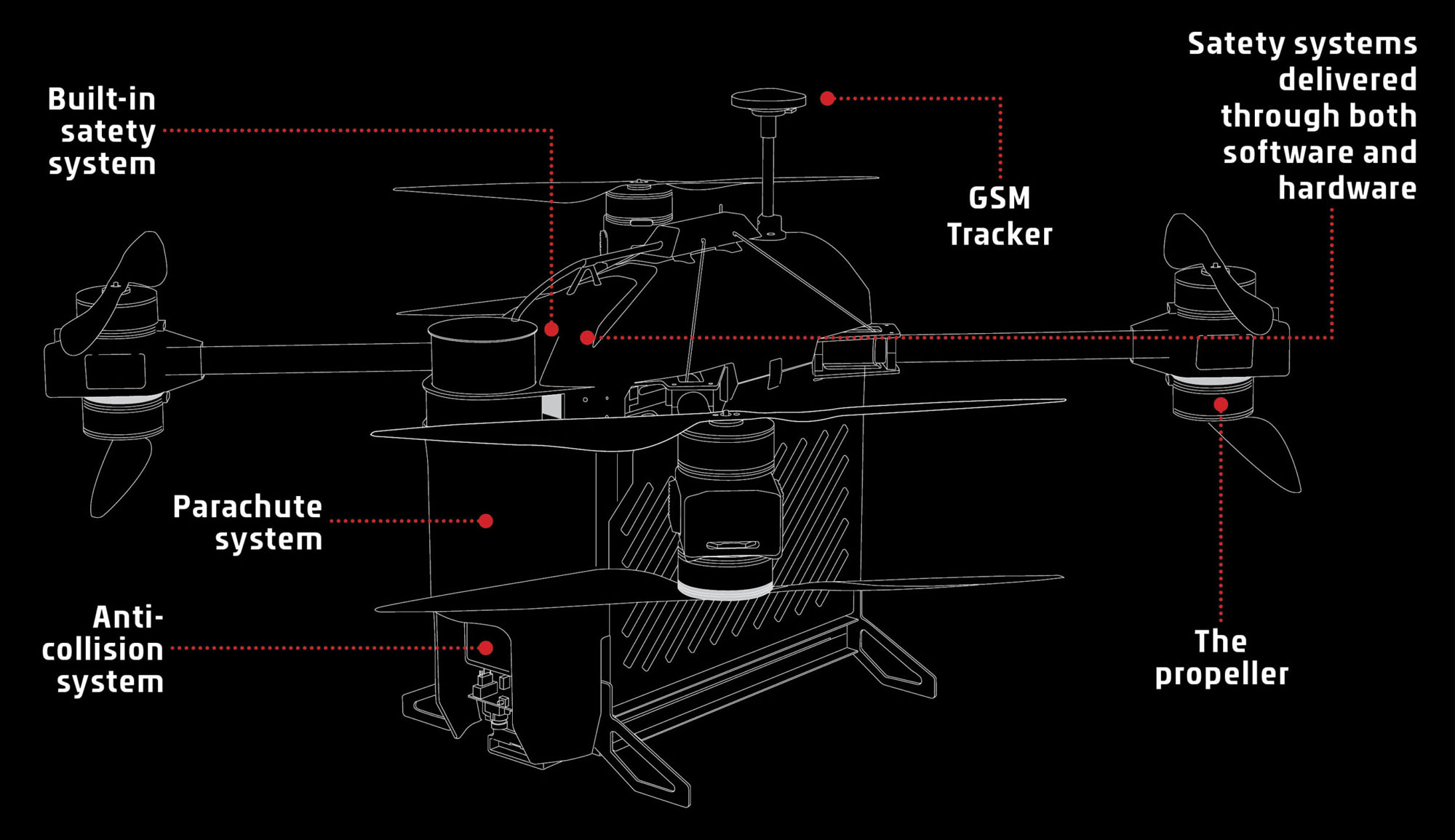

UVL Robotics, a UAE-based robotics startup, is the first company to provide a fully operational commercial drone delivery service in the MENA region. After winning several high-profile contracts, the company is now preparing to trial drone flights in Abu Dhabi — an Emirate with over 200 islands.

“It all depends on the graders,” explains CEO Eugene Grankin. “If they rate us well, we could soon get the permission to fly in Abu Dhabi.” Grankin has good reason to be confident. In 2021, after a tropical cyclone hit Oman, UVL drones were successfully deployed to deliver supplies. “We could deliver medicine to remote areas where it took a long time to reach by car,” the CEO explained.

Today, UVL Robotics is focused on inventory management as well as delivery. In Europe, UVL drones can scan 300-750 pallets in under five seconds. The company now uses drones to perform stocktaking at more than 50 warehouse locations, with global companies like PepsiCo utilizing the service.

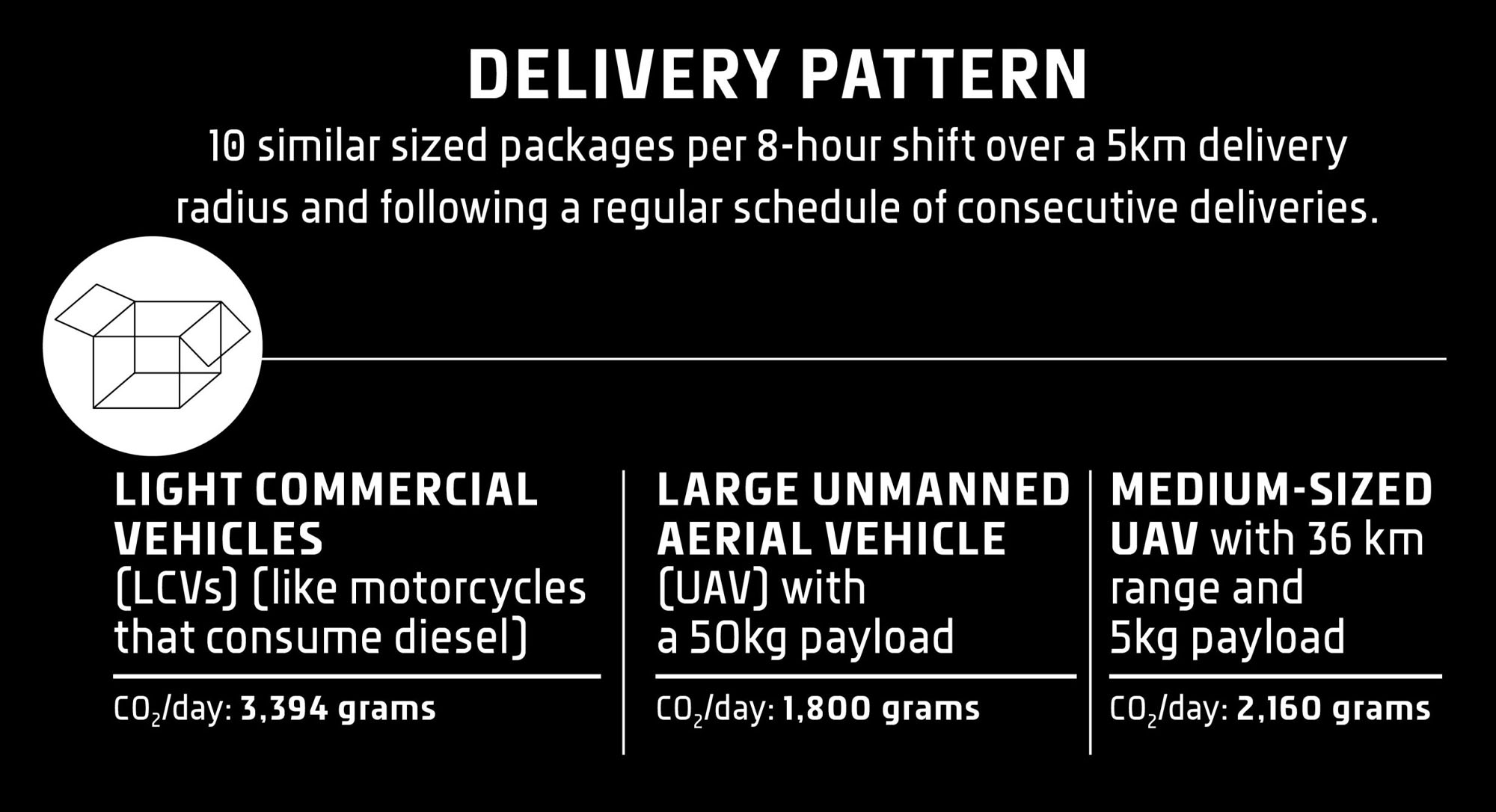

In the Middle East, sustainability and CO₂ reduction are the primary drivers of drone adoption. Saudi Arabia plans to cut carbon emissions by 278 million tonnes per year, while the UAE has plans to reduce its own output by 31%. Research conducted by UVL found that drones produce 36% fewer emissions than moving the equivalent load volume by truck, despite each UAV having a payload of just 10kg.

As well as reducing CO₂, drones can also improve operational efficiency. In Oman, coastlines and rugged terrain mean that food deliveries typically take 30-60 minutes by human courier. With drones, that time is cut to a predictable 15 minutes. In addition, drones can handle over 30 orders daily, compared to just 20 when delivered by regular vehicle.

Also Read: USB-C Will Be Mandatory From 2025 For All Saudi Smart Devices

Meanwhile, at King Abdullah University of Science and Technology (KAUST) in Saudi Arabia, UVL Robotics is preparing to launch campus-wide smart loading stations, which the company hopes will act as a blueprint for future smart city projects across the region.

News

PayPal & TerraPay Join Forces For Cross-Border MENA Payments

The collaboration will be especially helpful in regions where traditional banking infrastructure is limited or inconsistent.

PayPal has teamed up with TerraPay to improve cross-border payments across the Middle East and Africa. The move is designed to make it easier and faster for users to send and receive money internationally, especially in regions where traditional banking infrastructure can be limited or inconsistent.

