News

Dubai-Based Startup Huspy Helps Emiratis Buy Homes Online

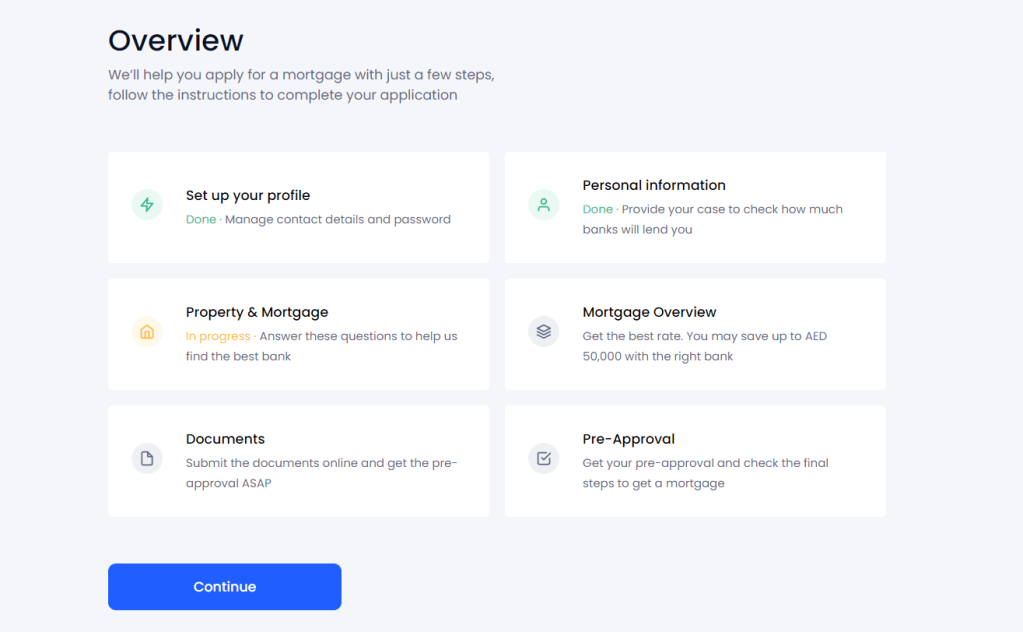

Instead of having to wait months to secure a home mortgage, Huspy lets users search over 500 home loan options in seconds.

Buying a home is a stressful process. Not only is it becoming increasingly difficult to find reasonably priced properties that are also attractive to live in, but the mortgage process, which most buyers have to go through, is time-consuming and full of potential traps. While the first problem won’t most likely be solved any time soon, there’s one Dubai-based startup that’s actively trying to address the second issue, and its name is Huspy.

Essentially, Huspy is an online mortgage platform that facilitates hassle-free financing for people who would like to live in Dubai. It was founded in August 2020 by chief executive officer Jad Antoun and chief technology officer Khalid Al Ashmawy, who understand the local market through first-hand experience.

Huspy Application Process

“We started Huspy with the aim to disrupt one of the largest industries and bring the entire home loan process online. Customers are massively underserved where lack of visibility, poor customer experience, and overpayment are common problems. We want to solve for that,” said Antoun. “The team has built tools and systems to leverage technology in a highly operational business to give us the ability to provide customers with the best rates, faster mortgage close times and a great digital experience,” added Ashmawy.

Also Read: Sarwa Helps UAE Residents Easily Invest In Global Stocks

Instead of having to wait up to 10 weeks to secure a mortgage, Huspy lets its users search over 500 home loan options in seconds to find the one that fits them the best. That way, it’s possible to get a personalized home loan three times faster and secure the best price possible. Best of all, Huspy doesn’t charge its users broker fees at all. Instead, it makes money by charging the banks a commission for every loan.

Huspy is available on iOS as well as Android, and you can download it yourself right now to see what it has to offer. The startup is backed by leading tech investors, including VentureFriends, B&Y Ventures, and Plug and Play, so you know your mortgage will be in good hands.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.

-

News3 weeks ago

News3 weeks agoSpace42 & Cobham Satcom Launch New Satellite Broadband Terminal

-

News3 weeks ago

News3 weeks agoVernewell UK: Forging The Future Of Intelligence, Quantum, And AI

-

News3 weeks ago

News3 weeks agoYasmina Smart Speakers Now Feature Ramadan-Specific Content

-

News3 weeks ago

News3 weeks agoPure Electric Expands To UAE, Boosting Micro-Mobility Sector