News

RemotePass Secures $5.5M Series A Funding, Led By 212VC

The company will use the funds to drive market expansion, improve its already award-winning app, and unlock a new phase of product innovation.

RemotePass, a platform aiding companies in remote workforce management, has acquired $5.5 million in a recent Series A funding round.

The round was spearheaded by 212 VC, with contributors from the US, Europe, and the Middle East, such as Endeavor Catalyst, Oraseya Capital, Khwarizmi Ventures, Flyer One Ventures, Access Bridge Ventures, A15, and Swiss Founders Fund. With the cash injection, RemotePass’s total raised funds now exceed $10 million, adding to previous investments from BECO Capital, Wamda Capital, Plug & Play, and Flat6Labs.

“Witnessing RemotePass’s remarkable product growth and stellar customer service since early 2023 solidified our belief in their visionary team & business model [which] positions them as game-changers in the UAE & KSA, hubs poised for global dominance,” said Ali Hikmet Karabey, Managing Director for lead investor 212 VC.

Established by Kamal Reggad and Karim Nadi, RemotePass caters to various sectors and clients, ranging from startups to major corporations like Spotify, Logitech, and Paymentology. The platform facilitates onboarding, management, and workforce payment in countries where companies lack local legal representation. RemotePass also allows the hiring of full-time employees and contractors across 150+ nations.

“Our platform helps democratize access to global opportunities, leveling the playing field for skilled individuals and enabling them to compete in a global job marketplace. This funding fuels our mission to empower countless lives and help global teams succeed,” explained Kamal Reggad, CEO and Co-Founder of RemotePass.

Also Read: Top 10 Best Freelance Platforms In The Middle East

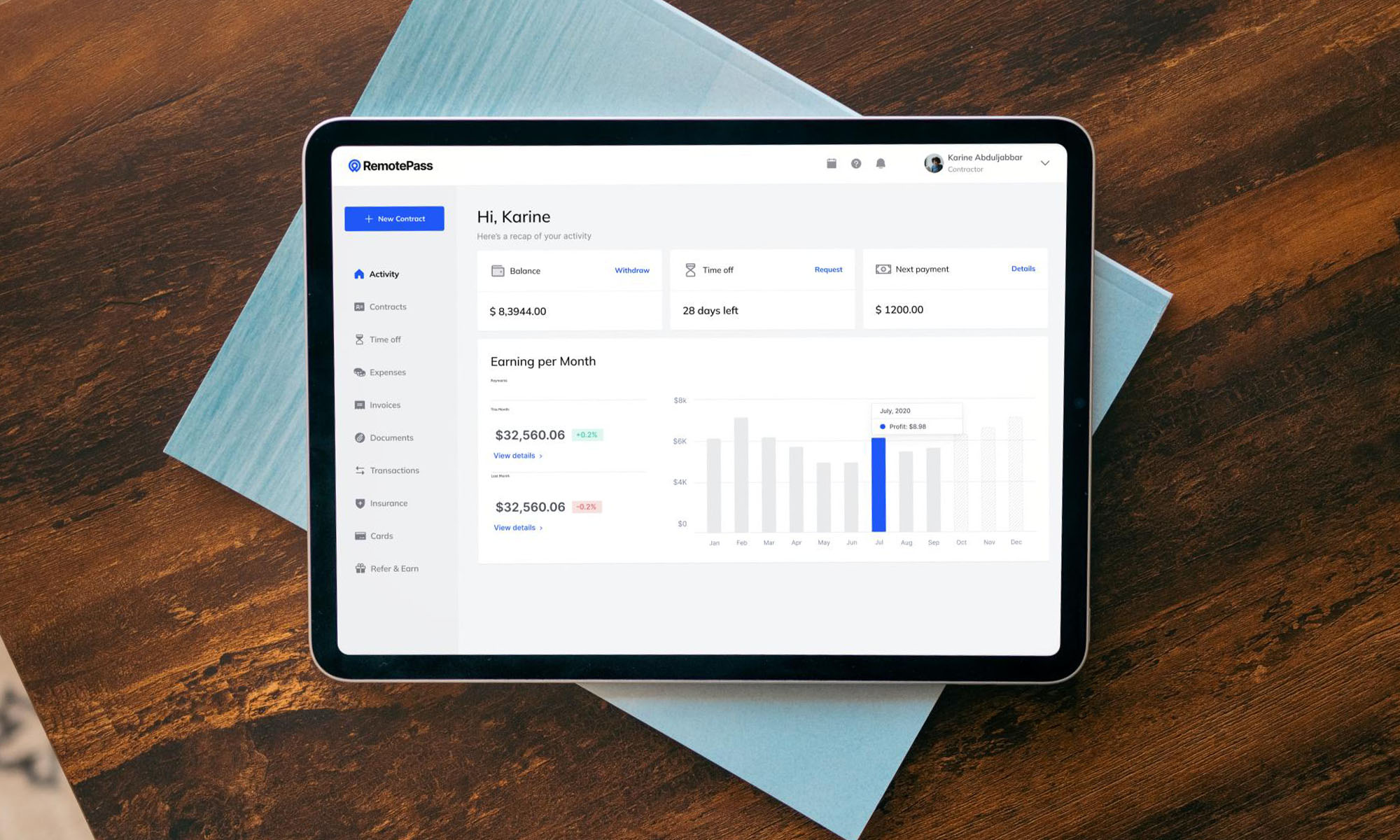

Amidst the evolving global remote work trend, RemotePass has positioned itself as a leader, notably making significant gains in the MENA region. The platform is accompanied by a comprehensive “super app” delivering financial services and tailored benefits for remote workers, including varied payout options, a USD debit card, and access to premium health insurance.

Initially conceived in 2019 as a SaaS platform for business travel, RemotePass’s founders, being remote work advocates, transitioned to address the challenges of remote team management, particularly in emerging markets. The pivot, catalyzed by the COVID-19 pandemic, enabled substantial growth for the company, with a remarkable 35% month-over-month increase in the first two years, predominantly propelled by client referrals.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.