News

Japan Sets New Record For Data Transmission Speed

The researchers have absolutely smashed their own previous achievement by transmitting data at a jaw-dropping 1.02 petabits per second.

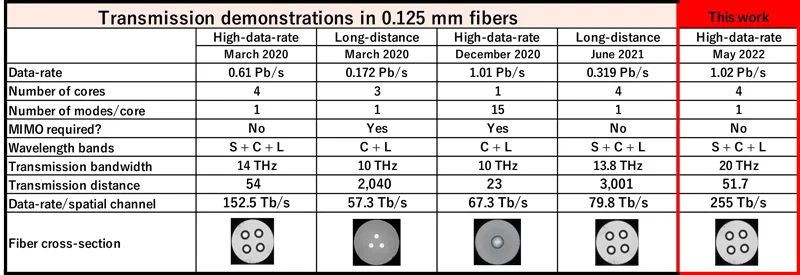

A team of researchers from the National Institute of Information and Communications Technology (NICT) in Japan is at it again. After achieving a data transmission speed of 319 terabits per second (Tb/s) last year, the researchers have now absolutely smashed their own previous achievement by transmitting data at 1.02 petabits per second (Pb/s).

Since 1 petabits is 125,000 gigabytes, it means that the team could theoretically transmit more than 31,000 movies in 4K resolution every single second. To make the record even more impressive, it’s important to highlight that it was achieved using fiber-optic cables with four cores, which is exactly how many cores were used to set the previous record.

“NICT constructed the transmission system using 4-core MCF with standard 0.125 mm cladding diameter, WDM technology and mixed optical amplification systems. The system allowed a data transmission speed of 1.02 petabit per second over 51.7 km,” explained the researchers in the official press release.

The mind-blowing record was first presented in May at the International Conference on Laser and Electro-Optics (CLEO) 2022 in San Jose, California, one of the largest international conferences related to optical devices and systems.

Also Read: Microsoft Blocks Lebanon-Based Hackers Targeting Israel

Moving forward, the NICT team wants to continue exploring different ways to transmit data faster across fiber optic cables. Their main focus is on low-core-count multi-core fibers with standard cladding diameter because such cables are comparable to standard single-mode fibers and thus more attractive for early adoption.

With dozens of countries around the world actively moving from 4G to 5G broadband cellular networks, the massive amount of data being sent and received is guaranteed to continue increasing at a rapid pace. Research projects such as the one behind the latest record can pave the way for new fibers capable of meeting the growing demand and supporting new bandwidth-hungry services.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News3 weeks ago

News3 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant