News

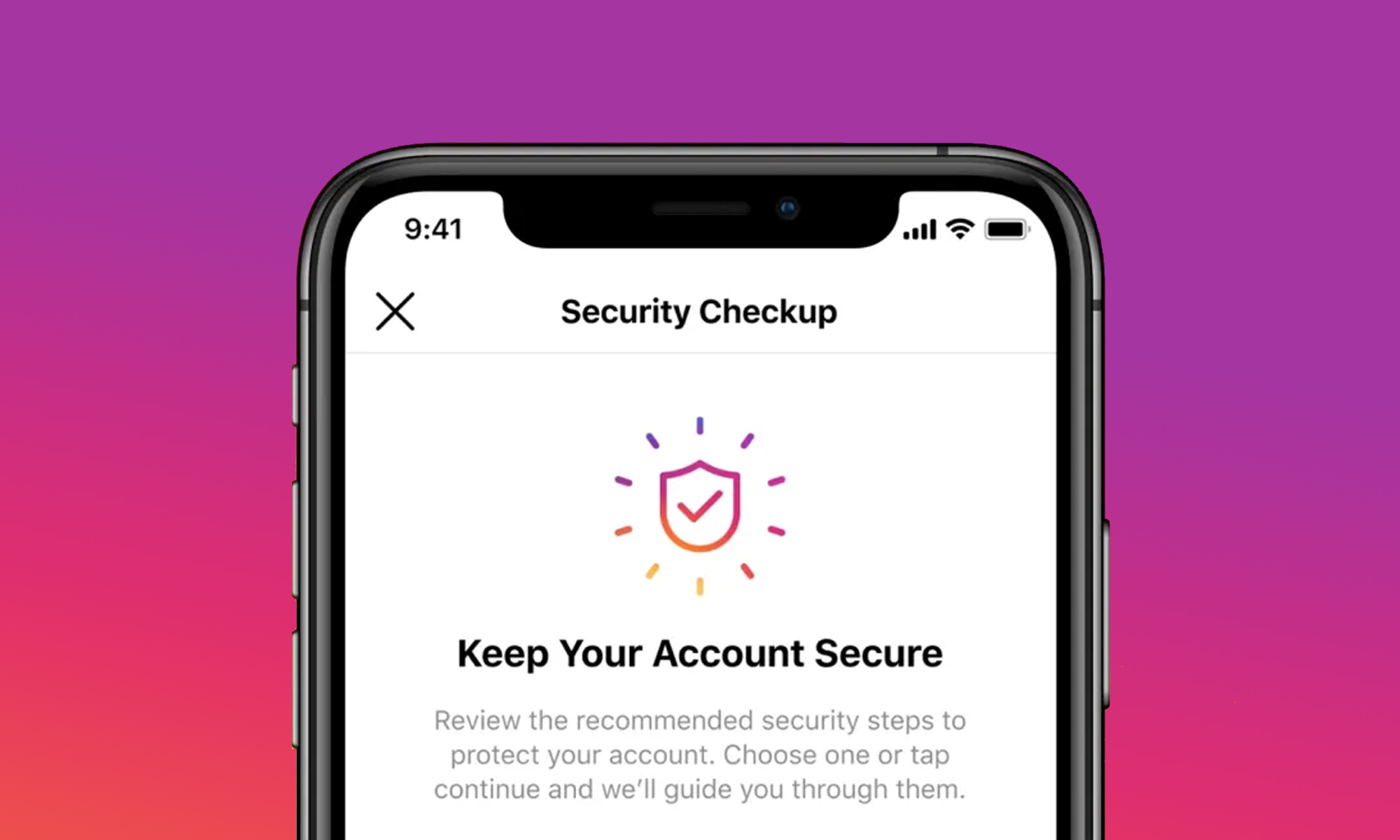

Instagram Fights Cybercrime With New Security Checkup Feature

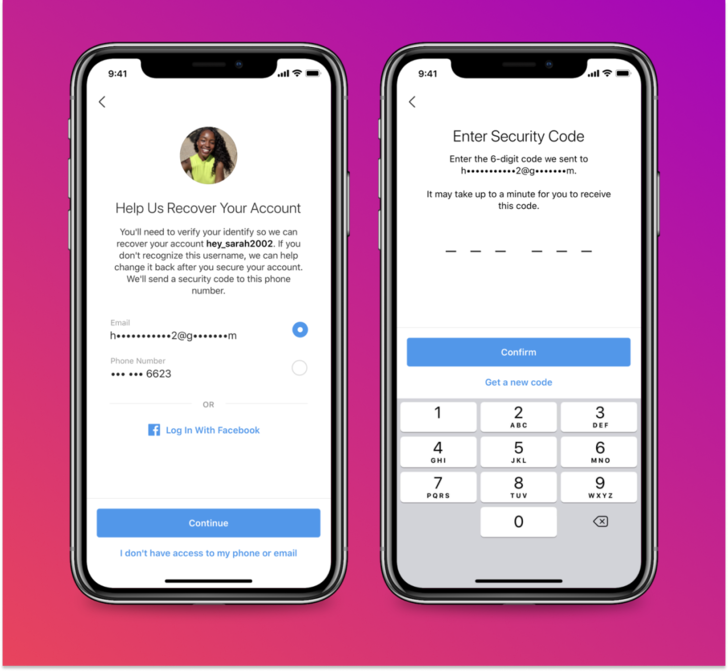

Security Checkup is a new Instagram feature that helps users recover accounts which may have been compromised.

