News

Lebanon’s Beirut Digital District (BDD) Partners With Zoho

The collaboration will help entrepreneurs and startups in the BDD community during uncertain economic times, offering full access to Zoho’s comprehensive suite of cloud applications.

Leading cloud software provider Zoho has announced that it will be teaming up with Beirut Digital District (BDD), a unique digital and creative community hub in Lebanon, to support local entrepreneurship during a time of increased economic disruption.

For those unaware of the current situation in Lebanon, an unprecedented series of events has led to a collapse of the local banking system and a rapid devaluation of the national currency, leaving the nation in a state of turmoil. Despite the bleak outlook, Beirut Digital District has remained a beacon of hope for startups and entrepreneurs, and continued to champion innovation and winning growth strategies.

As part of the collaboration, BDD network member businesses will gain access to Zoho’s complete suite of digital solutions, including accounting, marketing, communication, and other productivity software, using a complementary digital wallet loaded with up to $1,000 of credit.

“We are thrilled to kick off this partnership with BDD […] helping them improve efficiency, reduce costs and quickly adapt to changing market needs. Through this partnership, we aim to digitally empower Lebanon’s businesses with our latest, scalable, and cost-effective solutions, as well as serve the community by sharing our expertise,” says Ali Shabdar, Regional Director, MEA at Zoho.

Also Read: The UAE Has Launched A Program To Assist 100 Startups

So what are the benefits of the Zoho collaboration for Beirut Digital District members? First and foremost, Zoho’s cloud platform offers a comprehensive suite of services, allowing businesses to run their entire operation from a central interface, with seamless integration and without multiple vendor contracts and compatibility hassles. User experience is a high priority for Zoho, along with a privacy-centric approach and a welcome lack of advertising.

If you’re a Lebanese reader keen to learn more about eligibility for the Zoho deal, the company has built a registration page containing further information and a form for businesses to submit their applications.

News

Fintech Galaxy Gains Approval To Pilot Open Banking In Jordan

The Central Bank has given the go-ahead to test fintech services through JoRegBox — Jordan’s regulatory sandbox for fintech innovation.

Fintech Galaxy has secured approval from the Central Bank of Jordan (CBJ) to join JoRegBox, the country’s regulatory sandbox for fintech innovation. The green light allows the company to test and implement Open Banking services within a controlled, real-world setting, and makes Fintech Galaxy the first Open Banking provider to gain regulatory backing in Jordan.

This move aligns with CBJ’s long term vision for financial innovation, introduced in August 2023 as part of the Economic Modernization Vision (2023–2025). The program’s purpose is to establish Jordan as a fintech hub, attracting investment in high-tech financial solutions. JoRegBox provides a supervised testing environment for fintech firms, in a bid to foster widespread financial inclusion and build more consumer-centric financial services.

Riyadh Al Zamil, Chairman of Fintech Galaxy’s Board of Directors, expressed his enthusiasm: “We are proud and honored to receive the Central Bank of Jordan’s approval to test and introduce Open Banking services to the country through the JoRegBox regulatory sandbox. This milestone underscores our commitment to fostering financial inclusion, enabling innovation, and empowering Jordan’s economy through Open Banking”.

Also Read: Visa Partnership Takes X Closer Toward Musk’s “Everything App” Vision

Mirna Sleiman, Founder and CEO of Fintech Galaxy, echoed the sentiment: “The Central Bank of Jordan’s approval is a testament to our shared vision of fostering innovation and inclusivity in the financial sector. By leveraging FINX Connect, we aim to empower financial institutions and third-party providers with data aggregation and payment initiation services, ultimately improving the lives of consumers across Jordan”.

Open Banking services allow banks and payment providers to share customer data securely with third-party providers (with their prior consent). Fintech Galaxy’s FINX Connect platform enables real-time bank account data aggregation and payment initiation, enhancing customer access to personalized financial services and simplifying payment processing.

To support its expansion, Fintech Galaxy has raised $9 million for platform development and market growth. The Jordanian arm, led by Zaid Khatib, will integrate with banks and financial institutions country-wide, focusing on Personal Finance Management (PFM) and Business Finance Management (BFM) applications.

-

News4 weeks ago

News4 weeks agoSamsung Galaxy S25 Release Date Confirmed For January 2025

-

News3 weeks ago

News3 weeks agoThe Quantum Visionary: Malak Trabelsi Loeb On Leadership And QIS 2025

-

News2 weeks ago

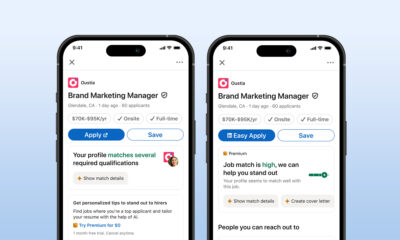

News2 weeks agoLinkedIn Is Trying To Help You Apply For Fewer Jobs

-

News4 weeks ago

News4 weeks agoNVIDIA’s RTX 50-Series Laptop GPUs Bring Blackwell To Mobile