News

RemotePass Secures $5.5M Series A Funding, Led By 212VC

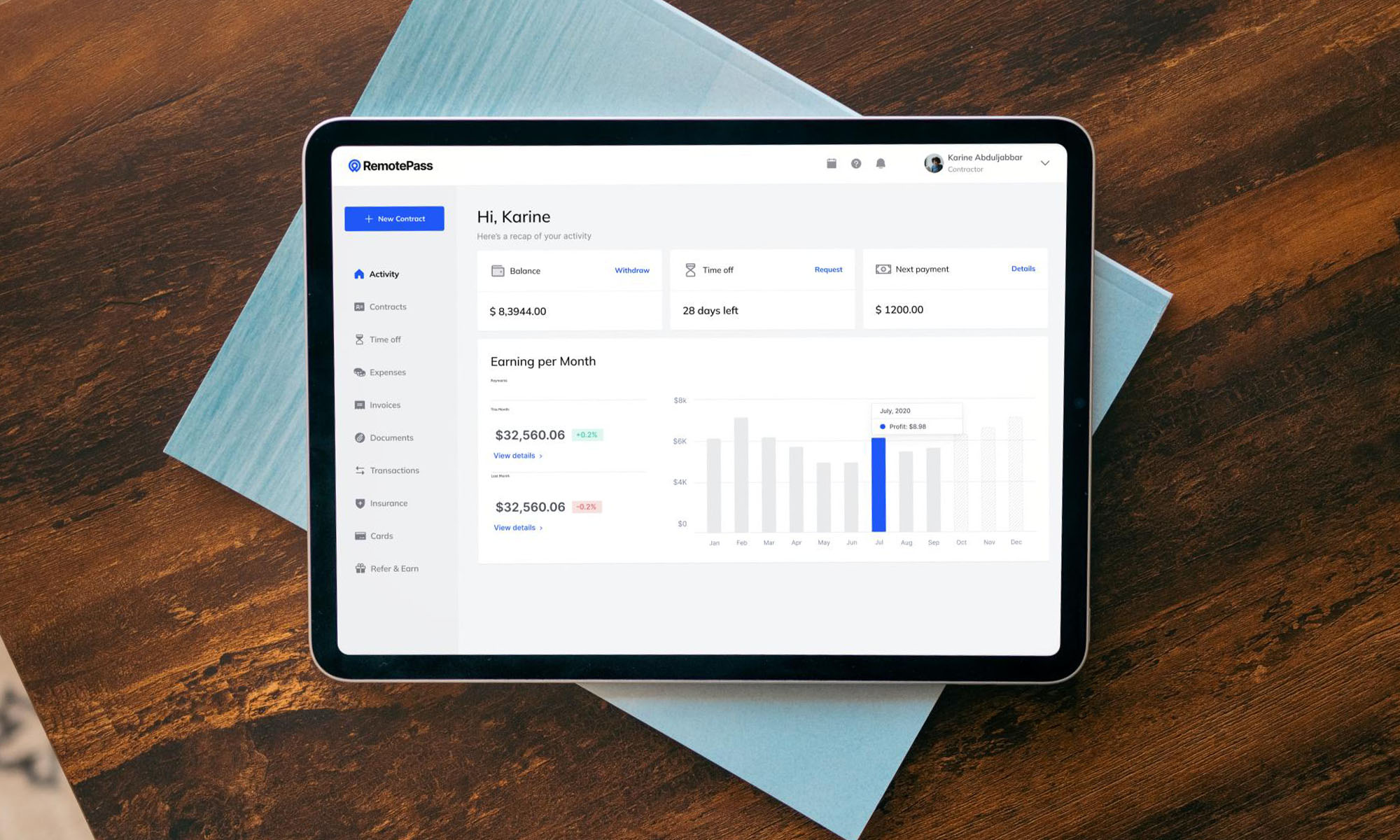

The company will use the funds to drive market expansion, improve its already award-winning app, and unlock a new phase of product innovation.

RemotePass, a platform aiding companies in remote workforce management, has acquired $5.5 million in a recent Series A funding round.

The round was spearheaded by 212 VC, with contributors from the US, Europe, and the Middle East, such as Endeavor Catalyst, Oraseya Capital, Khwarizmi Ventures, Flyer One Ventures, Access Bridge Ventures, A15, and Swiss Founders Fund. With the cash injection, RemotePass’s total raised funds now exceed $10 million, adding to previous investments from BECO Capital, Wamda Capital, Plug & Play, and Flat6Labs.

“Witnessing RemotePass’s remarkable product growth and stellar customer service since early 2023 solidified our belief in their visionary team & business model [which] positions them as game-changers in the UAE & KSA, hubs poised for global dominance,” said Ali Hikmet Karabey, Managing Director for lead investor 212 VC.

Established by Kamal Reggad and Karim Nadi, RemotePass caters to various sectors and clients, ranging from startups to major corporations like Spotify, Logitech, and Paymentology. The platform facilitates onboarding, management, and workforce payment in countries where companies lack local legal representation. RemotePass also allows the hiring of full-time employees and contractors across 150+ nations.

“Our platform helps democratize access to global opportunities, leveling the playing field for skilled individuals and enabling them to compete in a global job marketplace. This funding fuels our mission to empower countless lives and help global teams succeed,” explained Kamal Reggad, CEO and Co-Founder of RemotePass.

Also Read: Top 10 Best Freelance Platforms In The Middle East

Amidst the evolving global remote work trend, RemotePass has positioned itself as a leader, notably making significant gains in the MENA region. The platform is accompanied by a comprehensive “super app” delivering financial services and tailored benefits for remote workers, including varied payout options, a USD debit card, and access to premium health insurance.

Initially conceived in 2019 as a SaaS platform for business travel, RemotePass’s founders, being remote work advocates, transitioned to address the challenges of remote team management, particularly in emerging markets. The pivot, catalyzed by the COVID-19 pandemic, enabled substantial growth for the company, with a remarkable 35% month-over-month increase in the first two years, predominantly propelled by client referrals.

News

PayPal & TerraPay Join Forces For Cross-Border MENA Payments

The collaboration will be especially helpful in regions where traditional banking infrastructure is limited or inconsistent.

PayPal has teamed up with TerraPay to improve cross-border payments across the Middle East and Africa. The move is designed to make it easier and faster for users to send and receive money internationally, especially in regions where traditional banking infrastructure can be limited or inconsistent.

The partnership connects PayPal’s digital payments ecosystem with TerraPay’s global money transfer network. The goal is to streamline real-time transfers between banks, mobile wallets, and financial institutions, significantly improving access for millions of users looking to move money securely and efficiently.

Through the partnership, users will be able to link their PayPal accounts to local banks and mobile wallets using TerraPay’s platform. This means faster transactions and fewer barriers for individuals and businesses across the region.

“The Middle East and Africa are at the forefront of the digital transformation, yet financial barriers still limit growth for many,” said Otto Williams, Senior Vice President, Regional Head and General Manager, Middle East and Africa at PayPal. “At PayPal, we’re committed to changing that […] Together, we’re helping unlock economic opportunity and build a more connected, inclusive financial future”.

For TerraPay, the deal is a chance to scale its reach while reinforcing its mission of frictionless digital transactions.

“Our mission at TerraPay is to create a world where digital transactions are effortless, secure, and accessible to all,” said Ani Sane, Co-Founder and Chief Business Officer at TerraPay. He added that the partnership is a major milestone for enhancing financial access in the Middle East and Africa, helping businesses grow and users move funds with fewer limitations.

Also Read: A Guide To Digital Payment Methods In The Middle East

The integration also aims to support financial inclusion in a region where access to global banking tools is still uneven. With interoperability at the core, TerraPay can bridge the gap between different financial systems — whether that’s a mobile wallet or a traditional bank — making it easier to send money, pay for services, or grow a business across borders.

As the demand for cross-border payment options continues to rise, both PayPal and TerraPay are doubling down on their commitment to provide reliable, secure, and forward-looking financial tools for the region.