From politicians to small business owners to regular users, it’s no secret that Instagrammers from all walks of life are being targeted by cybercriminals. Now, Instagram is finally doing something to increase the security of its users.

On its official blog, the social media giant (Instagram is the fifth largest social network in the world when ranked by the number of active users) has recently announced the launch of a new feature called Security Checkup.

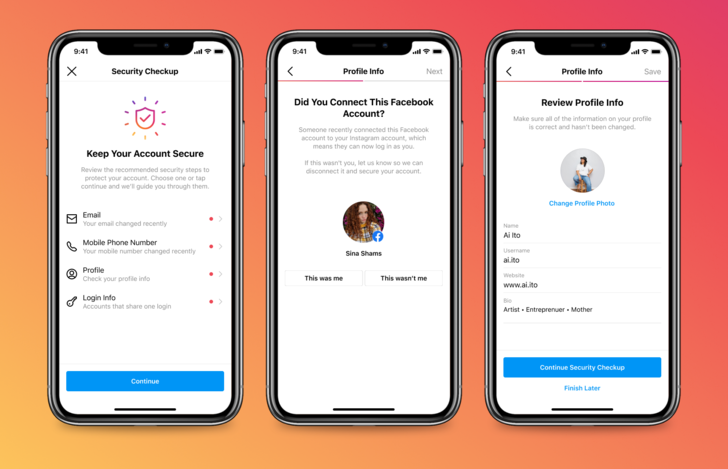

The purpose of Security Checkup is to guide Instagram users whose accounts may have been hacked through the steps needed to secure them.

“This includes checking login activity, reviewing profile information, confirming the accounts that share login information and updating account recovery contact information such as phone number or email,” explains Instagram.

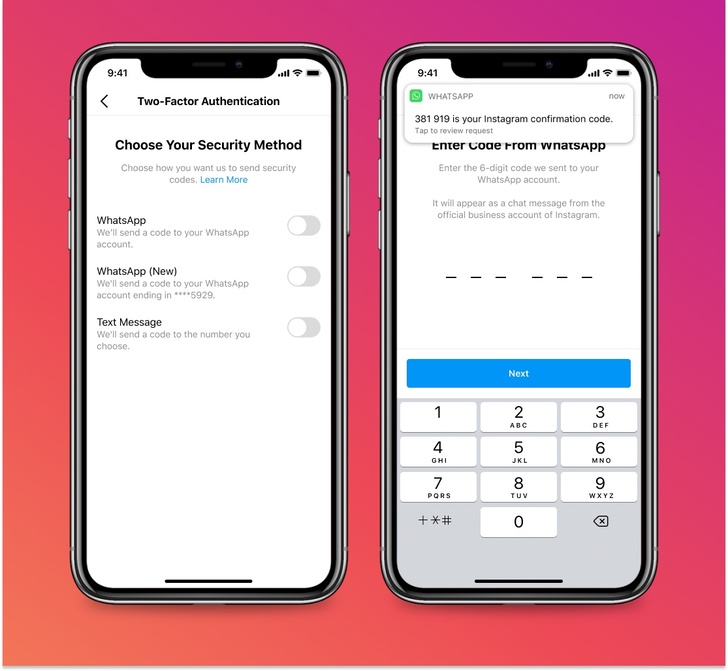

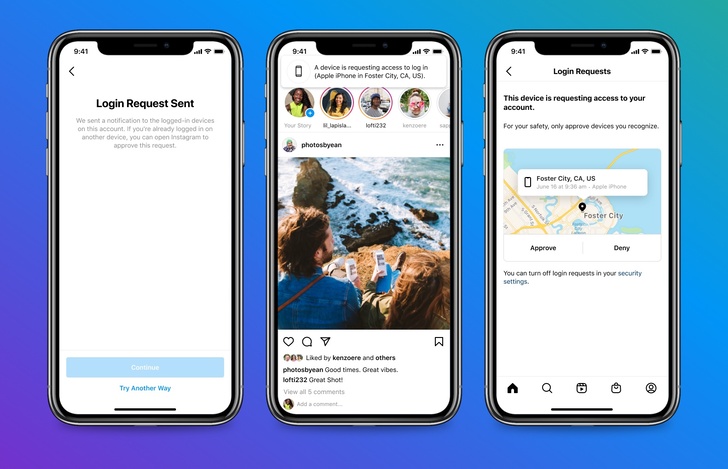

Of course, an ounce of prevention is worth a pound of cure, which is why Instagram recommends its users to enable two-factor authentication and login request, update their contact information, and report contact and accounts they find questionable.

Instagram stressed that it never sends direct messages to users. Instead, the social network communicates with its large userbase only via email, and users can see all emails from Instagram in the Emails from Instagram tab in the settings menu.

Likewise, users should exercise caution when messaging with people they don’t know well, even if their accounts have been verified. “Over the past few months, we’ve seen a rise in malicious accounts DMing people to try and access sensitive information like account passwords,” Instagram clarified.

Also Read: 4 Upcoming WhatsApp Updates You’re Going To Love

While the Security Checkup feature isn’t the solution some users have been hoping for, there’s no doubt that it’s a step in the right direction. Hopefully, Instagram will maintain its focus on cybersecurity and keep increasing the security of its users, helping them defend themselves against cybercriminals.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.