The partnership connects PayPal’s digital payments ecosystem with TerraPay’s global money transfer network. The goal is to streamline real-time transfers between banks, mobile wallets, and financial institutions, significantly improving access for millions of users looking to move money securely and efficiently.

Through the partnership, users will be able to link their PayPal accounts to local banks and mobile wallets using TerraPay’s platform. This means faster transactions and fewer barriers for individuals and businesses across the region.

“The Middle East and Africa are at the forefront of the digital transformation, yet financial barriers still limit growth for many,” said Otto Williams, Senior Vice President, Regional Head and General Manager, Middle East and Africa at PayPal. “At PayPal, we’re committed to changing that […] Together, we’re helping unlock economic opportunity and build a more connected, inclusive financial future”.

For TerraPay, the deal is a chance to scale its reach while reinforcing its mission of frictionless digital transactions.

“Our mission at TerraPay is to create a world where digital transactions are effortless, secure, and accessible to all,” said Ani Sane, Co-Founder and Chief Business Officer at TerraPay. He added that the partnership is a major milestone for enhancing financial access in the Middle East and Africa, helping businesses grow and users move funds with fewer limitations.

Also Read: A Guide To Digital Payment Methods In The Middle East

The integration also aims to support financial inclusion in a region where access to global banking tools is still uneven. With interoperability at the core, TerraPay can bridge the gap between different financial systems — whether that’s a mobile wallet or a traditional bank — making it easier to send money, pay for services, or grow a business across borders.

As the demand for cross-border payment options continues to rise, both PayPal and TerraPay are doubling down on their commitment to provide reliable, secure, and forward-looking financial tools for the region.