News

Disney+ Confirms Its Middle East Launch Date

With a single Disney+ subscription, subscribers can watch films and television series on up to 4 devices at the same time and create profiles for up to 7 people.

Disney+, a video streaming service owned and operated by The Walt Disney Company, has just confirmed its Middle East launch date: June 8th.

In the UAE, the service will cost 29.99 AED a month or 298.99 AED a year. Disney+ subscribers can access a large library of content produced by The Walt Disney Studios and Walt Disney Television, including original films and television series.

“Subscribers will have access to Star Wars’ The Book of Boba Fett and The Mandalorian from executive producer and writer Jon Favreau,” Disney+ highlights some of its content. “Subscribers will also be able to enjoy Disney and Pixar’s Academy Award-nominated Luca and from Walt Disney Animation Studios’ Academy Award-winning Encanto.”

With a single Disney+ subscription, subscribers can watch films and television series on up to four devices at the same time and create profiles for up to seven people. Parents can create special kid-friendly profiles for the youngest family members to enable a child-friendly user interface and restrict access to potentially inappropriate content.

Also Read: 4 Smartphones Coming To The Middle East This Spring

Disney+ started in 2019 in the United States, Canada, and several other countries. The service has been steadily expanding to other markets since then.

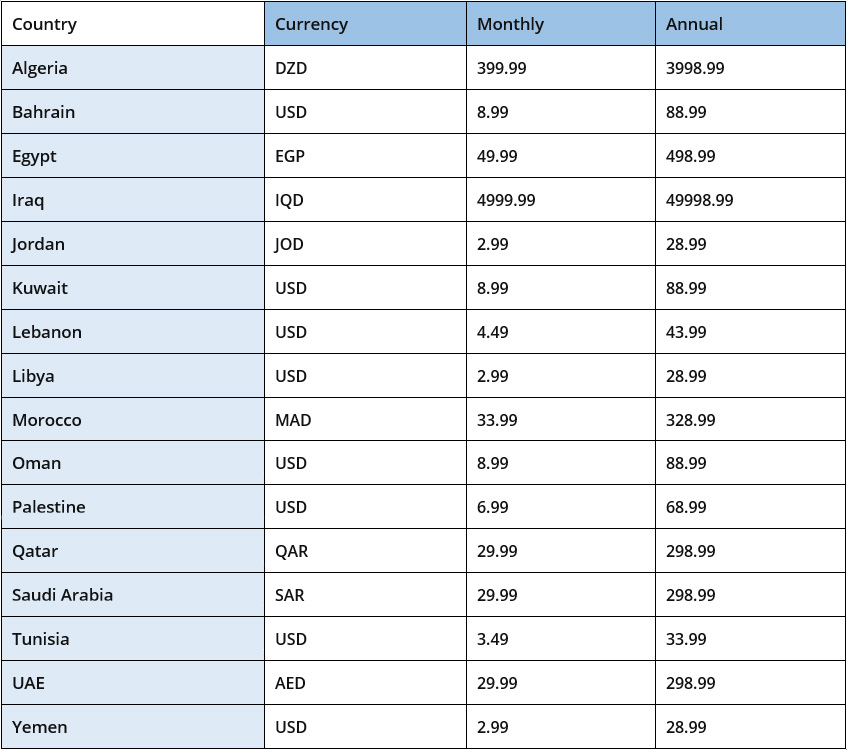

All countries (and price guide) where Disney+ is launching on June 8th:

As of January 2022, Disney+ has around 130 million global subscribers, making it the third-largest video streaming service in the world, after Netflix (222 million) and Amazon Primo Video (175 million).

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant